The top performing 2.4% of companies were responsible for the $75.7 trillion in net global stock market wealth creation over three decades.

Nicholas Colas, co-founder of DataTrek Research, highlighted in a blog that an academic paper, ‘Long-term shareholder returns: Evidence from 64,000 global stocks,’ has been circulating recently so DataTrek commented on the findings.

The academics analysed long-run shareholder outcomes for more than 64,000 global common stocks between January 1990 and December 2020. They found that the top-performing 2.4% of firms account for all of the $75.7 trillion in net global stock market wealth creation over that timeframe. Outside the US, 1.41% of firms account for the $30.7 trillion in net wealth creation.

In addition the majority, 55.2% of U.S. stocks and 57.4% of non-U.S. stocks, underperform one-month U.S. Treasury bills in terms of compound returns over the full sample.

“The fact that most global stocks fail to beat T-bills is, to our thinking, even more of an “aha!” observation than the fact that just a few stocks pull all the weight,” said Colas.

The top five names contributed 10% of total net global equity wealth creation on their own:

- Apple: 23.5%

- Microsoft: 19.2%

- Amazon: 31.1%

- Alphabet/Google: 19.3%

- Tencent: 48.1%

Colas highlighted that the top 20 companies were responsible for 20% of total net global equity wealth creation in the sample even though many were not public for the entire period. For example, Amazon went public in 1997.

“Disruptive innovation is the key driver of global equity returns, and this will not change over the coming decades,” he added.

He continued that as just a relative handful of names are responsible for total long run global equity returns, the right way to think about stocks is that equity indices usually go up, but only because of a small group of names. Therefore, he recommended that traders dealing in these names should look for catalysts, set stops and take-profit levels, and avoid turning a trade into an investment.

“To match index performance over time one must have at least market-weight exposure to the handful of stocks that actually drive performance,” he added. “This is one reason why index-based investing is superior to most alternatives. The market gets things wrong, but human judgement often makes even more errors.”

Colas expects the list of long run winners will be different in the next 20 to 30 years but that US companies will still dominate the Top 20 list. So, investors should be overweighting US equities, especially in tech and adjacent industries.

“The key lesson from the current list is that disruptive innovation drives global equity returns more than any other factor,” he said. “America, with its world-leading venture capital industry, is best positioned to create the winning companies of the future.”

The performance of US stocks was highlighted by UK asset manager Schroders in its Equity Lens report for August 2023.

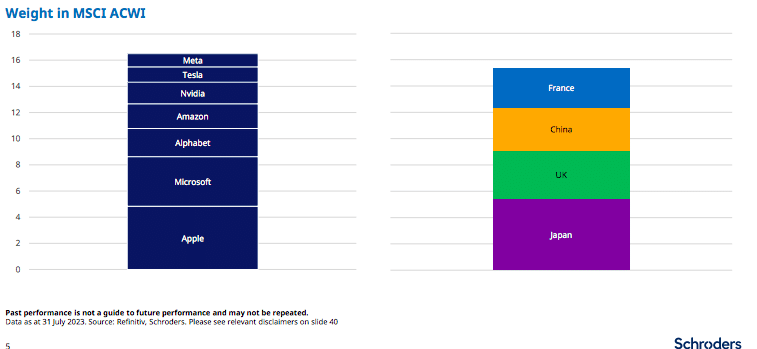

Schroders strategic research unit said in the report: “The Super-7 US stocks now make up more of MSCI ACWI than Japan, UK, China and France combined. The rest of the world has been left in their wake this year.”

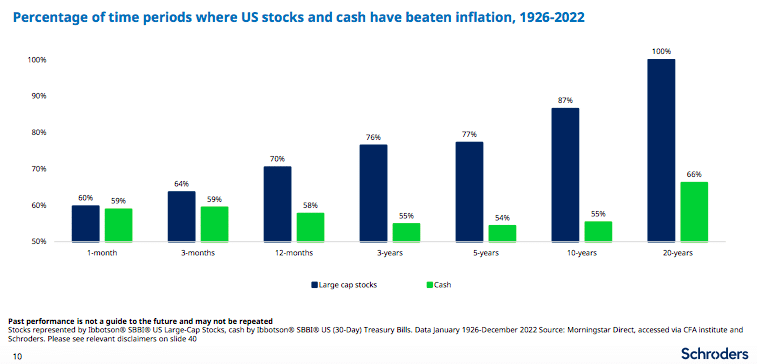

Schroders also argued that in the long-run, stock market investing wins out over cash.

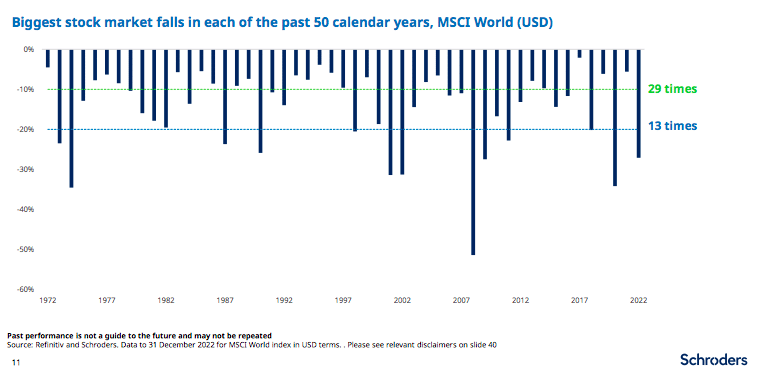

However, the asset manager said it can be a bumpy ride as 10% falls often happen in a year.

The source paper used by Datatrek can be read here: “Long-term shareholder returns: Evidence from 64,000 global stocks” (Bessembinder, Chen, Choi, Wei, revised 2023): https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3710251