Interdealer broker TP ICAP believes that the energy transition presents an opportunity, while it can continue to benefit from the continued growth in traditional energy sources.

Andrew Polydor, chairman and global head of energy & commodities at TP ICAP, said in the full-year results presentation: “Around one-third of our clients are actively trading energy transition products, and we expect demand to grow as a transition drives further change.”

The energy & commodities division operates in all major markets including oil, gas, power, renewables, ferrous metals, base metals, precious metals, soft commodities and digital assets and offers clients three distinct liquidity pools through Tullett Prebon, PVM and ICAP.

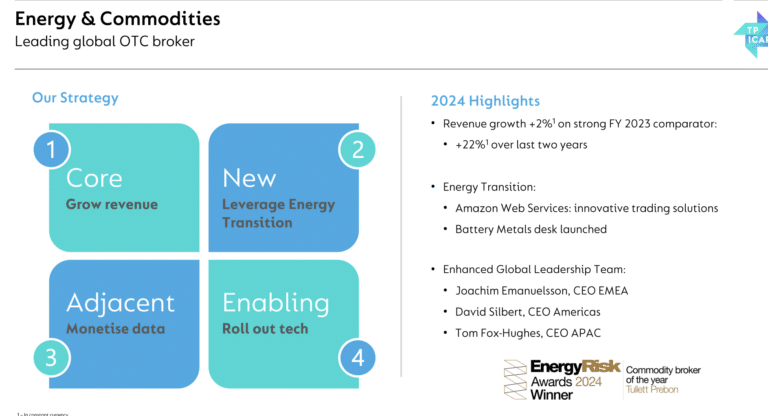

Developing new products to support the energy transition is one of the four parts of the strategy to grow the division, according to Polydor. The other three are continuing to deliver revenue growth in traditional or core markets, monetizing more data and rolling out technology to improve workflows for both clients and brokers.

Polydor said 2023 was a very strong year for the energy and commodities business, but revenue was 2% higher in 2024. In addition, the business has delivered organic revenue growth of 22% over the last two years. He added that the division performed “strongly” across all asset classes, due to the exceptionally favourable market conditions

Polydor highlighted that the business enhanced its senior leadership team with the appointment of three new regional chief executives in July 2024. Tom Fox Hughes was named chief executive of the division in Asia Pacific. Joachim Emanuelsson became chief executive of the business in EMEA after joining from SCB Group, which he co-founded and built into one of the leading low-carbon commodity broking and advisory firms over 16 years. Emanuelsson was appointed co-chief executive of energy and commodities in April 2025.

David Silbert also became the co-chief executive of energy and commodities in April 2025, after joining to lead the business in the Americas in July 2024. He was previously founder, senior partner and chief executive at global commodities trading firm Trailstone Group. Silbert told Markets Media that Polder has built TP ICAPS’s energy and commodities business over 20 years and the company wants to continue to focus on growth initiatives, including inorganic growth opportunities.

“Andrew can focus on acquisitions and more high-level strategic opportunities,” said Silbert. “We’ve been able to transition into running day-to-day operations and working with him on staffing the teams.”

Silbert continued that the energy transition requires an increasing reliance on natural gas, so volatility will continue to increase in power markets in the U.S. and Europe, and he argued that TP ICAP is well-positioned for this opportunity.

In January 2025 TP ICAP boosted its energy transition capabilities by launching a new Copenhagen-based dry bulk commodities desk, led by John Hamming, which allows the firm to serve clients across the entire supply chain from mine to consumer.

Emanuelsson said in a statement: “This is an exciting step forward as we expand our capabilities and bridge the gap between physical and derivatives markets. As the world’s leading energy and commodities broker, it’s important that we’re able to offer clients an unmatched, end-to-end service in the commodities space.”

TP ICAP touches the ESG (environmental, social and governance) value chain in many different ways – from the raw materials required to build wind farms to hedging carbon credits that they generate, as well as hedging the power that they produce. Emanuelsson highlighted that the transition economy is not just just biodiesel, ethanol or carbon credits but encompasses a bridge range of commodities such as battery metals, steel to build the wind farms, carbon credits to sustainable aviation fuel.

“We’re not advising on investments in the space, but advising clients with assets and exposure on how best to hedge and providing liquidity and access to markets,” Emanuelsson added.

Silbert argued that being in both physical and financial markets and having a global platform across the U.S., Europe and Asia is a huge advantage compared to smaller boutiques.

“We are not alone in that advantage,” he added. “A lot of our markets operate across 24 hours so it is a huge advantage to be able to service clients.”

He identified uranium markets as a possible gap in the division’s coverage, as nuclear energy will be part of the energy transition, and said this gap may be addressed either organically or through an acquisition.

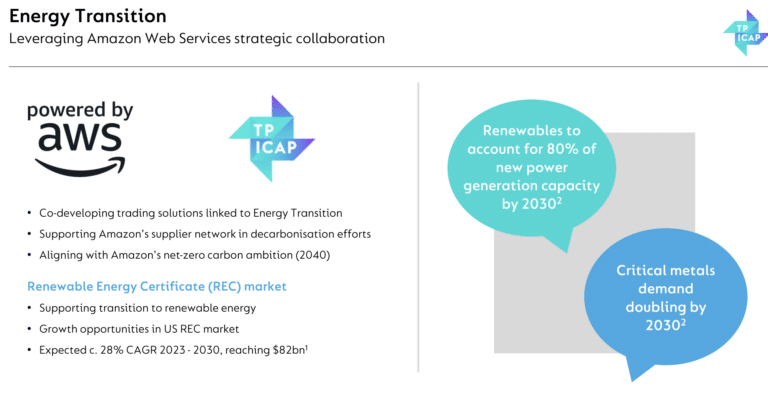

TP ICAP is also focused on the growing demand for environmental products, including renewable energy certificates and carbon certificates. The firm already operates in the renewable energy certificate market in Norway, Australia, and the U.S.

In addition, TP ICAP is building capability in metals and launched a new battery metals team in London and Singapore in 2024. Demand for rare metals to support the transition is expected to more than double by 2030 according to Polydor.

There has been a backlash against the energy transition under the Trump administration in the U.S. Emanuelsson told Markets Media that although some projects been put on hold, the transition has not been canceled in its entirety. Emanuelsson said: “Some firms have adjusted their targets but we don’t see it disappearing completely.”

Silbert continued in the short term, uncertainty has created some changes in commodities pricing, including environmental products, which is challenging for clients who want visibility and transparency.

“That creates a need for people to execute with us,” said Silbert. “They need more help than ever in assessing what is becoming overvalued or undervalued, and for what reasons.”

However, legislative uncertainty is also a major challenge for clients, especially as corporates need guidelines to be able to plan and make long-term investments.

“Corporates need certainty to be able to move forward and this is being reflected in the headlines of oil majors scaling back their targets,” added Emanuelsson. “The big challenge is around what we do in the next five to 10 years, which needs government guidance.”

AWS

In December 2024 TP ICAP partnered with cloud provider Amazon Web Services (AWS) to accelerate the development of Fusion, the firm’s electronic platform, and to co-develop sustainability trading solutions.

Polydor said: “This agreement also offers the energy and commodities division an exceptional opportunity to co-develop sustainability-focused trading solutions with Amazon’s suppliers, all of whom have to develop decarbonisation plans to align with Amazon’s 2040 Net Zero ambition.”

TP ICAP also owns a data business, Parameta Solutions, and Emanuelsson said data is a key component in the analysis of risk and natural exposure for clients. Emanuelsson added: “We provide that and we also provide micro-analysis around trade flows and how best to offset risk.”

For the first quarter of 2025, TP ICAP reported in its trading update that global broking revenue increased 14% from a year ago. Energy and commodities revenue was unchanged which TP ICAP said was in line with expectations, reflecting a competitive hiring market for brokers in 2024.