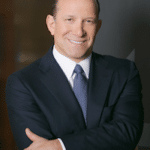

BGC Group, the brokerage and financial technology firm, aims to launch its FMX Futures Exchange for U.S. Treasury and SOFR contracts in the summer of this year, and compete against CME Group, who reported a record year for 2023.

In January this year BGC announced that its FMX Futures Exchange had received regulatory approval from the Commodity Futures Trading Commission.

Howard Lutnick, chairman and chief executive of BGC, said on the results call on 14 February that the group was pleased with the CFTC’s recent unanimous approval for FMX to operate an exchange for U.S. interest rate futures products, the largest and most widely traded futures contracts in the world.

“We intend to launch the FMX Futures Exchange in the summer of 2024,” he added.

At the time of FMX’s regulatory approval Lutnick said BGC will combine its Fenics UST cash Treasury platform with the new exchange to compete across CME’s US interest rate complex.

“Similar to U.S. interest rate futures, the wholesale U.S. Treasury market had historically been dominated by the CME until we launched Fenics UST,” he added. “Since our launch, Fenics UST has grown rapidly, reaching 25% market share during the third quarter of 2023, up from 18% only a year ago. We will execute the same playbook with our FMX Futures Exchange.”

Lutnick said his confidence level is “off the charts” that BGC will be able to discuss the strategic partners for FMX and further details on, or before, the firm’s first quarter earnings call.

“We got CFTC approval in January and we are going to open in the summer,” he added. “It would be more fun to talk about the partners in the middle.”

BGC’s objective is not to deliver just a list of the names of partners, but the full details of the transaction and how the exchange will work. Lutnick said BGC will be very transparent, very detailed and very explanatory. He does not see any barriers to launching FMX.

“These are just plumbing issues, meaning we have to connect to all the FCMs and sign up clients,” he added.

The first year after launch will involve FMX connecting trading firms, and Lutnick said BGC has a huge advantage because the firm is already connected to virtually all of them in its rates business.

“I don’t know that there’s ever been a firm with a better advantage in that regard,” said Lutnick.

After the first year of robust connectivity, Lutnick expects FMX’s second year will be about transactions.

“We view the third year as fundamental competition to CME,” he added.

CME’s interest rate complex

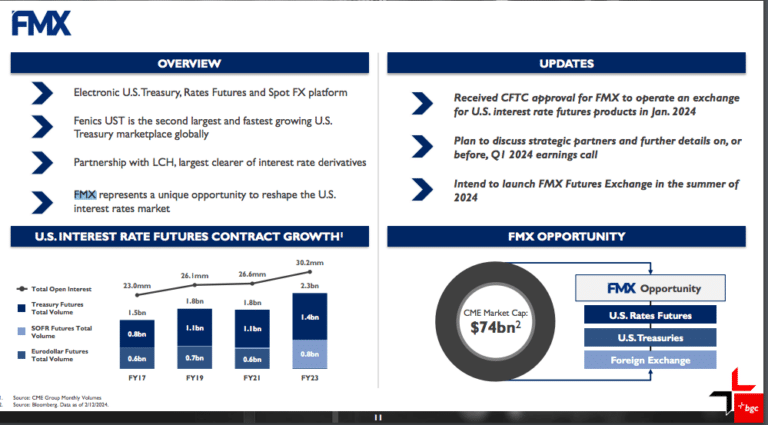

On 14 February CME Group also reported its full-year 2023 results. CME said average daily volume for 2023 was a record 24.4 million contracts.

Fourth-quarter 2023 ADV was 25.5 million contracts, up 17% from the same period in 2022. CME said this was the highest of any historical fourth quarter ADV and 33% higher than the recent 5-year average for the final three months of the year.

Terry Duffy, chairman and chief executive of CME Group, said on the results call that the fourth quarter of last year was the tenth consecutive quarter of double-digit adjusted earnings growth.

Duffy said: “This strong performance was driven, in large part, by a 36% increase in interest rate volumes in the fourth quarter, including a 46% rise in Treasury futures ADV.”

Interest rates ADV grew to 13.3 million contracts in the fourth quarter, the highest fourth quarter ADV on record according to CME.

CME reported that Treasury futures and options ADV increased 44% in the fourth quarter from the prior-year period to a record 7.7 million. Interest rates ADV grew 36% to 13.3 million contracts in the fourth quarter, the highest fourth quarter ADV on record, which included Treasury futures and options ADV increasing 44% to a record 7.7 million.

CME had quarterly ADV records across 2-Year, 5-Year, Ultra 10- Year, 30-Year Bond, Ultra Treasury Bond, and Micro 10- Year Yield futures.

Duffy continued that there is a common view that a rising rate environment is optimal for CME’s interest rates complex, but volume growth accelerated after the US Federal Reserve stopped raising rates in July 2023. In the six months between August 2023 and January 2024, interest rates ADV increased 24% year-on-year.

In addition, CME Treasury futures open interest reached a record 21.4 million contracts on 24 November 2023. In the prior month, interest rates large open interest holders reached a new high of 3,238 on 24 October.

In January 2024 interest rates ADV rose to a record 13.1 million contracts, up 27% from a year ago.

Clearing

In January 2023 CME’s enhanced cross-margining arrangement with the Depository Trust & Clearing Corporation (DTCC) went live, in order to improve capital efficiencies for clearing members that trade and clear both US Treasury securities and CME ‘s interest rate futures.

Under the new arrangement, eligible clearing members can cross-margin an expanded suite of products, which expands clients’ capacity for increased risk management and trading.

Suzanne Sprague, global head of clearing and post-trade services, at CME said on the call that the new arrangement is in its early days but eight clearing members are already live.

“Some portfolios are already seeing consistent savings of 75% to 80% in their margins,” she added.

FMX has a clearing agreement with the London Stock Exchange’s LCH SwapClear, which BGC said is one of the largest holders of interest rate collateral in the world, and positions FMX to compete and reshape the US interest rate market.

Lutnick said: “LCH means that this will be the first time that CME has a real competitor who can provide margin offsets and capital efficiency.”

Financials

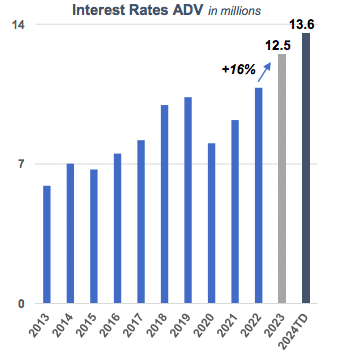

Lynne Fitzpatrick, chief financial officer at CME, said on the results call that in addition to reaching record average daily volumes in 2023, the group also reported record financial results.

Total revenue for full-year 2023 was a record $5.6bn, operating income was $3.4bn and net income was $3.2bn.

Fitzpatrick also highlighted that transaction fee changes became effective on 1 February 2024.

“Assuming similar trading patterns as 2023, the fee adjustments would increase futures and options transaction revenue approximately 1.5% to 2%,” she added. “Taken in aggregate with the fee changes for market data and non-cash collateral which took effect January 1st, the fee adjustments would increase total revenue by approximately 2.5% to 3% on similar activity to 2023.”

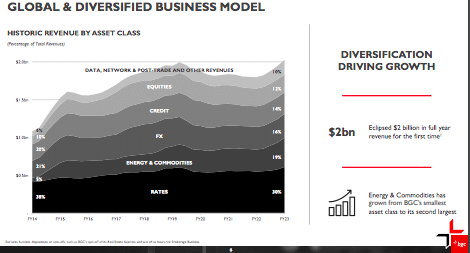

Lutnick said BGC had its best fourth quarter in 2023, with record revenues of $516.8 m and adjusted earnings of $110.8 m.

“Our revenues improved over 18% ending a strong year where we delivered accelerating year-over-year revenue growth each quarter,” Lutnick added. “We expect favorable macro trading conditions to continue throughout 2024.”