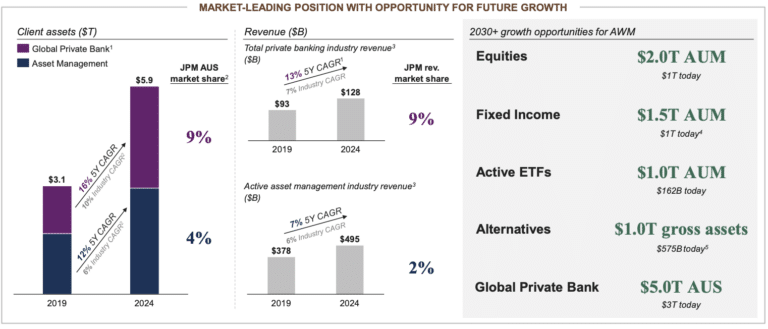

Mary Callahan Erdoes, chief executive of asset & wealth management at JPMorganChase, said the business will receive its largest ever investment spend this year and described how it could grow to more than $10 trillion in assets, from the current $5.9 trillion.

Erdoes said at the JPMorganChase investor day on 19 May in New York that the business is worth focusing on because it is has recurring revenues and is very capital light She said: “73% of our revenues come from recurring revenues, and we are firing on all cylinders in each region, in each sector, in each channel.”

Five years ago the group invested $1bn in the business, which increased to $2.3bn in 2024, and will be $2.7bn this year – the largest ever spend on the business according to Erdoes.

The investment can be financed because new clients have given $1 trillion in assets to the firm over the last two years, the business is “maniacally” focused on getting rid of waste and it had a 34% pretax margin and 34% return in equity in 2024.

The business has about $6 trillion in assets under management from sovereign wealth funds of the world to first time savers that walk into one of the bank’s branches.

“We have a path to $10 trillion if we continue to invest in the way that we have been,” she added. “If our investment performance holds up, I don’t see any reason that we wouldn’t be able to get there.”

She highlighted that the money will be spent on areas that will make a difference in the future including active management, alternatives, M&A and technology.

Active management

Erdoes said: “The first and foremost important investment we make every single morning of every single day is investing in active management.”

Erdoes described the business as the” most sought after active manager in the world” and said there were more assets flowing to the firm than anyone else in this space.

JPMorganChase is ranked fifth in overall asset management according to Erdoes, but third in active management. She added: “We are closing the gap to number one because of our flows.”

She argued that one of the most exciting growth areas is in active ETFs. The mutual fund growth is also expected to grow at about 6%, but growth in the active ETF business will be “explosive.” Erdoes stressed that JPMorgan is a top five active manager for net new flows in both mutual funds and ETFs, and believes that it is important that the same portfolio managers run both mutual funds and ETFs.

“We are number two in assets under management in the active ETF space, but our flows are number one,” she added. “Clients will end up closing that gap for us quite quickly.”

In addition, JPMorgan has three of the five largest ETFs in the world according to Erdoes, and 24 ETFs with more than $1bn in assets under management, most of which are less than three years old. She said: “You should expect those to have really explosive growth, probably growing at about five times that in the coming years.”

Erdoes said alternatives will define the next decade of the asset management business and she argued that JPMorgan has an advantage because the firm runs both traditional and alternatives “very well.” She also argued that the firm has four “killer” distribution channels for alternatives including the private bank. In contrast, customers at Chase are hungry for alternatives but have had little access to alternatives, but evergreen strategies for retail are going to grow.

Technology and AI

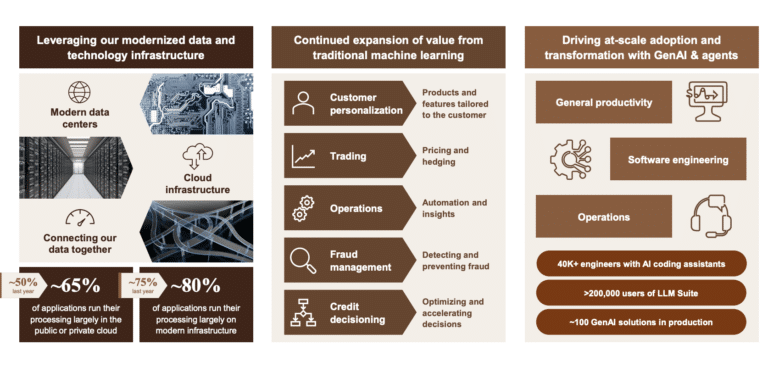

Erdoes discussed how technology has helped the business cope with the ”volume explosion” since April. The business averaged about 14 million trades a day, which doubled to 28 million trades in April, which included three of the four highest trading days the business has ever had.

“We trade roughly $260bn every day across asset and wealth management,” said Erdoes. “In April that went up to $500bn a day with no stress on the system.”

Artificial intelligence is being used to reimagine workflows, and change the loading capacities for thousands of staff. For example, portfolio managers use AI to digest millions of call reports, regulatory filings, the movement of stocks, including those that are not in their universe. “It’s taking things that take days and weeks and turning them into seconds, which is super powerful,” she added.

The Connect Coach application anticipates the next best action in a very personalized way to any particular situation, which will be available to about 17,000 employees by the end of this year.

Jeremy Barnum, chief financial officer, said at the investor day that the group’s outlook for total technology spend this year is approximately $18bn, up about $1bn year-on-year, with the majority spent on products, platforms and features.

“We are now probably past the point of peak modernization spend, resulting in a tailwind this year that is funding some of our ongoing investments in products, platforms and features,” he added. “We continue to see volume growth across the company which will drive some increased hardware and infrastructure expense.”

The group is continuing to make progress on moving to the cloud and modern infrastructure. About 65% of its applications now run a large part of their workloads on the public or private cloud, up from 50% last year, according to Barnum. He said that if the group includes the applications that run largely on virtual servers, that number increases to 80%.

The firm has also almost completed the application migrations for its largest legacy data centers, and is in the process of dismantling the physical infrastructure in those sites.

“This progress in our modernization efforts continues to deliver significant engineering efficiencies, which we see through ongoing improvement in our speed and agility metrics,” he added.

Barnum said the firm is particularly excited about the accelerated adoption of AI coding assistance by software engineers.

He described 2024 as a “pivotal year” with the launch of the group’s flagship model-agnostic generative AI platform, called LLM Suite. Over 200,000 employees globally have access to the platform, and on average, certain key subsets of the users have gained several hours a week of productivity from saving time on less valuable tasks.

“While we’ve made substantial progress over the last decade, we are still in the early stages of our AI journey,” said Barnum. “We are focused on modernizing data, investing in scalable platforms, and being at the forefront of innovation as technology evolves, positioning the company for sustained future success.”