By Phil Mackintosh, Chief Economist, Nasdaq

With 13 exchanges currently and three more on the way, it’s an interesting time to ask, “How much does fragmentation benefit investors?”

It would be fair to say that most investors benefit from tighter spreads and more liquidity.

Whether additional exchanges add to, or fragment, liquidity is difficult to quantify with recent data. But we can assess how much they improve spreads. The answer is: Less than you might expect.

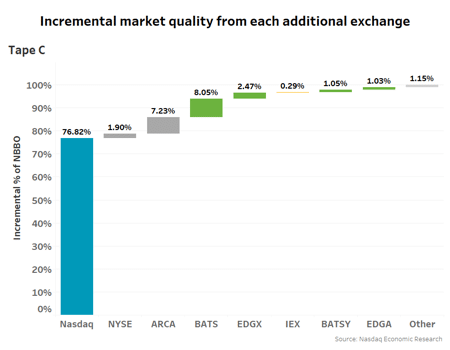

How much does each additional exchange improve the NBBO?

We start from the premise that without a listing exchange, there are no tickers to trade.

When we look at the National Best Bid and Offer (NBBO), we see that the prices on the primary market are the same as the NBBO around 77% of the time. So there is evidence that additional exchanges improve spreads and therefore reduce costs for investors. But the question is, “How much does each incremental exchange help?”

Chart 1: Incremental value added by additional trading venues in Nasdaq listings

If we add the next largest exchange by market-wide liquidity to the quote, we can see how often they tighten spreads to the NBBO. Doing this for all exchanges shows the marginal (incremental) value added by each additional competing venue.

Interestingly, after the fifth largest exchange is included in the market, investors would have the same spread as the NBBO in Nasdaq listings more than 96% of the time. Combined, the next eight exchanges (and soon more) improve the quote less than 3.6% of the time in Nasdaq-listed stocks. The data is similar for NYSE-listed securities as well.

Importantly, this shows that the marginal spread saving benefits of fragmentation are decreasing.

How much cost do additional venues add?

But exchanges are a high fixed-cost businesses.

Data suggests each additional exchange may cost between $30-$50 million to run, even for smaller new exchanges. While that excludes potential gains from innovation, it also does not factor connection and hardware costs from the broker community.

The point being, marginal costs of new entrants are more likely to be fixed costs.

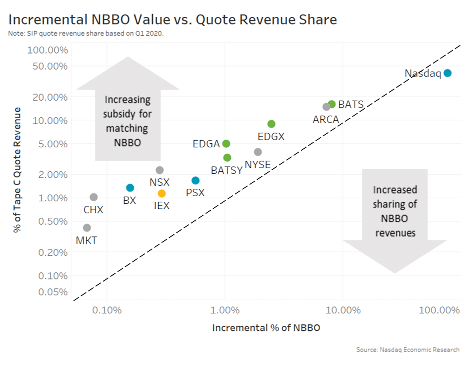

Does the current system reward capital formation or fragmentation?

One of the oft-cited problems with the Securities Information Processor (SIP) revenue formula is that by allocating revenues to all exchanges at the NBBO, it supports start-up exchanges and subsidizes fragmentation.

Comparing marginal spread improvements against SIP revenues earned supports this argument.

Many trading venues benefit from far greater quote revenues than their incremental value to NBBO, based on the calculations we’ve done above. That means the SIP also provides revenues to these venues disproportionately to the marginal price improvement they provide investors.

Chart 2: Incremental value added vs. SIP quote revenues

Will the new system reward fragmentation even more?

Importantly, the SECs new SIP governance proposal puts more votes in the hands of those smaller exchanges that already benefit the most disproportionately from their value under the current SIP formula. So the new rules are unlikely to fix this problem as (ironically) those participants will be conflicted.

But if depth is added to the SIP as well, it may make this problem worse. We’ve previously found that smaller exchanges are far less likely to have a two-sided quote, especially across smaller-cap stocks. Although some small venues supposedly offer prop data “for free” now, new core-data expansion may provide those venues with additional subsidies for depth data.

Chart 3: Many exchanges don’t even have two-sided markets in many small-cap stocks

Can we incent capital formation and market quality while also lowering costs?

The SIP formula is already complicated. But data here shows it still creates distortions.

In fact, SIP revenues now reward displayed quotes regardless of what whether they result in a trade. Rewarding quotes that result in trades is something we suggested be addressed in our TotalMarkets proposals.

In addition, half of the SIP revenue is also allocated to executions, including dark executions. That means off-exchange participants also benefit economically from the SIP revenue allocations, adding even more fragmentation to liquidity.

While all quotes are important, fragmentation has a bunch of external costs as well, from additional hardware spend by the industry to the geographic latency it creates. As our analysis shows, these fragmentations costs add up, often without bringing value to the investing public by providing transparency and liquidity to the market.

It’s a revolutionary concept, but rewarding capital formation and discouraging fragmentation might reduce brokers’ fixed costs while also making it more attractive to list new companies. Issuers, brokers, and investors might all benefit.

With this kind of model, the whole ecosystem could potentially benefit from better allocating the true costs of fragmentation, with the savings going to investors and issuers.