Boris Spremo, head of enterprise/financial services for software developer Polygon Labs, described the launch of the first fully regulated trading platform for tokenized real estate on the Polygon blockchain as “pivotal”, as he expects to see major capital deployments into tokenized assets this year.

In March this year RealEstate.Exchange (REX) said in a statement that it had launched the first fully regulated trading platform for tokenized real estate on the Polygon blockchain allowing investors to easily buy, sell, and manage fractional ownership of property investments. The US trading venue has been launched as a partnership with Texture Capital, a FINRA member broker dealer, and operator of an SEC registered Alternative Trading System (ATS).

Spremo told Markets Media in an email: “The launch was a pivotal moment for tokenized real estate because it addresses a critical gap in the market: liquidity. By creating a regulated, on-chain trading venue for fractional property investments, we have been able to fractionalize one of the world’s largest yet least liquid asset classes into a more accessible and tradable market.”

He expects there will be continued major capital deployments into tokenized assets due to increased regulatory clarity and maturing blockchain infrastructure which enables scalable, secure handling of high-value assets. In addition, increased demand for tokenized credit, treasuries, indices, equities and hybrid assets and the blending of DeFi (decentralized finance) and real-word asset collateral will accelerate adoption.

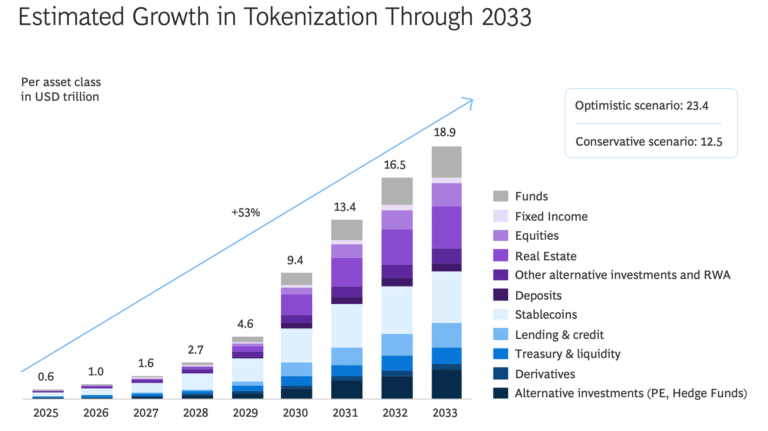

Since early 2023, the market value of tokenized assets has seen a double-digit compound annual growth rate according to a report from Ripple, a provider of digital asset infrastructure for financial institutions, and Boston Consulting Group. The report, Approaching the Tokenization Tipping Point, estimated that tokenization of real-world assets will grow from around $0.6 trillion in 2025 to $18.9 trillion by 2033 in the midpoint scenario, representing a 53% compound annual growth rate.

Institutional interest

Institutional interest in tokenization has surged significantly over the past year, according to Spremo. He added that traditional financial institutions such as BlackRock, JPMorgan, and Hamilton Lane have all moved beyond pilots to deploy real on-chain products via the Polygon network, with strong challengers such as Spiko, Mercado Bitcoin bringing much more.

In March this year Mercado Bitcoin, a cryptocurrency exchange in Latin America, partnered with Polygon Labs to accelerate the tokenization of real-world assets in the region. Mercado Bitcoin said in a statement that it has already issued more than 340 tokenized products, totaling approximately $180m, which cover private credit, fixed income and revenue-sharing products. The partnership with Polygon Labs is expected to more than double the current total of tokenized assets.

In June 2024 Spiko, the French fintech, said in a statement it had launched the first two tokenized money market funds in the European Union, after approval from AMF, the French financial regulator.

Spremo said these projects demonstrate how tokenization creates liquid, accessible markets.

“As these use cases expand to include mortgage lending tied to tokenized properties, the market could scale dramatically, posing serious challenges to legacy market infrastructure in major jurisdictions,” he added.

In order to attract more institutions, Spremo said the tokenization ecosystem needs interoperability, compliance-ready tooling, robust liquidity mechanisms and clear regulatory frameworks.

“Institutions require seamless integration with existing financial systems, which Polygon addresses through partnerships like Spiko, Libre, and Cashlink for regulated issuance and reporting,” he added.

Additionally, infrastructure must support high-throughput, low-cost transactions while meeting traditional finance-grade auditability.

“Finally, whitelisted liquidity pools and programmable yield products will draw institutions seeking controlled yet dynamic markets,” said Spremo. “These elements are already in progress, and 2025 will be a critical year for scaling adoption.”

He stressed that interoperability is the linchpin for a cohesive tokenization ecosystem and argued that Polygon’s AggLayer is a “game-changer” because it enables connected blockchains to share liquidity and operate as a unified platform.

“This addresses the siloed liquidity that has historically fragmented blockchain networks, allowing institutions to transact seamlessly across chains,” added Spremo. “Polygon’s focus on Ethereum alignment and modular infrastructure further enhances compatibility, making it a hub for interoperable real world asset solutions.”

As more real world assets become tokenized, traditional institutions such as BlackRock and JPMorgan are entering the space and Spremo said competition will hinge on collaboration and specialization. He believes crypto-native firms have a first-mover advantage in technical expertise and agility and can differentiate themselves by offering modular, DeFi-native tools that complement TradFi’s scale and regulatory expertise.

“Polygon’s ecosystem, for instance, supports both Circle’s stablecoins and KfW and Deutsche Bank’s bond issuance, showing how crypto-native infrastructure can serve diverse players,” he added. “Strategic partnerships will be key.”