Jacobi Asset Management expects to launch a suite of exchange-traded funds over the next 12 months after launching Europe’s first spot bitcoin ETF.

Martin Bednall, chief executive of Jacobi Asset Management, told Markets Media that the fund manager expects to launch more ETFs over the next year. On 15 August Jacobi listed Europe’s first spot Bitcoin ETF on Euronext Amsterdam with Flow Traders operating as market makers and Jane Street and DRW as Authorised Participants.

Bednall said: “We have had a number of conversations with investors who were waiting for a spot Bitcoin ETF structure before they would enter the asset class. Institutions have not had the right product to invest in digital assets and we feel we have addressed that issue.”

He said it will take time for institutions to do their due diligence on the ETF and sentiment in the crypto market will be a big factor in their investment.

Genesis, an institutional digital assets financial services firm, said in its Q2 Market Observations report that the introduction of ETFs in the past has proven a meaningful catalyst for further price appreciation in the underlying asset.

“Such was the case for assets previously considered ‘fringe,’ from junk bonds to emerging market debt and precious metals, which now form a core part of most macro portfolios, for which index and ETF access product is now rife and which experienced a material appreciation post-ETF launch,” added Genesis.

Jacobi was launched in May 2021 with Jamie Khurshid, a former Goldman Sachs investment banker, as chief executive. In August 2022 Bednall took over as executive with Khurshid becoming chairman. In a previous role Bednall had spent more than thirteen years at BlackRock, including as co-head of the the product team of iShares, the asset manager’s ETF arm.

Bednall said that his experience at Blackrock and launching ETFs and exchange-traded products (ETPs) over many years means he has a very good understanding of the market, regulations, investor preferences, and how they come to bear in terms of product design at Jacobi.

Crypto ETPs are already listed in Europe but Bednall explained that the structure of an ETF and ETP are very different. The ETF is regulated by the Guernsey Financial Services Commission and has greater investor protection according to Bednall.

He said ETPs are debt instruments issued by a special purpose vehicle which owns the physical Bitcoin. In contrast, ETF investors buy fund units which have direct ownership of physical Bitcoin held in custody under a trust arrangement, in this case by Fidelity Digital Assets, a brand that is well known to institutional investors and regulators.

“When I was at iShares we would first look to do a physical fund, then a swap fund if that was not possible, and a note was third on the list,” added Bednall. “Notes are easier to launch from a regulatory perspective but we have put in the hard work working with regulators and service providers to launch an ETF.”

Sustainability

The fund manager said the Jacobi FT Wilshire Bitcoin ETF represents the first digital asset fund compliant with SFDR Article 8 through its decarbonisation strategy. Bednall explained that due to EU regulation, institutions want to get into crypto and digital assets but at the same time they need to address their SFDR reporting requirements.

The European Union’s Sustainable Finance Disclosures Regulation (SFDR) is a part of the trading block’s plan to shift capital flow towards sustainable finance and requires mandatory ESG disclosures. Under SFDR funds are classified as either article 8, which are referred to as ‘light green’, or article 9, which are called dark green as they have core ESG objectives.

“We are really proud of adding the sustainability element to the ETF,” said Bednall. “As a firm we look to embed sustainability into everything that we are doing.”

Jacobi claimed its ESG solution differs from carbon offsetting products by quantifying the electricity consumption attributable to Bitcoin in the ETF and purchasing equivalent RECs, the standardised instrument for procuring clean power from Zumo. This provides digital proof of RECs, transparently recorded on a blockchain.

Kirsteen Harrison, environmental manager at Zumo, said in a statement: “The decarbonisation of crypto is one of the most pressing challenges facing the nascent digital assets sector, and there is increasing pressure on all businesses to have credible plans to decarbonise.”

Growth strategy

The European ETF market is dominated by large asset managers but Bednall argued that most of them have not launched digital asset products, which have been issued by specialists and new market entrants.

“We are in a space where there are newer players so its a good area for us to enter the marketplace,” he said. “SFDR Article 8 is a differentiator that builds a moat around what we are going to do for this product and future product launches.”

Jacobi has been having interesting conversations around sustainable investing in digital assets and so expects to launch more products in that sphere over time. In addition, Bednall believes that the time needed to receive regulatory approval for an ETF product also gives Jacobi some first-mover advantage.

He continued that Jacobi will look to offer other single coin ETFs and then multi-coins. Jacobi has also partnered with Wilshire Indexes, who are providing the benchmark for the first ETF, and will work with the index provider to develop future products.

“We will be very deliberate about future launches, which will also be based on the macro environment,” said Bednall. “There is some low-hanging fruit that we can easily go after this year, and then slowly build up the product range.”

The US Securities and Exchange Commission has only permitted bitcoin futures ETFs, and has so far rejected all the applications for spot bitcoin ETFs. However, in July this year five bitcoin ETF applications from BlackRock, Fidelity, Invesco Galaxy, VanEck and WisdomTree were published in the Federal Register, which sets a timeline for the SEC to review the proposals. The Jacobi FT Wilshire Bitcoin ETF is not available to US investors.

“There are a lot of positive reasons to think the market will grow, especially with the spot Bitcoin ET applications in the US,” Bednall added.

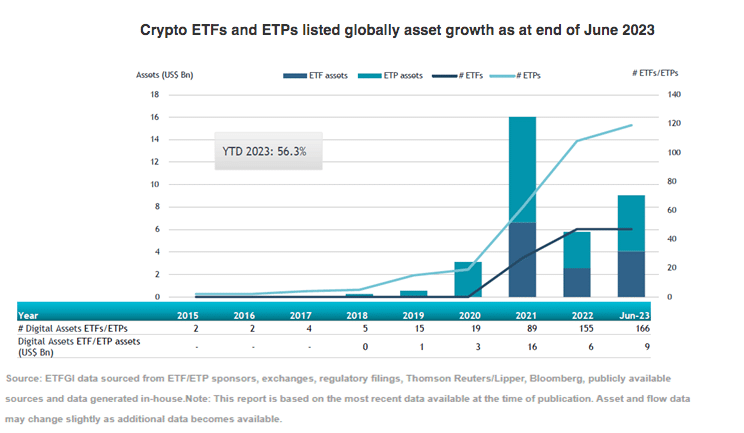

Crypto ETFs and ETPs listed globally gathered year-to-date net inflows of $242m in the first half of 2023, which is lower than $567m in net inflows at the same point last year according to ETFGI, an independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem.

Total assets invested in crypto ETFs and ETPs listed globally increased by 9.7% from the end of May to $9.1bn, according to ETFGI’s June 2023 ETF and ETP Crypto industry landscape insights report. ETFGI said substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $434m during June. BTCetc, ETC Group’s Physical Bitcoin – Acc (BTCE GY) gathered $121m, the largest individual net inflow.