Rachel Reeves, the UK Chancellor, met senior representatives from investment banking and asset management to discuss speeding up the settlement of securities trading.

In 2024 Canada, Mexico and Argentina cut their settlement cycles from two days after a trade, T+2, to T+1 on 27 May. On the following day, 28 May 2024, the US market made that transition.

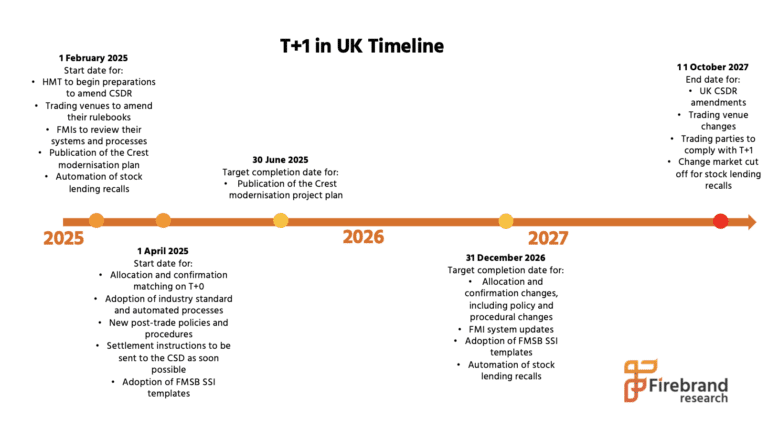

The UK government set up the T+1 Accelerated Settlement Task Force, which recommended that the shift should be made by 11 October 2027.

The UK Treasury said in a statement on 19 February 2025 that senior executives from JP Morgan, BlackRock, abrdn, Morgan Stanley, Goldman Sachs, Citi, Fidelity, and Schroders were part of the ongoing engagement with the financial industry.

Conor Hillery, deputy chief executive and head of investment banking in EMEA at JP Morgan, said in a statement the bank welcomed the Chancellor’s continued dialogue with UK financial services on its role in facilitating growth, which requires the right policy and regulatory framework. Hillery said: “This move to a modern T+1 settlement cycle will contribute to keeping London as a competitive financial centre, so we support the government’s efforts to make it happen.”

Reeves spoke about the importance of going further and faster to drive growth, according to the statement, and said the government had accepted all recommendations made by the Accelerated Settlement Technical Group . The Financial Conduct Authority and the Bank of England also support the industry recommendation to move the UK to T+1 settlement by 11 October 2027.

The UK government will bring forward legislation to implement the change.

“Faster settlement will support economic growth by putting the UK at the forefront of modernised, highly efficient and automated capital markets, bringing the UK into line with key international markets such as the US and reducing costs for investors by limiting risks when making trades,” added the Treasury.

Terms of reference have been published for the next phase of the project, which includes modernizing Crest, the UK securities settlement system. The project will continue to be led by the industry taskforce with Andrew Douglas as chair and the Treasury, FCA and Bank of England as observers.

European migration

Industry chairs from the European Union and Switzerland have also been invited to observe the UK industry taskforce to encourage alignment across Europe.

The European Commission has also proposed that 11 October 2027 is the appropriate date for the European Union to transition to T+1 settlement. The proposal needs to be submitted to the European Parliament and the Council and will enter into force once the co-legislators have reached an agreement on the proposal and after publication in the EU Official Journal. The Commission said in a statement: “It will avoid market fragmentation and costs linked to misalignment between EU and other global financial markets, contributing to the competitiveness of EU capital markets.”

The Swiss Securities Post-Trade Council (swissSPTC) has also recommended that the transition to T+1 for the domestic markets in Switzerland and Liechtenstein should occur in October 2027. The swissSPTC Task Force T+1 will commence detailed assessments on specific proposals and produce recommendations for the transition.

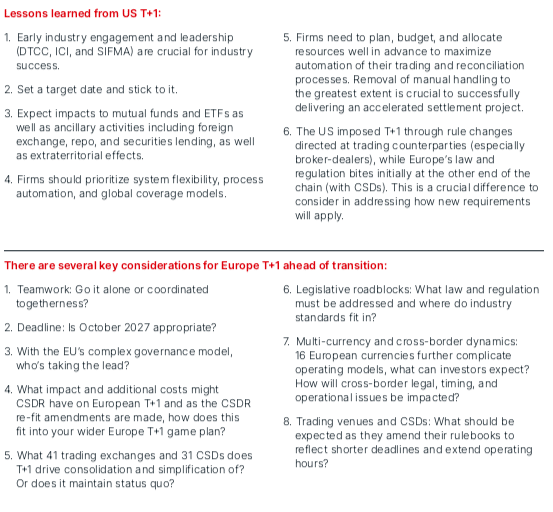

Adrian Whelan, global head of market intelligence at Brown Brothers Harriman Investor Services, told Markets Media that there are many salient learnings from the US transition, however, European T+1 will be more challenging despite the huge volume and scale of the transition last year.

Whelan said: “My US colleagues don’t like it, but I tell them that US T+1 was easier because it was a single currency, a single central securities depository and three exchanges.”

The biggest difference between Europe and the US is the fragmentation of markets, due to numerous local exchanges and CSDs due to local property and tax laws, which increases operational complexity.

The European Commission said in a statement that it is proposing a targeted amendment to the Central Securities Depositories Regulation (CSDR). The Commission said: “The move to T+1 will require increased automation of post-trading processes. This will lead to more modern and efficient post- trading processes across the EU.”

Whelan said it is positive that the UK, EU and Switzerland have all set a deadline of October 2027.

“I think the big decisions will be made now,” he added. “We need to get the band back together on T+1 as there were great learnings from last year.”