Investors can now access 13 tokenized funds on WisdomTree Connect, the asset manager’s platform which offers crypto-native institutions access to tokenized real world assets.

Maredith Hannon, head of business development, digital assets at WisdomTree, told Markets Media that this is the largest number of tokenized funds that are available from a regulated asset manager as they span tokenized equities, fixed income and asset allocation funds. The 13 funds are registered with the US Securities and Exchange Commission under the Investment Company Act of 1940. When the platform was launched in September last year, it offered institutional access to just WisdomTree’s tokenized money market fund.

Hannon said: “What’s really exciting about these 13 funds being included on the WisdomTree Connect platform is that institutions can build a diversified portfolio and complete their asset allocation on-chain across five chains.”

The WisdomTree Connect ecosystem has expanded beyond the Ethereum blockchain to the Arbitrum, Avalanche, Base and Optimism’s OP Mainnet chains, so the platform can be used by more on-chain firms without having to leave their ecosystem. Crypto-native institutions can interact with WisdomTree-issued tokens directly on-chain and they can be held in third-party and self-custodial wallets.

“Historically, investors would have to go off-chain to purchase these types of exposures in a brokerage account,” added Hannon. “This is the shift towards bringing more traditional assets on-chain, but we are also focussed on making the experience seamless for the end-investor.”

Users also do not have to go off-chain to invest in WisdomTree’s tokenized funds as they can USDC, Circle’s stablecoin, in addition to fiat US dollars. WisdomTree will look to add other stablecoins over time, and Hannon said this is critical to enable clients to access these funds in the same way as they interact with other crypto-native tokens.

“Blockchain technology is rooted in reducing friction,” she said. “It is about how we make processing more efficient, ledgering more efficient, recordkeeping more efficient and transactions more efficient.”

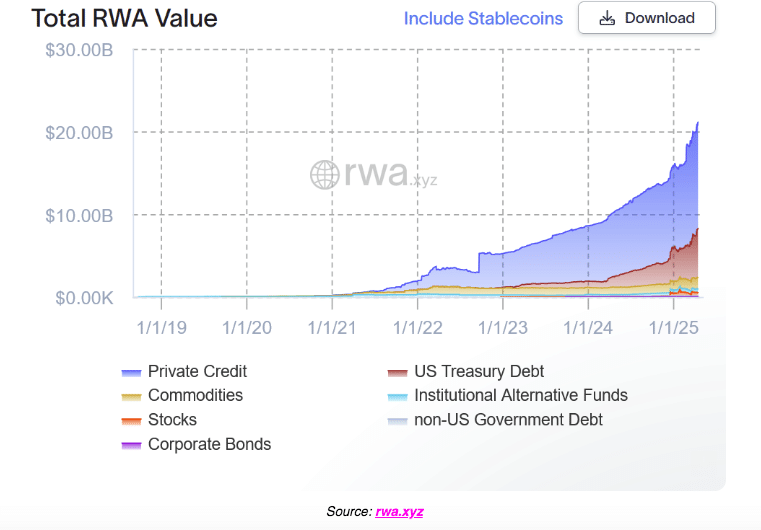

The total value of onchain real-world assets (excluding stablecoins) has reached a record $21.1 bn, according to data provider rwa.xyz.

Hannon continued that being able to use tokens in the ecosystem in a more native way will lead to WisdomTree developing interesting products in terms of other decentralised finance (DeFi) integrations such as collateral management, lending pools or payment integrations.

“We are starting to think about the utility of these on-chain assets and how to improve the experience for the end investor,” said Hannon.

For example, last year the asset manager launched the WisdomTree Prime Visa Debit Card, which allows individuals to spend their digital asset investments. WisdomTree Prime offers a curated set of digital assets (such as dollar tokens, gold tokens, ether and bitcoin) and digital funds offering a variety of exposures in bonds and equities to retail investors.

Identity

In order to join WisdomTree Connect, institutional investors must complete customer due diligence verification in accordance with anti-money laundering and other applicable regulations. Once they are approved, they receive an on-chain attestation represented by a non-transferable NFT (non-fungible token) for their wallet, and only approved wallets can participate in transactions on the platform. Investors with approved wallets can make peer-to-peer transfers of tokens with the Transfer Agent maintaining the official record of share ownership. Hannon said WisdomTree frequently reviews the approved wallets and continuously reviews the client base to ensure it fits within the asset manager’s risk framework.

“This theme around identity is starting to be a focus of our industry, and rightfully so,” she added. “We think this is the next evolution beyond a white list or a black list, and a real way to build a network of networks.”

Longer term, WisdomTree could accept another party’s whitelist or identity program but Hannon said that is very far down the line and requires some changes in regulation. Eventually, WisdomTree’s NFT could be used as an on-chain verification of identity for investors to use in the wider token ecosystem.

“The vision is to think about on-chain identity more broadly, and how we achieve that in a regulated way so we only work with approved counterparties,” she said.

BlackRock’s Larry Fink also raised digital identity in his 2025 Annual Chairman’s Letter to Investors . Fink wrote that tokenized funds will become as familiar to investors as ETFs provided that the critical problem of identity verification is solved.

Fink said financial transactions demand rigorous identity checks so a new digital identity verification system is needed. For example, Apple Pay and credit cards verify identity billions of times a day and traditional trading venues do the same for buying and selling securities.

“It sounds complex, but India, the world’s most populous country, has already done it,” Fink added. “Today, over 90% of Indians can securely verify transactions directly from their smartphones.”

Hannon continued that an on-chain verification of identity will increase the utility of tokens. She said: “I think that is the future and enables tokens to move.”

Tokenized fund risks

Moody’s Ratings said in a report that as tokenized fund adoption grows, so do risks. The ratings agency said tokenized funds are introducing new possibilities to traditional finance by using blockchain to digitize shares of funds that invest in real world assets, and potentially reduce costs, streamline operations, open the door to a broader range of investors and offer 24/7 liquidity. In addition, tokenized funds can support new financial use cases, such as being used as collateral in lending transactions.

“With a current market capitalization of $3.6bn, tokenized funds have experienced close to 400% growth over the past year,” said Moody’s. “The rise of tokenized funds introduces numerous advantages, but also a broad array of risks that demand scrutiny.”

These risks included potential weaknesses in the blockchain technology that underpins these funds, including security vulnerabilities and scalability, and legal issues and difficulties in protecting investors, according to the report. Potential difficulties could also arise from a fund team’s limited size and track record in managing tokenized funds. Moody’s said: “The nascent state of the industry requires careful consideration of the domain-specific experience of the parties involved in transactions.”

Asset representation and regulatory compliance are also key to upholding investors’ legal rights so a thorough assessment of fund compliance is needed to safeguard investors because of the diversity of regulatory approaches to digital assets in various jurisdictions.

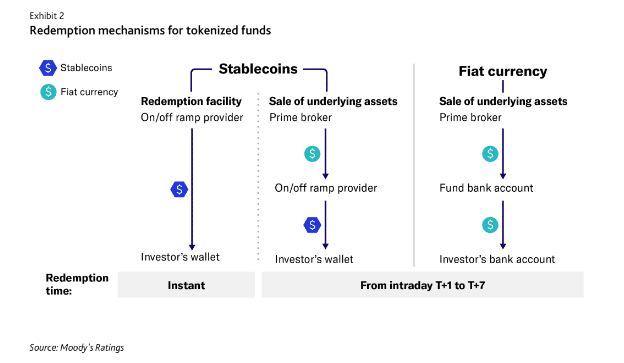

The ratings agency said efficient redemption management is crucial for maintaining token holders’ confidence in the fund. “Redemption facilitated through both stablecoins and traditional banking channels could serve as a protective measure against depegging events or blockchain malfunctions,” added Moody’s.