BlackRock’s exchange-traded fund business, iShares, had a record start to the year which has taken the fund manager’s assets to a record $10.6 trillion at the end of June.

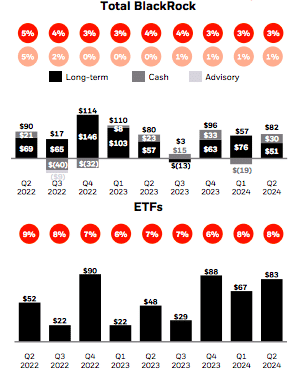

On 15 July, BlackRock reported in its second quarter results that assets under management increased $1.2 trillion year-over-year, driven by consistent organic growth and positive market movements. In the second quarter of this year the firm had $82bn of total net inflows, and $139bn of net inflows in the first half of 2024.

Martin Small, chief financial officer of BlackRock, said on a conference call on 15 July that flows in the second quarter were impacted by the redemption of a $20bn active fixed income mandate from a large insurance client that was linked to M&A activity but were positive across product types, active and index.

“Excluding the single client specific item and low-fee institutional index equity flows, we saw nearly $150bn of total net inflows,” Small added.

Small claimed that BlackRock led the ETF industry for inflows in the first half of this year, and that flows were more diversified by product type, channel and region than for any other issuer. ETF flows also more than doubled from the first half of last year according to BlackRock.

ETF net inflows of $83bn in the second quarter were led by fixed income at $34bn, equities at $32bn and precision ETFs added another $14bn as clients reassessed their tactical portfolio allocations and added exposures to growth equity.

“BlackRock’s bitcoin ETF continues to lead and gathered another $4bn in the second quarter, for $18bn of net inflows in its first six months,” said Small.

Laurence Fink, chairman and chief executive of BlackRock, said on the call the bitcoin ETF is the third highest grossing ETF in the industry this year.

“Three of the five top asset-gathering bond ETFs are iShares, and our active ETFs contributed $12bn in net inflows in 2024,” said Fink.

Fink continued that flows for iShares in June were the strongest month in the firm’s history and for any other issuer.

BlackRock is focused on innovating in ETFs, particularly with active ETFs bond ETFs, and extending distribution partnerships. In June this year, BlackRock partnered with the platforms of a number of international banks and brokers to expand distribution and provide access to the asset manager’s products according to Fink.

BlackRock expanded its ETF business with the acquisition of Barclays Global Investors in 2009. At that time iShares had assets under management of approximately $300bn, according to Fink, and is approaching $4 trillion today.

“We have never been shy about taking big, bold, strategic moves to transform ourselves and most importantly, transform our industry,” said Fink. “We continue on our mission to transform private markets.”

Private markets

In January this year, BlackRock announced the acquisition of independent infrastructure fund manager Global Infrastructure Partners (GIP), which is expected to double private markets base fees and add approximately $100bn of infrastructure assets under management. Small said the deal is expected to close in the third quarter of this year, subject to regulatory approvals and other customary closing conditions.

“The industrial logic that informed our planned acquisition of GIP has only become even clearer in the last six months,” said Fink. “There is a generational demand for capital and infrastructure, including finance, data centers for AI, and for the energy transition.”

For example, in June this year Germany’s Mainova Group sold 50.1% of its shares in Mainova WebHouse to a fund managed by BlackRock’s diversified infrastructure team in order to plan, construct and operate sustainable data centres in Frankfurt and the Rhine-Main region. In the same month, Fink said BlackRock joined a new coalition to mobilize infrastructure investments in the Indo Pacific region, alongside GIP and other global investors.

Fink said: “The opportunities we have in infrastructure are way beyond I ever imagined, even just seven months ago when we were contemplating and formalizing the GIP transaction.”

In addition in June this year, BlackRock announced another acquisition in private markets through the $3.2bn purchase of Preqin, an independent provider of private markets data. Preqin is expected to accelerate the growth and revenue contribution of BlackRock’s technology services business according to Small.

In June this year BlackRock also announced a strategic partnership with financial technology firm GeoWealth in the US wealth market. Through the partnership, BlackRock will offer custom models via GeoWealth’s platform that enable advisors to meet client demand for private markets, direct indexing and fixed income separately managed accounts (SMAs) in a single account with ETFs and mutual funds.

Fink said: “Stakeholder feedback on both GIP and Ipreo has been increasingly enthusiastic. We are on a differentiated path to transform our capabilities and infrastructure and meet the growing need for private market technology, data and benchmarking.”

He continued that BlackRock has longstanding relationships with corporates and governments as a long-term investor in public equity and debt, which differentiate the firm as a capital partner in private markets and can drive unique deal flow for clients.

“We have strong sourcing capabilities, and we are transforming our private markets platform to bring even more benefits of scale and technology to our clients,” Fink added. “As private markets grow, data and analytics will become increasingly important.”

He argued that as a result of its acquisitions, BlackRock will provide infrastructure solutions across equities and debt, a full range of infrastructure sector exposures and origination across developed and emerging markets.

“We envision we can bring the principles of indexing to private markets through standardization of data, through benchmarking and through better performance tools,” Fink added. “We think this opportunity to index the private markets is one of the most attractive that we’ve had in the history of BlackRock.”

Fink explained that as allocations to private markets have increased, the ability to seamlessly manage portfolios and risk across public and private asset classes on a single platform became critical for investors.

“BlackRock invested ahead of these clients needs to acquire eFront in 2019 and going on to integrate it with Aladdin to deliver a whole portfolio view, and our planned acquisition of Preqin will expand our capabilities,” he said. “We see a significant runway ahead as private market allocations from our clients will continue to grow alongside their need for integrated enterprise level technology, data and analytics.”

Financials

Small said that the first half of this year saw some of the firm’s highest growth rates in the post-pandemic period.

“We are growing faster than last year, delivered double-digit operating income growth and expanded our margin by 160 basis points year-over-year,” Small added.

He highlighted that BlackRock’s business tends to be seasonally stronger in the second half of the year.

Revenue in the second quarter increased 8% year-over-year, which Small said was primarily driven by the positive impact of markets on average assets under management, organic base fee growth, and higher performance fees and technology services revenue. Operating income rose 11% over the same period.

In January 2021 BlackRock completed the acquisition of Aperio, which customizes tax-optimized index equity separately managed accounts. Small said Aperio recently crossed the milestone of $100bn in assets under management and has demonstrated 20% organic growth since the acquisition three years ago.

Blackrock is also helping in the creation of the new Texas Stock Exchange.

“The exchange aims to facilitate greater access and increase liquidity in US equity capital markets,” said Fink. “This is built on a history of investing in similar market structure opportunities for the benefit of BlackRock clients.”

Outside the US, BlackRock agreed in April this year to launch a Riyadh-based multi-asset investment management platform in partnership with Saudi Arabia’s Public Investment Fund. PIF will anchor an initial investment mandate of up to $5bn. BlackRock’s joint venture in India with Jio Financial Services has expanded beyond asset management to brokerage and wealth management.

“Through strong organic growth and scaling of our private markets and technology platforms we believe we can drive compelling earnings growth and multiple expansion for our shareholders,” said Small. “We’re moving swiftly and aggressively to position our firm to achieve or exceed our 5% organic base fee growth target over the long term.”