Eurex is introducing contracts on socially responsible indices while trade association ISDA has launched a clause library for sustainability-linked derivatives.

Deutsche Börse’s derivatives arm said in a statement that it is adding to its environmental, social and governance (ESG) suite by launching derivatives on socially responsible investing (SRI) indices.

On 22 January 2024 Eurex will start trading futures on the STOXX Europe 600 SRI Index AND MSCI’s SRI index suite, covering Europe, USA, World, and Emerging Markets.

There are more than 500 funds tracking SRI indices, said Eurex, and the top 10 SRI ETFs account for more than $45bn in total assets under management.

Randolf Roth, member of the Eurex executive board, said in a statement: “Our offering will certainly appeal to new user groups that have stricter ESG mandates and need to invest responsibly, such as asset managers who invest on behalf of endowment funds or foundations.”

The product launch will be supported by a liquidity provider scheme, offering regular rebates and revenue sharing elements.

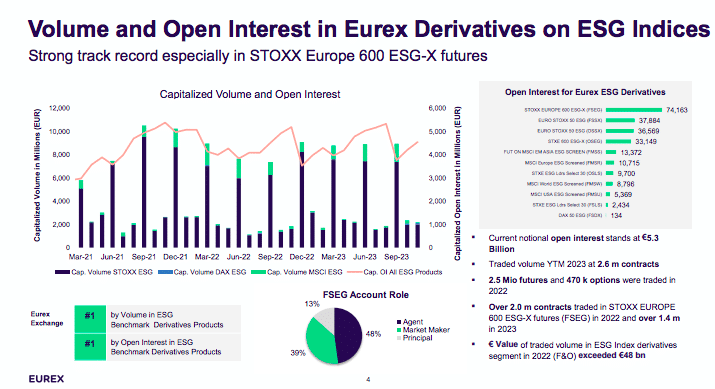

Eurex launched its first derivatives on ESG indices in February 2019 and total volume reached nearly 11 million contracts by the end of 2023 according to the exchange.

Average daily trading volume in 2023 was 12,000 contracts, and annual volume increased 5% from 2022.

“Around 110 Eurex members have been active in Eurex derivatives on ESG indices to date; customers account for about half of the volumes traded,” added Eurex.

ISDA

In the over-the-counter derivatives market, ISDA has launched a clause library for sustainability-linked derivatives (SLDs), designed to provide standardized drafting options for market participants to use when negotiating transactions.

Scott O’Malia, chief executive of ISDA, said in a statement: “The ISDA SLD Clause Library is designed to eliminate unnecessary differences and bring greater standardization to this market. This will bring more efficiency to the negotiation process and reduce risks, setting the foundations for this market to develop further.”

SLDs embed a sustainability-linked cashflow in a derivatives structure and use key performance indicators to monitor compliance with ESG targets, incentivizing parties to meet their sustainability objectives.

ISDA said that while the market is still in its infancy and is highly bespoke, their survey in 2022 showed that there is demand for standardized terms and clauses in specific areas to support the development of this product.

The ISDA SLD Clause Library provides standard-form drafting options in several key areas, including provisions stipulating what evidence of sustainability performance must be delivered and when, mechanisms to adjust cashflows depending on whether relevant ESG targets have been met, and options available to counterparties following disruption and review events.