Clearstream, Deutsche Börse Group’s post-trade services provider, has partnered with fund manager Azimut to develop a digital solution for private market funds as Samuel Riley, chief executive of Clearstream Securities Services, said private market assets are the top priority for the firm’s funds business.

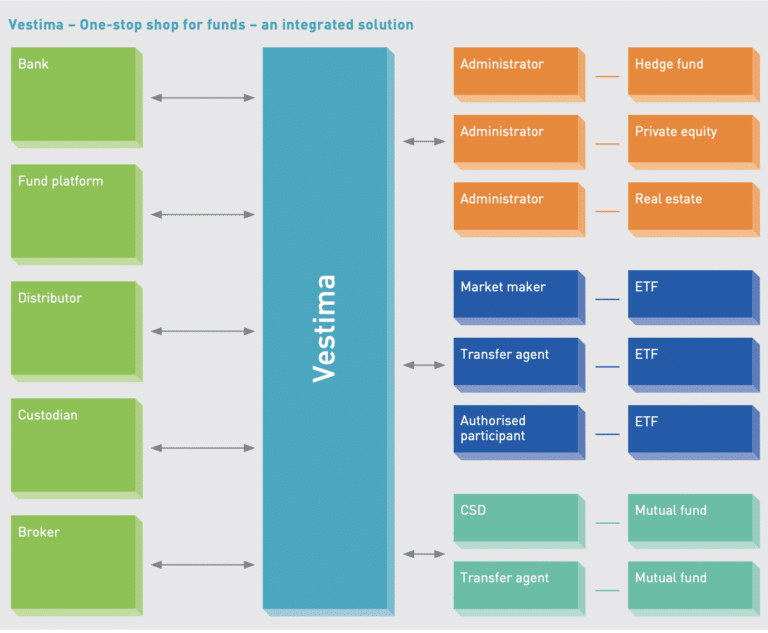

Riley told Markets Media that a move to Vestima to benefit from more efficient processing for both mutual and private market funds was one of the most important trends in his business. Vestima bundles Clearstream’s suite of investment fund services to provide order routing, settlement and asset servicing for mutual funds, ETFs and alternative funds, and covers more than 245,000 funds in over 55 markets.

“We have more than €300bn of private market assets on Vestima, which are growing fast,” added Riley. “This segment is the number one priority for the funds business.”

On 4 June 2025 Clearstream and Azimut, which specializes in asset management across public and private markets and wealth management, said in a statement that they are developing a new digital solution for private market funds, which will be an extension to Vestima. They are piloting the digital solution which aims to streamline the distribution and execution of private market products by automating processes, reducing costs and providing access to a wide fund repository.

Giorgio Medda, chief executive of Azimut Holding, said in a statement: “This innovative solution will provide broader access to private market strategies, along with a liquidity option that will allow investors to unlock the illiquidity premium embedded in private asset portfolios.”

The partnership with Azimut involves FundsDLT, Clearstream’s distributed ledger technology-based platform. FundsDLT technology offers a new account model for accessing multiple investor portfolios under a single Clearstream Custody account, while Azimut can access anonymized, detailed insights into the portfolios of individual investors.

Riley said another important trend is that clients are looking for more efficient settlement of ETFs by realigning Clearstream’s international central securities depository (ICSD) in Luxembourg and T2S, the European Union’s TARGET-2-Securities platform.

“The ability for automated realignment of assets between Clearstream’s ICSD and T2S will lead to more automated and optimised use of collateral,” he added. “We are also using AI to suggest potential collateral matches.”

Digital capabilities

Clearstream also runs D7, its digital post-trade platform, which currently supports fixed income and structured products.

Riley said there have been more than 1.3 million digital issuances on D7, with a value of more than €27bn from issuers including KfW, Germany’s promotional bank, and Commerzbank, the German financial services group. He added: “Digital issuance is now business as usual.”

The D7 platform will go live in Luxembourg this year according to Riley. D7 has launched APIs for issuers in fixed income, commercial paper and structured products, and Riley said ETFs and Eurobonds will be added.

“More than 60% of structured products never reached the trading floor in the past,” added Riley. “D7 allows more products to come to the market more quickly, and increased speed and efficiency will also allow more private placements to wealth management clients.”

There is also a lot of interest in Clearstream’s new crypto custody offering according to Riley, as clients can very easily use their existing setup and existing SWIFT connection. He said: “This allows them to manage both traditional and crypto assets in a single account.”

In March this year Clearstream and another member of Deutsche Börse Group, Crypto Finance, said in a statement they will offer crypto custody to institutional investors. Crypto Finance is being used as a sub-custodian after obtaining the European Union’s Markets in Crypto-Assets Regulation (MiCAR) license.

Jens Hachmeister, head of issuer services & new digital markets at Clearstream, said in a statement that offering crypto custody is the next step on Clearstream’s journey to digitise financial markets.

Hachmeister added: “The institutional-grade, regulatory compliant solution offers clients easy and quick access to new asset classes while enjoying the best features of our trusted and established post-trading systems.”

Clients of Clearstream’s ICSD can use their existing accounts to access crypto custody for trading activity concluded 24/7 on various venues. Bitcoin and ethereum are the first crypto assets in the scope of Clearstream’s offering.

Clearstream also took part in the European Central Bank (ECB) trials last year as part of the Eurosystem’s exploratory work for wholesale digital payments targeting a central bank digital currency (CBDC).

For example, in November 2024 Goldman Sachs borrowed cash from Clearstream whilst delivering collateral via HQLAx, a DLT platform for securities finance and repo. The transactions marked the first delivery versus payment (DvP) repo trades to settle in production using HQLAx. Participants submitted the trades on the Eurex Repo F7 trading system with Clearstream using D7 to act as market DLT operator. Trades were submitted same-day, and securities and cash were settled and returned intraday.

Retail

Another important trend that Riley identified was the entrance of retail through neo-banks and neo-brokers such as Trade Republic, a European savings platform. In 2024 Trade Republic took over all its securities settlement from a third party with its new custody infrastructure linking with Clearstream in order to increase automation.

The European Union is trying to increase retail investment in the region’s capital markets. For example, in May this year the European Securities and Markets Authority launched a consultation on understanding retail participation in capital markets, which follows similar consultations in previous years.

Riley said: “There is a sense of urgency and an opportunity to enable investors to be more active in capital markets in Europe. They need incentives and the 28th regime could be a new way to implement common practice and achieve standardisation.”

The 28th legal regime is due to be proposed by the European Commission to allow innovative startups and scaleups to operate across the EU’s 27 member states under a single set of rules.

Accelerating settlement

The European Union, UK, Liechtenstein and Switzerland are also preparing to shorten securities settlement to T+1, one day after a trade, in October 2027.

Firebrand Research, a capital markets research and advisory firm, in collaboration with Clearstream, The Depository Trust & Clearing Corporation (DTCC) and Euroclear, said in a report that the move to T+1 in Europe will be a more complex and costly process than it was for North America in May last year, involving larger teams to deliver a smooth transition working with the higher number of financial market infrastructures, regulators and markets.

Val Wotton, global head of equities solutions at DTCC. said in a statement: “Post-trade automation has proven to be a critical enabler of T+1 settlement, significantly reducing errors and operational costs. Therefore, it is imperative that firms allocate sufficient resources and budget to invest in advanced automation systems, including technology to support central matching and standing settlement instructions.”

Partnerships

Canada also moved to T+1 last year. In order to prepare for a shorter settlement cycle TMX Group, the Canadian financial market infrastructure, and Clearstream Banking, the international central securities depository, announced plans in 2023 to launch a new, automated Canadian Collateral Management Service, or CCMS. Canadian clients would also benefit from Clearstream’s cloud-based, digital collateral schedule capability known as OSCAR.

CCMS launched in 2024 with its first live tri-party repo transactions in April.

Riley said: “There will be more partnerships with other international financial market infrastructures. We will also partner with other institutions in areas such as collateral, and in the funds business interoperability is high up on our strategic agenda.”