Data analytics in capital markets is experiencing a boom within a boom, as a long-term increase in demand converges with a period of extraordinary volatility.

JP Morgan’s Execute Analytics, a cross-asset data and analytics platform designed to optimize trade execution, recorded its two busiest days in April 2025, with usage running more than 50% higher than average, according to Jessica Hamilton, Vice President at the Wall Street bank.

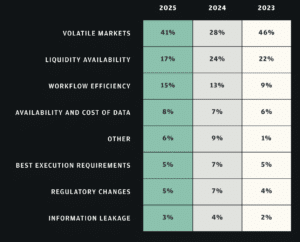

The utility of leading-edge data and analytics platforms has been a developing trend for some time. Volatile markets was the leading predicted daily trading challenge this year, well ahead of liquidity availability and workflow efficiency, according to JP Morgan’s 2025 e-Trading Edit, which surveyed more than 4,200 institutional traders.

Increased demand for data and analytics was named a 2025 market structure trend to watch by Crisil Coalition Greenwich, which noted that traders and investors need to work harder to find an edge. “The data itself is only the first step in that journey,” the January report stated. “New delivery mechanisms (e.g., cloud for real-time market data), better analytics (AI anyone?), and tools to make that data actionable on the trading desk are all areas of critical investment.”

That multi-year upswing has been turbocharged in recent weeks as trade wars roiled markets and monetary policy uncertainty increased, pushing traders and investors into the markets to protect positions via hedging or to seek profits via speculation. This has resulted in record volumes in a range of asset classes for exchange operators and trading venues including CME Group, Tradeweb, and MultiBank.

Better Data, Better Insights

Execute Analytics spans tradables including FX, FX options, commodities, rates, and Repo and Futures. JP Morgan’s breadth and scope is a built-in differentiator for the platform, Hamilton said.

“Our franchise size enables a unique perspective for our clients, showcasing where and how people are trading, current market positioning and how it has evolved over time,” she said. “In changing markets our alerts, trade ideas, quant models and market structure insights, equip clients with better insights on what actions to take.”

By way of background, Execute Analytics started as an analytics portal for FX algo trading, aimed at investment managers who traded on multi-dealer platforms. “The point was to be there on the client’s journey every step of the way, from pre-trade to real-time analytics to post trade TCA,” or transaction cost analysis, Hamilton said.

The platform started expanding beyond FX in earnest about 18 months ago, and now offers analytics across eight asset classes.

Hamilton said Execute Analytics’ customization capabilities distinguish the platform from other offerings in the marketplace. “We can tailor the experience for each client, generating trade ideas based on historical data and our assessment of potentially beneficial opportunities for them, all integrated with execution.”

Further, the platform addresses a common bugbear for multi-asset traders by stitching up a fragmented workflow. “Clients don’t have to go to one place for pre-trade, another place to trade, and another place for post-trade,” Hamilton said. “Everything is available within one container.”

Markets are expected to continue to be volatile even as the US and China agreed to cut tariffs for at least 90 days and post-tariff inflation reports are released. An easing of the trade war has led to the S&P 500 making up all of its losses this year and the Cboe Volatility Index, which measures the stock market’s expectation of volatility over the next 30 days, has fallen back to levels before “liberation day” tariff announcements from the Trump administration on 2 April.

Support Amid Volatility

Hamilton highlighted the market structure function embedded within Execute Analytics as popular with clients during volatile markets. She described this as volume profiles created by JP Morgan’s quantitative research team that predict trading volume in five-minute buckets, which is then compared with the actual volume that occurred.

“Real-time volume, volatility and spread profiles in partnership with pre-trade modeling, alerts and flow commentary help support our clients through volatile times and give a greater understanding of market environments,” she said.

JP Morgan also offers Algo simulations which Hamilton said enable Algo users to replay algos traded with JP Morgan under different strategies, perhaps faster or slower, or simulate the trade using a different type of algo in the same market conditions. The end product is another layer of targeted and personalized insights. “Once the dust settles, that’s going to be where some of the most interesting analysis comes out,” she said.

Going forward, JP Morgan aims to continue expanding Execute Analytics across a broader range of asset classes, and also explore whether and how to deploy emerging technologies. “We’re always looking for ways to enhance the quality of analytics for our clients, and new technology offers some interesting opportunities.”