The sustainability-linked bond structure needs to improve to focus on use of proceeds as there is a lack of transparency over results and issuers may not have an incentive to meet meaningful goals.

Stephen Liberatore, Nuveen

Steve Liberatore, head of ESG/Impact – global fixed income at Nuveen, told Markets Media that the asset manager focuses on direct and measurable impact.

“We want to be able to control how capital is being used and to be able to report back to our investors,” he added.

However, sustainability-linked bonds may not give a direct use of proceeds.

“The use of proceeds concept really works well whether it’s a green bond, a social bond, a sustainability bond or sustainability-linked bond,” he said.

Liberatore is the lead portfolio manager for Nuveen’s fixed income ESG and impact strategies that have a total of more than $15bn (€12.3bn) in assets under management. He is also a member of Nuveen’s Investment Committee and serves on the ICMA Green Bond Principles Advisory Council.

He made his comments ahead of the anniversary of the publication of the ICMA Sustainability-Linked Bond Principles on June 9 last year.

Sustainability-linked bonds have been defined by the International Capital Market Association as any type of bond instrument for which the financial and/or structural characteristics can vary depending on whether the issuer achieves pre-defined sustainability/ environmental, social or governance objectives. These objectives are measured through predefined key performance indicators and assessed against predefined sustainability performance targets. Issuers explicitly commit, including in the bond documentation to future improvements in sustainability outcome(s) within a predefined timeline.

Liberatore said in a blog that Nuveen’s approach to impact investing, established in 2007, focuses on use of proceeds and transparent, relevant impact measurement and reporting frameworks.

“At their root, sustainability-linked bonds are general obligation or general corporate debt instruments, and the issuer retains full discretion for how capital will be allocated once it is raised,” he added. “To us, that requires an assessment of the issuer and its credibility as an ESG leader – can it be trusted to pursue environmental and sustainable goals in a meaningful and responsible way, without extending the life of carbon-based technologies or doing harm in pursuit of headline goals?”

He continued that Nuveen passed on deals from a U.S. high yield issuer and an Indian cement company because the sustainability-linked bond structure gave the issuers too much latitude in how they invested the proceeds.

“In both cases, the securities benefit from a halo effect of carrying a “sustainability-linked” label, yet reporting will be limited to a singular enterprise-wide carbon footprint or emissions reduction target,” said Liberatore. “This makes it virtually impossible for an investor to know how the proceeds of the bonds were directed and what specific outcomes they delivered.”

As an impact investor Nuveen wants to measure carbon intensity key performance indicators, which are driven by specific projects.

The penalties for sustainability binds may also not create sufficient incentive for management to pursue material changes. He gave the example of a 2021 issue with a 2030 carbon footprint reduction goal that used its 2017 carbon footprint as the baseline.

“In the most egregious case, a structure included a KPI that had already been achieved,” he said. “We’ve seen eight and 10-year new issues that put off the KPI disclosure and potential coupon step-up into the fifth and ninth years, respectively. And if the goals aren’t met, step-ups can be as low as 6.25 basis points which isn’t steep enough to incentivize management to make the targets a strategic priority.”

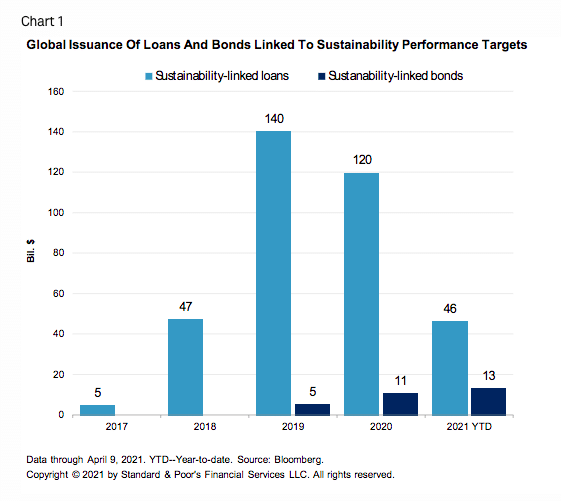

S&P Global Ratings said in report that it expects sustainability-linked loan and sustainability-linked bond issuance to surpass $200bn this year.

Source: S&P Ratings.

The ratings agency said the greater flexibility in the use of proceeds broadens the universe of issuers who can obtain sustainable financing.

“Issuers unable to issue a use of proceeds instrument because they don’t have sufficient capital expenditures connected to sustainability projects could still tap the sustainable debt market. This includes companies in the consumer discretionary and health care sectors,”said S&P.

Smaller issuers and issuers at the beginning of their sustainability journeys may also lack the capacity to implement effective tracking or reporting practices required for use of proceeds instruments.

S&P believes the sustainability-linked transition instrument market could grow rapidly as transparency and disclosure requirements become more comprehensive and robust.

“Over 80% of sustainability-linked bonds followed ICMA’s SLBP in 2020 and we expect this share will increase over time, enhancing market integrity and consistency and helping mitigate investor fears of ESG-washing in this rapidly evolving asset class,” said the report.

The ratings agency gave the example of the European Central Bank accepting sustainability-linked bonds as eligible collateral since January this year. In addition the London Stock Exchange introduced the ability for issuers to display SLBs on the Issuer Level Classification segment on its Sustainable Bond Market.

Engagement

Liberatore agreed that the sustainability-linked structure has promise and is better than no targets at all. He stressed the important of engagement with issuers and underwriters of new issues.

“My team last year had 84 different engagements and this year we are already into the 60s,” he added. “I certainly see continued growth and continual improvement in use of proceeds as ultimately the investor is going to decide what works for them and what they are comfortable with.”

He explained that one of the reasons that ESG and impact investing has grown so rapidly in fixe income is because investors can control how their funds are used. In addition, data is available over a longer period of time showing that investors do not have to sacrifice performance in order to to be responsible.

“We use third party data sources and have had a proprietary impact framework since 2007,” he added. “Our impact report in very important because we want to show our investors that we are attempting to achieve a double bottom line of financial performance, but also a direct and measurable outcome.”

The European Union has proposed a taxonomy for sustainable investing. Liberatore said he supports regulation that outlines basic expectations but both issuers issuers and investors have concerns that the EU’s proposal it too prescriptive.

He gave the example of the the Seychelles’ inaugural blue bond which would not fit the the taxonomy. In October 2018 the Republic of Seychelles raised $15m in the world’s first sovereign blue bond which was designed to support sustainable marine and fisheries projects. The World Bank assisted in developing the blue bond and reaching out to the three investors – Calvert Impact Capital, Nuveen, and Prudential Financial.

Liberatore said: “We want a supportive regulatory framework that doesn’t stifle the innovation that is needed to continue to grow this market.”