Singapore Exchange (SGX), Asia’s most international multi-asset exchange and largest FX derivatives marketplace, has integrated with Baton Systems (“Baton”), a provider of post-trade solutions for capital markets, to automate and standardize the end-to-end collateral workflow for its clients.

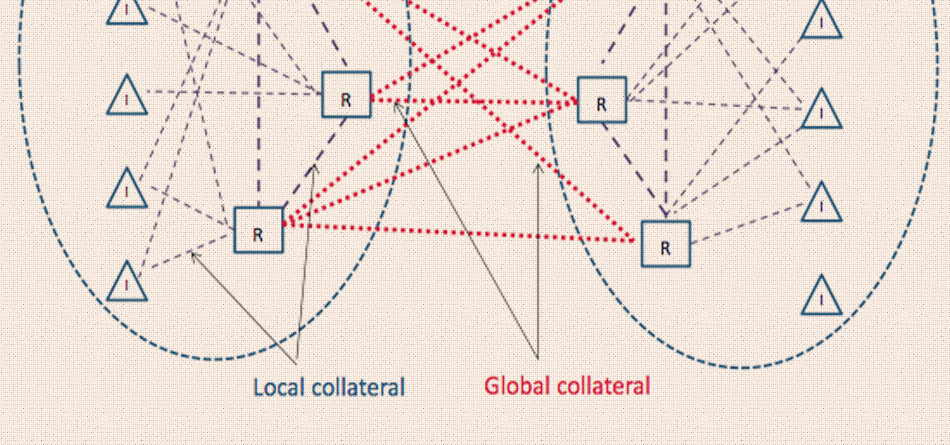

Baton’s platform normalizes and harmonizes data and collateral workflows for all integrated central clearing counterparties (CCPs). As a result, SGX’s clients will have access to consolidated intra-day information in a single dashboard, with real-time visibility of margin requirements, a standardized process for pledging and recalling collateral and clear visibility of the progress of asset movements between SGX and themselves.

The resulting end-to-end automation of the collateral workflow process significantly improves operational efficiency. Accurate, real-time data is central to the optimization process.

#SGX is excited to partner @batonsystems, a provider of post-trade solutions for capital markets, to automate and standardise the end-to-end collateral workflow for our clients.#PostTrade #Derivatives #UnclearedMarginRules #UMR https://t.co/592pg91e2W pic.twitter.com/OHADSXOPJ0

— Singapore Exchange (@SGX) October 15, 2020

“We are excited to partner with SGX as we continue broadening our CCP integrations,” said Tucker Dona, Head of Business Development and Client Success at Baton Systems. “By expanding the scope of our CCP connectivity, we are enabling greater efficiency across the entire collateral workflow process for all market participants. Our customers and partner CCP’s observed during the recent periods of volatility just how important this really is.”

The deep integration provided by Baton also means that SGX will benefit from increased efficiency and reduced manual touchpoints when working with its clearing members.

“In today’s low interest rate environment coupled with new margin rules for uncleared derivatives (UMR) transactions, collateral optimization is an important focus for clearing members globally, many of whom are SGX’s clients,” said Alison King, Head of Trading and Clearing Services, Equities at SGX. “As we look to innovate and continuously enhance our clients’ trading and clearing experience, we partnered with Baton Systems to offer our clients visibility of intra-day margin data on SGX Titan derivatives and clearing platform, to reduce any friction associated with collateral movements, which is especially crucial in a market with increasing liquidity and activity.”

With SGX on-boarded as its first Asian CCP, Baton is extending its network across the region and is in the process of expanding its office in India.

Source: SGX