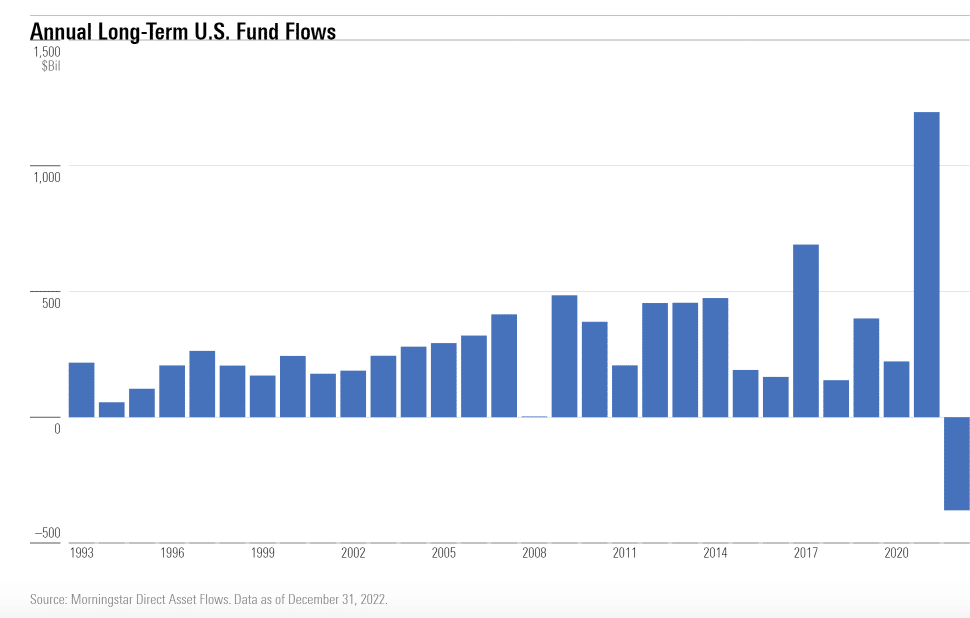

In 2022 U.S. funds had their first calendar year of outflows since Morningstar began tracking data in 1993, primarily due to actively managed funds.

Adam Sabban, senior manager research analyst, equity strategies and Ryan Jackson, manager research analyst for Morningstar Research Services LLC, said in a report: “U.S. funds shed $370bn in 2022, with six of 10 category groups suffering outflows—another first.”

Actively managed funds had outflows of $926bn in 2022, which was three times their second-worst calendar year outflow in 2018. “It equated to their worst year on an organic growth basis as they shrank by roughly 6%,” added Morningstar.

In contrast, passive funds collected $556bn in the same period, although assets gathered were 42% lower than 2021′s record of nearly $1 trillion.

“The fact that passive taxable- and municipal-bond funds experienced inflows as their active counterparts suffered their worst year ever speaks to the magnetism of index-tracking funds in today’s market,” added Morningstar. “Investors appear to be buying passive funds in both good times and bad.”

Many broad bond indexes posted record annual losses in 2022 and as a result, investors pulled a record $216bn from taxable bond funds and $119bn from municipal bond funds , which were their worst organic growth rates in at least two decades. Active bond funds bore the brunt of the outflows, shedding $529bn according to Morningstar.

In contrast U.S. equity funds gathered approximately $46bn, led by passive large-blend funds which had inflows of $144bn. There were outflows from all the other categories, except large value and mid-cap blend funds with investors redeeming most heavily from growth-oriented funds.

U.S. ETF flows

Exchange-traded funds in the U.S. gathered net inflows of $607.23bn in 2002, the second highest on record after net inflows of $919.8bn in 2021 according to ETFGI, an independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem.

@ETFGI reports the #ETFs industry in the United States gathered US$607 billion in net inflows in 2022

Read More – https://t.co/nVuMuqY8Ph

— ETFGI (@etfgi) January 13, 2023

Equity ETFs in the US gathered net inflows of $305.7bn in 2022, the third highest on record after 2021 and 2017.

Fixed income ETFs attracted net inflows of $184.1bn in 2002, higher than the $174.7bn attracted in 2021.