A year ago, in October 2023 Catherine Clay took on the newly created role of global head of derivatives at Cboe Global Markets, the derivatives and securities market operator. She is ready to execute on a new strategy after putting a global team in place to meet the demand from overseas for access to US markets.

Clay told Markets Media that she felt that she understood the US landscape pretty well, but the global lens has expanded dramatically in the first year of her new role.

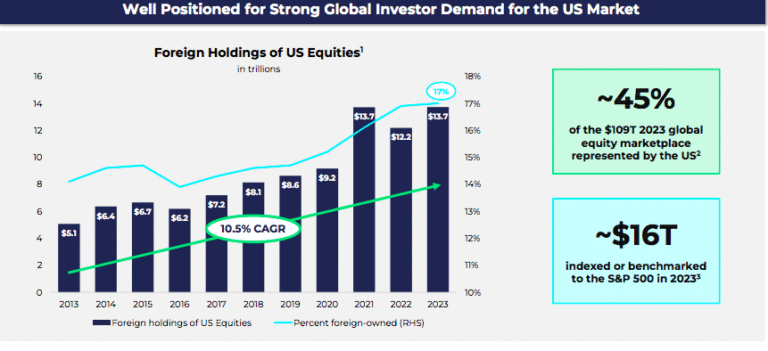

“Intuitively the United States is a magnet for capital formation and access to capital markets,” she said. “I learnt that the appetite for investors across the globe to access US markets, and specifically the S&P 500, is overwhelming and a relatively untapped opportunity for Cboe, and a lot of our global clients and partners.”

As a result, Cboe has altered the go-to-market strategy for the group and, in particular, derivatives. Cboe has offices in Sydney,Tokyo, Hong Kong and Singapore but Clay explained that from these landing pads, the firm can see where else it makes sense to have a physical presence.

“The change is allocating and reallocating resources in a way that we had not contemplated before,” she added.

Cboe already has an equities exchange and a derivatives exchange in Europe, and equities exchanges in Japan and Australia. The current focus is not to launch derivatives exchanges in Asia Pacific, but instead, to provide access to global clients.

“From Asia Pacific, it is about providing the on-ramps for trading into our markets here in the US, and into Europe,” Clay said.

Therefore, Cboe needs to understand the barriers to access, which Clay said can be as simple as not getting the firm’s market data. Cboe needs to understand new vendors and new access points and data delivery, and then understand how to help onboard clients and help them trade into the US.

In the US Cboe faces competition from new options exchanges. MEMX, a technology-driven exchange operator founded by members, reached over 3% total options market share and 6.1% regular electronic options market share in September 2024, coinciding with the one-year anniversary of the exchange.

IEX Group, which operates a US equities exchange, has plans to launch an options exchange. If IEX receives regulatory approval, it will become the nineteenth US options exchange. In August this year Miami International Holdings launched the newest options exchange, MIAX Sapphire electronic exchange, which will be followed by a physical trading floor in Miami next year.

Clay said Cboe welcomes competition, which benefits retail investors, but the proliferation of options exchanges is difficult for liquidity providers who need to connect to each venue. She added: “There are some considerations about how healthy it is to continue to have more and more options exchanges, as at some point it might not be helpful to the industry.”

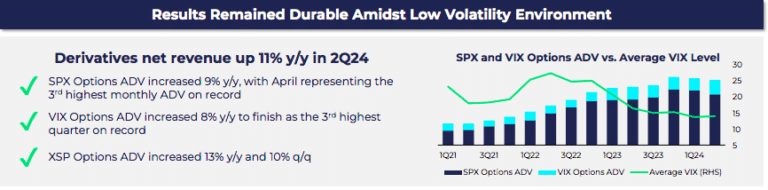

Cboe reported an all-time high of 4.23 million contracts for average daily volume (ADV) of of its proprietary index options product suite in the third-quarter of this year. Total volume in Cboe Volatility Index (VIX) options was 62.7 million contracts, with an ADV of 980 thousand contracts, the second-best quarterly volume on record.

Global structure

Cboe launched a derivatives exchange in Europe in September 2021 and CEDX has now been integrated into the global derivatives team alongside the Cboe Labs Innovation hub and the firm’s educational arm, the Options Institute.

“When I look back on the year, it is the perfect time to reflect on the way we have organized ourselves for the first time under this global derivatives structure, which allows for where we are headed going forward,’ said Clay. “We have restructured along global reporting lines, into a global team with global ambitions under the same incentive structure, so we have been able to work much more collaboratively.”

She gave the example that this has fostered the ability to think about how to go into a region like Asia Pacific more efficiently. A united team can bring education, sales and marketing efforts into the region and talk about the European and US exchanges together.

Clay said: “I’m most grateful that we have built the team that we need to carry the business forward in a really thoughtful way. We hired some really good talent this year and will continue to hire.”

New products

She continued that Cboe always thinks about innovating around its core SPX and VIX ecosystems. Options on Cboe VIX futures are expected to begin trading on Cboe Futures Exchange (CFE) on 14 October 2024.

Cboe currently offers securities-based VIX index options but the new contracts are physically settled. With futures as the underlying asset, the new options will be CFTC-regulated, enabling access for market participants that are restricted from accessing U.S. securities-based options to use the product to express their views on equity market volatility.

“We believe this will open up the product to a new and more global constituent base,” added Clay.

The contract should appeal to new users such as commodity trading advisors, customers of futures commission merchants, as well as market participants currently active in VIX exchange-traded products and in Cboe’s SPX option and VIX product ecosystems.

Cboe’s VIX Index options have seen record trading volumes during the last two years, with average daily volumes reaching over 851,000 contracts in 2024, up approximately 60% from 2022, according to the firm.

Rob Hocking, head of product innovation at Cboe, said in a statement: “We believe there is a strong demand for risk management tools, especially as investors prepare for the upcoming election and the recent change in the Fed’s monetary policy. We’ve seen a shift in how investors are using options on a day-to-day basis, and with Options on VIX Futures having a mid-curve structure and the ability to offer short-term exposure, investors are expected to be able to manage short-term volatility with greater precision.”

The exchange has also launched Cboe S&P 500 Variance futures on 23 September 2024 on the Cboe Futures Exchange. The variance futures offer a streamlined approach to trading the spread between implied and realized volatility of the U.S. equity market as measured by the S&P 500 index, enabling market participants to take advantage of discrepancies between market expectations and actual outcomes.

Keith DeCarlucci, chief investment officer at Melqart KEAL Macro Fund, said in a statement: “VIX futures and options play an important role when managing portfolios, and we welcome Cboe’s further expansion of its exchange-traded volatility tools with Options on VIX Futures. Combined with the recent variance futures launch, we have two new products to leverage.”

In addition, Cboe is still engaged in discussions with regulators about how to launch cash-settled index options tied to the FTSE Bitcoin Index, and has not yet made a regulatory filing.

Retail trading

Clay believes the trends in retail trading are getting even stronger, and that retail investors are becoming more sophisticated in how they access the markets and the strategies they use.

“This is not just because of education, but also the tools available to retail traders today, which are some of the tools I used as a market maker years ago,” she added. “The democratization of analytics, data and tooling for the retail trader has just been tremendous, and we love that they are finding more success and more utility in our markets.”

The Options Institute took its education program for retail traders into Europe this year and will go into Asia Pacific in 2025.

Robinhood Markets, the US retail broker-dealer, has said it intends to add index options and futures for active traders this year. Clay highlighted that Robinhood has approximately 24 million retail accounts, and only 4% are currently enabled for options trading.

“We couldn’t be more excited about partnering with Robinhood for their big launch,” added Clay.

Many other US broker-dealers already offer Cboe’s index options in the US. In Asia Pacific Cboe has also identified six focus countries for 2025 where the firm will work with local retail broker-dealers to help them to provide access to US index options for their clients.