While the importance of global regulatory reporting continues to increase, there is a noticeable contrast between readiness across geographies, according to the S&P Global Market Intelligence Global Regulatory Reporting Survey.

While the survey highlights that the financial services industry is being more proactive in preparing for upcoming regulatory change, there is disparity among respondents on their readiness for regulatory requirements in Europe and the US. While 38% of respondents with European Market Infrastructure Regulation (EMIR) Refit requirements are confident they’ll be ready or have made significant progress on the program expected to go live in the first half of 2024, more than half of respondents with Commodity Futures Trading Commission (CFTC) Rewrite reporting requirements are not ready for December’s implementation date.

“The survey results indicate that more than a year ahead of implementation, those firms with EMIR Refit reporting requirements are taking a proactive approach to regulatory readiness,” said Igor Kaplun, Head of Cappitech Business Development, S&P Global Market Intelligence. “As with any large-scale regulatory change, it pays to prepare early to stay ahead of the next wave of changes on the horizon.”

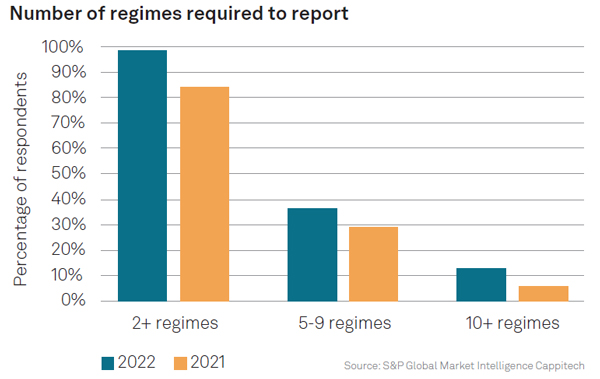

Conducted by S&P Global Market Intelligence Cappitech, the survey found that 99% of respondents indicate having reporting obligations in at least two jurisdictions. As this trend continues, the industry is taking a more proactive approach to existing and new regulations, with more than half making changes in 2022 to enhance existing processes or prepare for new regulations, almost double the 26% who made changes in 2021.

“The industry has matured significantly over the past decade and there is a realization that reporting requirements will continue to change and evolve, and firms need to plan ahead, not only for new regulations, but in terms of how best to benefit from improved technology and global solutions,” said Ronen Kertis, Head of Cappitech, S&P Global Market Intelligence. “In some regions, we are starting to see a genuine shift in the way in which firms consider and plan for their regulatory reporting requirements, while there are other regions where work still needs to be done.”

Key highlights from the report include:

- The use of a combination of in-house and vendor reporting continues to grow, particularly among Tier 1 firms: 64% of respondents are using a hybrid approach today, with 68% of those being Tier 1 organizations; this is up from 57% overall, over half of which were Tier 1 in 2021.

- The most common change to regulatory reporting is increased automation, used to prevent and manage inefficiencies and inaccuracies as a key driver.

- Managed services for regulatory reporting is expected to grow over the next few years, with 60% identifying it as a tool being considered in their future plans.

- The EU’s Sustainable Finance Disclosure Regulation (SFDR) is still in its early phases, but sourcing data is very clearly the most notable challenge – highlighted by 55% of those in scope.

The Global Regulatory Reporting Survey data was collected during August and September 2022 from 89 respondents, of which 51% worked for banks, 18% asset managers and 9% brokers. 31% were from Global Tier 1 organizations. The geographic spread was also varied with 37% of respondents based in Europe, 31% in the UK, 7% in North America and 25% in APAC.

To request a copy of the Global Regulatory Reporting Survey, please contact katherine.smith@spglobal.com.

Source: S&P Global Market Intelligence