Depository Trust & Clearing Corporation (DTCC), the U.S. post-trade market infrastructure, has launched a new unified digital collateral infrastructure for the industry.

Nadine Chakar, global head of DTCC Digital Assets, told Markets Media that the company has introduced DTCC Digital Launchpad, its digital sandbox, over the past several months and the DTCC Composer X suite of platforms. Now they are live, the next goal is to use these platforms to demonstrate that DTCC can solve some of the biggest challenges facing the industry in a collaborative way.

On 2 April DTCC said in a statement that it had launched a new platform for tokenized real-time collateral management which uses its AppChain financial infrastructure to support institutional decentralized finance (DeFi). Chakar has previously worked in security services, so she is aware of challenges in collateral management due to rules and a fragmented market, which she said makes it a very expensive proposition.

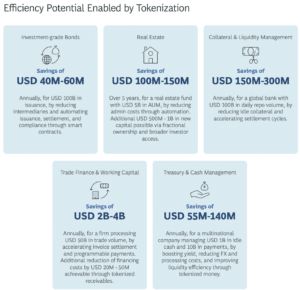

Crypto company Ripple and Boston Consulting Group said in a report, Approaching the Tokenization Tipping Point, that the $16 trillion global repo and collateral markets are hindered by fragmented settlement and slow asset mobility. The report said a global bank managing $100bn in repo could save $150m to 300m annually by reducing idle collateral, accelerating trade cycles, and achieving settlement on the trade date.

“If the industry is to scale tokenization, it needs interoperable token standards, common margin rules, and regulatory clarity on rehypothecation,” added the report.

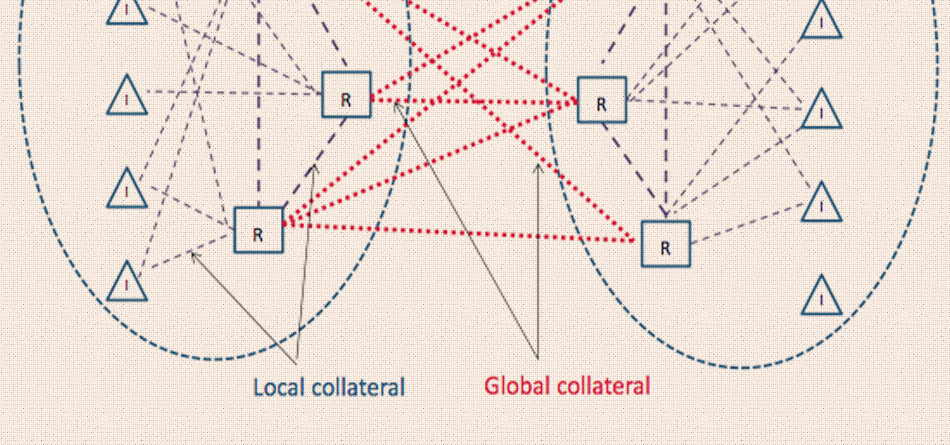

Collateral management can be an intensively manual process requiring a lot of paperwork, which can lead to delays and errors that cost the industry billions of dollars each year. However, distributed ledger technologies offer real-time visibility across global markets that can be combined with AI to provide powerful analytics that cut settlement times from days to minutes, and offer automated reporting, reducing both risk and costs. The use of distributed ledger technologies and smart contracts enables seamless connectivity across continents and products, which Chakar said creates holistic, global collateral pools.

“While we are not offering collateral management services, we saw an opportunity to work with the industry on a common infrastructure to enhance its mobility,” Chakar said.

She described DTCC’s job as acting as a galvanizing force to bring the industry together in a safe and resilient way, as it did for reducing the settlement time to one day following a trade, T+1, and helping the industry meet the requirements of the new Treasury clearing mandate. DTCC built the collateral platform infrastructure and invited clients to join its efforts.

A large client council has been involved and volunteered some of its experts to help on a legal workstream and to develop the operating model, according to Chakar. She said they have been experimenting with the platform and the feedback that DTCC receives from the industry will inform its next steps.

“I think about our platform as the Starship Enterprise,” she added.

Over the last 10 years, pipes have been built to use DLT to improve post-trade processes but they currently don’t talk to each other, according to Chakar. She describes interoperability as a lot more than moving tokens between chains – the industry also needs to agree on data standards, better controls, processes and regulatory compliance. People can come in and attach their own tools to the platform so DTCC can bring it all together.

Chakar said: “Only by working together can we accelerate adoption and increase liquidity.”

The new platform is an application-specific blockchain, using Hyperledger Besu because it is private, which Chakar said is reassuring to regulators and clients. On the AppChain, DTCC can control who has visibility into transactions.

“Our tokenization engines are geared toward allowing people to put in their own digital data schema, which is really important,” she added. “We have tools to track tokens, 24/7, every nanosecond, every day.”

The Great Collateral Experiment demonstrated how collateral can be moved on distributed ledger technology, underscoring the capabilities of institutional decentralized finance and unlocking new efficiencies in collateral management.

Watch the replay: https://t.co/zeiyO4OPMD pic.twitter.com/P9LNMHz5Q4

— DTCC (@The_DTCC) April 24, 2025

On 23 April DTCC and industry participants demonstrated how distributed ledger technology can be used in The Great Collateral Experiment. Chakar said during the demo: “Collateral management is the perfect killer application for blockchain. We have all witnessed the recent market volatility and liquidity challenges, which have underscored the criticality of resilience across global financial markets.”

She highlighted that DTCC’s goal is to find common ground for a unified digital collateral infrastructure for the entire industry, and that an open, interoperable approach to this new infrastructure is the best path forward as both technology and global regulations continue to evolve.

“Our collateral AppChain allows financial institutions to tokenize assets using any tokenization capability and issue assets onto any network, private or public, while remaining seamlessly integrated with traditional finance market infrastructure,” she added.

The experiment demonstrated 24 hours of a fictional global bank managing collateral across multiple real life scenarios across Asia, Europe and the U.S using a digital operating model. Synthetic data was used from DTCC Launchpad to show how digital technology makes collateral management faster, better and more efficient across dealers, the buy side, CCPs and triparty agents, as they all use the same platform.

Chris Watts, chief executive and co-founder at capital markets consultancy Tonic, said on the demonstration that it was a “real game changer.”

“The digital collateral use case is super strong and the ability to shortcut major collateral constraints in TradFi is the holy grail we have been searching for,” he added. “Imagine a world where an asset moves fluidly from one continent to another with no restriction on settlement windows, regions or product silos.”

Watts argued that there are a myriad proofs of concept for digital collateral, but nothing with the scale and completeness of DTCC’s experiment, especially as it is driven by industry participation.

Blockchain allows traders to use a single platform to interact with any form of value in any jurisdiction, 24/7. Using AppChain means there are no fees for transactions, which can be connected to any public or private ledger, traditional custodian, digital asset or tokenization protocol.

For example, in one fictional scenario , the Tokyo branch of the bank was unable to cover its margin requirement with a central counterparty using its own inventory. Digital technology allows the bank to access inventory from its U.S. branch outside of U.S. market hours to support its obligations in the Japanese time zone. The net asset pool allows the bank to manage inventory across both traditional and DeFi markets using a single platform, bringing significant operational efficiencies.

Conversion orders can bridge TradFi and DeFI. Traders can use a conversion order to change traditional assets, such as cash, treasuries, funds, equity and debt securities or any private security into digital form and back again, so they can move on unified rails and trade and settle in real time 24/7. Smart contracts can be programmed so that traders can only make transactions that are compliant with corporate policies and to automate the collateral life cycle.

Watts said he is a big fan of the conversion order. He added: “Instant tokenization of real world assets is not only super cool, but disrupts the whole market in an incredibly positive way.”

For example, tokenized assets can have embedded smart contracts to automate corporate actions, such as distributing dividend payments directly to investors’ digital wallets. In traditional finance, corporate actions require integration across dozens of systems management and reconciliation of many sourced data. In particular, processing corporate actions for alternative assets can take days, weeks, and sometimes, even months.

Sandy Kaul, head of digital assets and industry advisory services at Franklin Templeton, said in the demonstration said the asset manager is starting to see growing interest in using tokenized money market funds as collateral, as they have been a feature of the financial ecosystem for decades.

“Seeing these vehicles move into the tokenized space is creating a huge opportunity for us to really start to import some of the best of the TrasFi ecosystem onto these new crypto-inspired rails,” Kaul added. “This is really starting to take hold.”

Michelle Neal, chief executive of Fnality International, which is developing a series of regulated DLT-based wholesale payment systems, said in the demonstration that a central promise of asset tokenization is faster settlement, and this means greater asset mobility, including on an intra-day basis. She argued that the creation of an intra-day market will result in a large reduction of credit risk exposures by enabling settlement with atomicity, meaning that both legs settle or neither do.

“When combined with the wider digitization of central bank money in major currencies, as well as increasing tokenization of traditional assets, this stands to dramatically increase collateral availability, including from markets that have not been previously widely supportive.” added Neal.

Chakar described the collateral experiment as a milestone in the industry’s journey toward the adoption of tokenization and digital assets as the digital technology will be available this year for use in production. However, technology is not the critical factor on the path to industry take up, but the advancement of regulatory and the legal frameworks.

Chakar told Markets Media: “This has been built in collaboration with the industry, for the industry, and I think that’s what differentiates this platform from anything else.”

Just watched @The_DTCC’s The Great Collateral Experiment — hands down the most compelling tradfi demo I’ve seen. Not just vision, but a live, working product showing how tokenised collateral can transform markets.

When the parent of the world’s largest CSD makes this move, it’s…

— Graham (@Grodfather) April 23, 2025

Graham Rodford, chief executive and co-founder of Archax Ltd, the UK regulated digital asset exchange, said: “When the parent of the world’s largest CSD [central securities depository] makes this move, it’s clear: digital securities are the future.”

DTCC just signaled the end of T+1. Real-time onchain collateral settlement is no longer a thought experiment.

DTCC is moving fast—but on permissioned rails, without composability. The window for public chains to meet institutional demands is narrow, and it’s open now. pic.twitter.com/7RvqrJhwGf

— Colin Butler (@RealCryptoColin) April 30, 2025