Since September 22, 2022, Tokyo Stock Exchange has been conducting the Carbon Credit Market Demonstration, which is a trial trading as part of the “Technical Demonstration Project for Carbon Credit Market” commissioned by the Ministry of Economy, Trade and Industry (METI). Japan Exchange Group is pleased to announce that today, January 31, 2023, was the last trading day of the demonstration. A research report on the demonstration will be prepared in the future.

News Release

-Last Trading Day for Carbon Credit Market Demonstrationhttps://t.co/zk3KvWcGQv— Japan Exchange Group EN (@JPX_official_EN) January 31, 2023

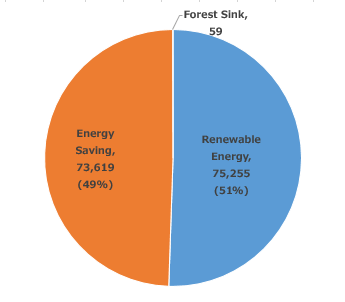

The total trading volume during the period was 148,933 tons of CO2, with 183 companies participating in the J-credit market as demonstration participants. In addition, several initiatives were implemented, including selling government-owned credits on the market starting on November 16 and changing the trading category (*1) on January 4. The volume traded by credit category is shown below.

| Categories of Credits (*2) | Volume(t-CO2) |

| Renewable Energy | 75,255 |

| Energy Saving | 73,619 |

| Forest Sink(incl. J-VER) | 59 |

| Total | 148,933 |

- The trading category was changed on January 4, 2023.

-“Renewable Energy” includes “Renewable Energy” prior to the change in trading category and “Renewable Energy (Electricity)”, “Renewable Energy (Heat)” and “Renewable Energy (Mixed Heat and Electricity)” after the change.

-“Energy Saving” includes “Energy Saving” prior to the change in trading category and “Energy Saving” after the change.

-“Forest Sink” includes “Forest Sink” prior to the change in trading category and “Forest Sink” after the change. - Categories include trading under “individual methodology” such as “Introduction of solar power generation”.

Source: Tokyo Stock Exchange