The U.S. Security and Exchange Commission’s conference on Emerging Trends in Asset Management included a panel discussion on digital assets and tokenization, moderated by Scott Walker, chief compliance officer at venture capital firm a16z.

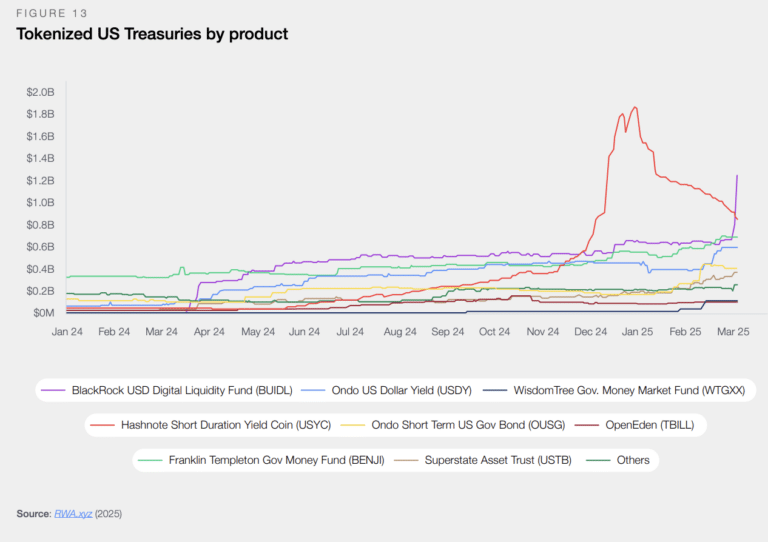

Mike Muir, head of digital assets technology, at Franklin Templeton Digital Assets spoke on the panel on 5 June 2025 in Washington D.C. He discussed how Franklin Templeton, a traditional asset manager, launched a tokenized money market fund back in 2021 which it said is the only US-registered mutual fund to use a public blockchain to process transactions and record share ownership. One share of the Franklin OnChain U.S. Government Money Fund is represented by a BENJI token.

Muir said the asset manager started to think deeply around 2018 and 2019 about the potential for blockchains to become a new record keeping system for all assets of value.

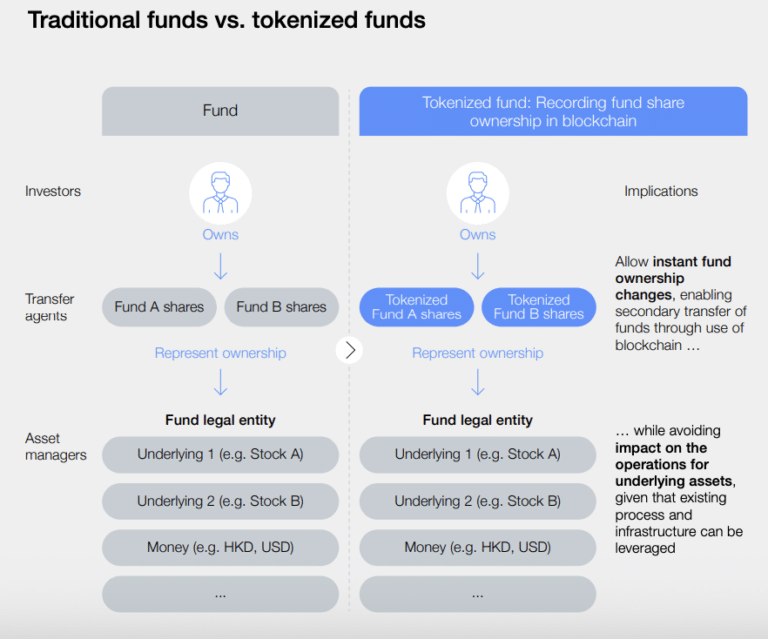

“Ledgers that record ownership are riddled throughout the financial services industry and many of them need to be in sync with one another over the life cycle of an asset,” he added.

After many discussions, Franklin Templeton received SEC approval to launch its on-chain treasury fund in the U.S. and represent the shareholder record on a public blockchain, replacing the relational database that the legacy transfer agent had traditionally used. Three variations of the fund are now available in different jurisdictions across a number of blockchains that meet certain suitability criteria for registered securities.

As blockchains are a shared database, many actors can all see the same information at the same time, in sync with one another, so firms do not have to worry about reconciliations. Muir said blockchain allows participants to think about the future structure of financial services.

For example, institutions can independently see their ownership in real time directly from the blockchain, the system of record, without having to rely on a periodic statement. Muir said: “We can bring features and functions to bear that have not been seen before in a traditional money market fund.”

Collateral

One of the biggest potential benefits of tokenizing assets on a blockchain is to make it easy to move collateral, which increases capital efficiency and reduces risk.

Amar Kuchinad, chief executive of Copper, which provides institutional digital asset infrastructure for custody and collateral management, said on the panel that tokenized funds, such as Benji, are a very efficient way of posting collateral for crypto derivatives, especially as they are interest bearing.

He continued that the crypto asset class is a collective is $3.5 trillion dollars and there is trading infrastructure such as futures, forwards and options which need collateral. Last year Copper moved over $2 trillion worth of collateral between parties who trade derivatives on venues, according to Kuchinad.

“One of the advantages of blockchain is that a very frequent cadence for moving collateral, which brings risk down in the system and we are really excited about that,” he added. “Many of our participants have hourly, or every two-hour, margin calls 24/7, 365 days a year.”

Kuchinad highlighted that he had been a trader at Goldman Sachs during the collapse of Lehman Brothers, and it would have been very different if collateral could have moved over the weekend before Lehman filed for bankruptcy on a Monday morning.

“If blockchain is implemented correctly and with thought, it could really change the way that we view risk, capital and operational issues,” he said.

Nadine Chakar, global head of DTCC Digital Assets, highlighted that the US post-trade infrastructure had replicated a default situation in its recent ‘Great Collateral Experiment’, which showed how tokenized collateral could be used. For example, a trader in Tokyo could move US securities while the US markets and banks were closed.

DTCC has been very encouraged by the response to the experiment, and has had interest from clearinghouses worldwide to become part of this collateral infrastructure, according to Chakar.

The Great Collateral Experiment demonstrated how collateral can be moved on distributed ledger technology, underscoring the capabilities of institutional decentralized finance and unlocking new efficiencies in collateral management.

Watch the replay: https://t.co/zeiyO4OPMD pic.twitter.com/P9LNMHz5Q4

— DTCC (@The_DTCC) April 24, 2025

Chakar said: “You can manage risk 24/7 in a way that is programmable and transparent. This is the beginning of the art of the possible and we all want to put together an infrastructure that is scalable and resilient to allow us to benefit from all the goodness this technology provides.”

She added that the ability to create global liquidity pools, to seamlessly and efficiently reduce friction, reduce operational risk, increase mobility of collateral and enhance capital efficiency has been proven. In addition, during the experiment one of the repos involved both traditional and digital assets

“We were able to show how you can marry the old and the new,” she said. ““However, we’ve got a long way to go before this is a scalable reality.”

Following the experiment, DTCC is working with legal advisors and market participants to ensure that tokens are accepted across jurisdictions.

“These are baby steps, but every single step is heading in the right direction as far as acceptance by institutional money,” added Chakar. “We are very excited about taking the collateral experiment into production and creating global liquidity pools that are accessible to all.”

Muir described digital assets and tokenization as a glimpse of what can be possible. For example, investors that own Benji can transfer any amount of their holding to any other investor in real time, 24/7, 365 days a year.

Not your average payment app.

Start earning yield instantly with every transfer.

🚀 New features unlocked on Benji: Peer-to-Peer transfers are now live on our retail mobile app. Try it out today!

Apple: https://t.co/MAJLVLvun1

GooglePlay: https://t.co/hfrfF55nbEFor… pic.twitter.com/99hW8tBN4o

— Franklin Templeton Digital Assets (@FTDA_US) June 5, 2025

“You can use your imagination to think about how we might reconstruct feature sets available to investors and securities across the entire landscape of our economy,” said Muir.

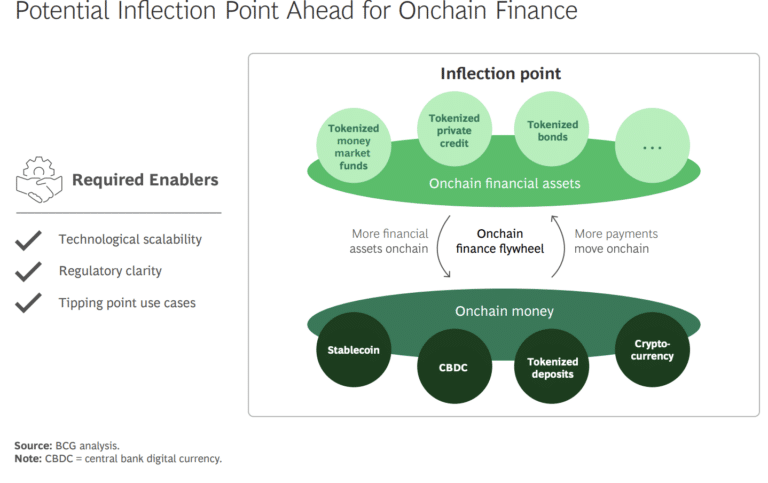

Boston Consulting Group said in a blog that onchain finance has promise, but hurdles remain.

“Realizing this potential means overcoming several challenges: developing interoperable, bank-grade infrastructure; establishing unified standards; and providing comprehensive regulatory guidance,” said BCG. “But major financial institutions are already actively piloting scalable use cases, although these will need to be scaled in the coming years to trigger network effects.”