State Street’s fourth annual global private markets survey found that retail investors are set to become the main source of private market fundraising over the next two years.

The report, The New Private Markets Advantage, found that the majority of respondents, 56%, believe at least half of private market flows will come through semi-liquid, retail-style vehicles marketed to individuals within one or two years. More than one fifth, 22%, of respondents think retail-style vehicles will be the main fundraising mechanism for private markets, up from 14% last year.

The survey was conducted for State Street by CoreData Research in the first quarter of this year and covered 500 respondents from buy-side firms and institutional asset owners across the globe.

Donna Milrod, chief product officer and head of digital asset solutions at State Street, said in a statement that democratisation of private markets has been underway for a number of years. Milrod said: “However, 2025 has the potential to be a watershed year for retail allocations to private markets. Distribution to wealth channels and retail fund flows could become the dominant contributor to future fundraising.”

Sven Eggers, head of private markets EMEA at State Street, agreed that the expected uptick in retail allocations in the survey was not a surprise. He told Markets Media: “Promoters and managers in Europe and the U.S.are approaching us to provide for servicing, so models. we see the intention and ambition to set up these products.”

It can be argued that institutions expect to contribute less to fundraising because they expect returns to fall. However, Eggers said retail investors are reacting to the previous lack of availability of certain asset classes, such as private equity and infrastructure. He added that retail has suffered from the spikes in volatility in public markets over recent years and they want more stable savings for their retirement.

“They are looking for stability, and especially when it comes to infrastructure there is a good purpose behind the investment,” said Eggers.

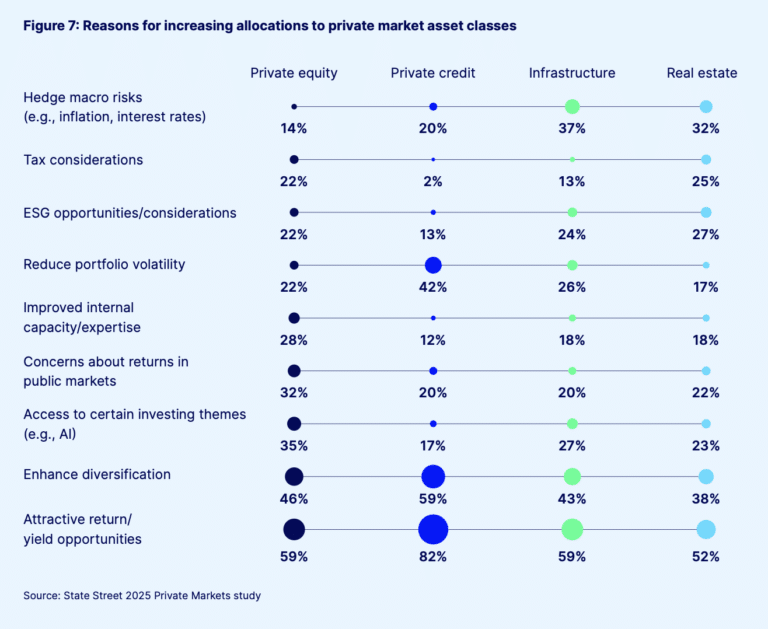

State Street believes the current geopolitical uncertainty following the U.S tariff announcements could support private markets. Lower volatility was given by 22% of respondents in the survey as their reason for increasing allocations to private equity, 26% for increasing allocations to private equity and 42% to private credit.

Semi-liquid funds

Investors in private market funds have traditionally had to lock up their money for the life of a fund, which is usually between eight to 10 years, but in return they have been rewarded with higher returns. Semi-liquid funds have been developed with a mix of public and private assets which allows investors to redeem on a quarterly or bi-annual basis and reallocate their capital.

State Street ‘s survey found that product innovation in the semi-liquid fund segment was the best means for driving the democratisation of private markets, according to 44% of respondents globally. The report highlighted examples ranging from the launch of private asset ETFs to structural innovations such as the European Union’s European LongTerm Investment Fund (ELTIF) and the UK equivalent, LTAF.

Morningstar, the fund management data provider, said the growth of semi-liquid funds has led to the firm beginning to assign qualitative, forward-looking Medalist Ratings to the segment in the third quarter of this year.

Jason Kephart, senior principal, multi-asset strategy ratings at Morningstar, said in a statement: “Semi-liquid funds have quickly become one of the most talked-about corners of the investment universe, yet definitions, data, and transparency have lagged behind the headlines.”

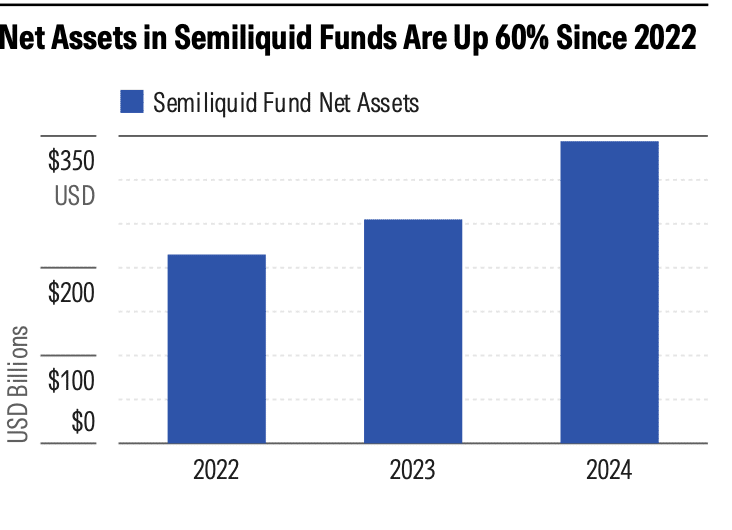

In a report, The State of Semi-liquid Funds, Morningstar found that assets grew to $344bn in 2024, up 60% from $215bn in 2022, as investors seek smoother and higher yield returns. The report focuses on semi-liquid funds accessible to investors with less than $5m in investable assets and covers interval funds, tender-offer funds, non-traded business development companies (BDCs), and non-traded real estate investment trusts (REITs).

However, Morningstar also warned that although semi-liquid funds provide greater access and returns, they also bring steep fees, heavy use of leverage, and liquidity limits.

“On average, semi-liquid fund fees are three times higher than traditional open-end funds, meaning their return premiums must be significant to offset the high costs,” said the report.

In addition widespread use of fund-level leverage, common in private credit funds, has enhanced returns but masked underlying risks, according to the report.

“Leverage-related losses can be delayed but not avoided,” added Morningstar. “Some funds use tactics that postpone recognizing losses, temporarily obscuring risks without eliminating them.”