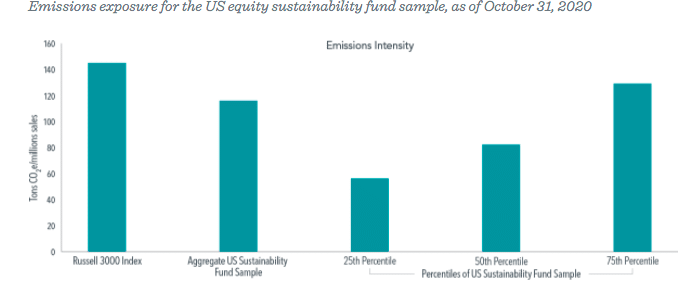

The lower quartile of funds labeled “sustainable” only reduce carbon emissions by 11% versus the total market while the top quartile is at 61%.

Dimensional Fund Advisors analysed 165 US equity mutual funds and exchange-traded funds categorized as “sustainable investments” as of October 31, 2020 by data provider Morningstar in a report Beyond the Label, ESG Funds May Miss Their Mark.

The study said the majority of the $131bn (€111bn) in the sample’s assets under management is focused on large cap stocks and the environmental, governance and social funds are spread across 16 categories spanning size, style, and sector composition.

Warwick Schneller, PhD, senior researcher and vice president at Dimensional, said in the report that ESG-focused US equity funds show a tilt toward higher relative price and smaller market capitalization than the Russell 3000 Index.

“Interestingly, the number of distinct US stocks included in the aggregate ESG sample totals more than 2,700, approaching the index’s 3,023 holdings,” he added. “This implies that, depending on whom you ask, more than 90% of stocks in the US market fit the bill for ESG investing.”

As there are so many approaches to ESG investing, there is substantial variation in the greenhouse gas emissions exposure data which is important as scientists have stated that GHG emissions are the primary contributor to climate change.

Source: Dimensional.

Emissions intensity and potential emissions of ESG funds in aggregate are meaningfully lower than those of the broad market. However, Schneller said the 75th percentile of funds had emissions intensity only 11% lower than that of the Russell 3000 Index while the reduction is 61% at the 25th percentile.

“To the extent that investors expect an ESG investment to reflect their concerns over environmental sustainability, the wide gamut in emissions exposure outcomes may be disappointing,” he added.

Will Collins-Dean, senior portfolio manager at Dimensional Fund Advisors, told Markets Media that rising investor interest in ESG has led to a proliferation of funds in the last three or four years. However, there is no universal definition of ESG.

Williams Collins-Dean, Dimensional Fund Advisors.

Collins-Dean said: “The ESG label is like going into the grocery store and seeing the ‘all natural’ labelling.”

He also advised that investors should not sacrifice sound investment principles such as diversification, cost effective implement and taking a systematic approach to pursuing securities with higher expected returns in pursuit of ESG goals and objectives.

“These foundational principles are just as important in the ESG space,” he said.

Setting ESG goals

In order for investors to get an ESG exposure that aligns with their values and goals, Collins-Dean recommended that they should set a targeted and clear ESG goal, rather than trying to check all of the ESG boxes.

“Investors should target an ESG goal that has a clear scientific link to issues facing the world,” he added. “They should make sure that managers claiming to have actual real-world impact can provide objectively measurable reporting that backs up their claims.”

He continued that not all ESG data should be treated equally, with some being more subjective.

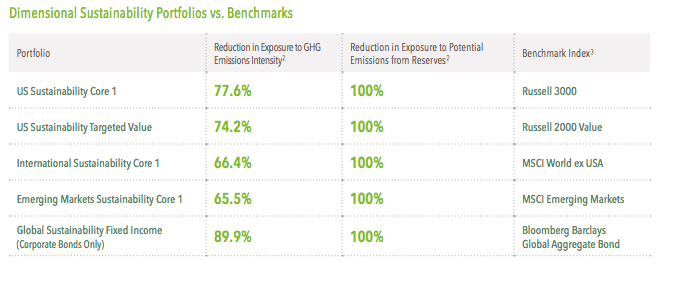

Collins-Dean said Dimensional works with climate scientists to ensure its sustainability funds target the reduction of greenhouse gas emissions and fossil fuel reserves that enable future emissions.

Source: Dimensional.

“We have been managing our sustainability portfolios for about 15 years and have consulted and engaged with experts such as climate scientists, economists, specialised data vendors, practitioners,” he added. “I think that cumulative experience is a differentiator.”

Dimensional uses multiple data vendors to source data related to GHG emissions and fossil fuel reserves and has also developed proprietary datasets.

“More emissions data has become available and coverage has increased over time,” said Collins-Dean. “That was one of the motivations behind us launching our Emerging Markets Sustainability strategy.”

He also warned that asset managers should be careful about claiming that their sustainability funds can meaningfully impact climate change.

“We think investors should be wary of those types of claims,” said Collins-Dean. “Just because you don’t own a company in your portfolio doesn’t mean that company will stop burning hydrocarbons.”