The European exchange-traded fund industry is at a pivotal moment and investors are also returning to ex-US bond ETFs for the first time in over a decade.

Jason Bloom, head of fixed income ETF strategy at issuer Invesco, told Markets Media: “We are seeing interest in foreign and ex-US fixed income ETFs for the first time in about 15 years, since the European debt crisis.”

For example, Bloom said assets in the Invesco International Corporate Bond ETF (PICB) have increased 25% in the past month. The ETF is based on the S&P International Corporate Bond Index and measures the performance of investment-grade corporate bonds issued in the Group of Ten (G10) currencies, excluding the US dollar.

European fixed income UCITS ETFs added €8.3bn in May this year, which was a quadrupling of flows from the previous month, according to a report from Amundi. The European asset manager said government debt remained the preferred strategy gaining €3.9bn while investors added €2.4bn to investment grade corporate debt, reversing April’s outflows.

“Within government debt, multi-currency strategies were the most popular adding €2.4bn,” added Amundi. “Euro-denominated bonds gained €0.9bn and US-dollar saw inflows of €0.5bn. This reflected the broader trend of investors preferring Europe over the US.”

Jane Sloan, head of EMEA for global product solutions at BlackRock, said at the asset manager’s investor day on 12 June 2025 that the firm has ambitions to double fixed income ETF assets in Europe, Middle East and Africa by expanding access to more parts of the bond market. She gave the example of iBonds ETFs, bond ETFs that have a fixed maturity date, as a prime example of this strategy. The iBonds suite was launched in 2023 is BlackRock’s fastest ever growing ETF suite in Europe, gathering over $8bn in under 18 months.

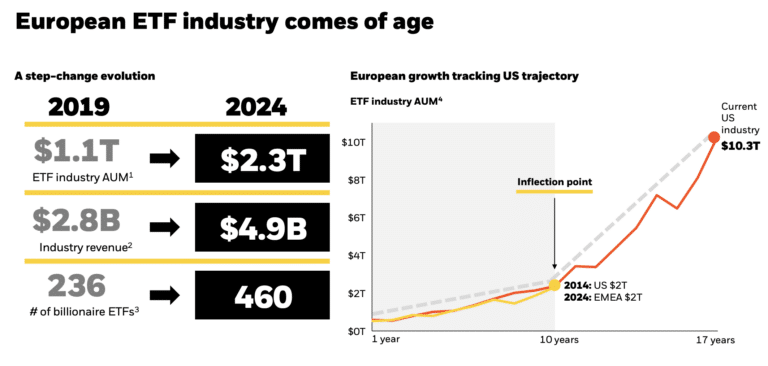

Sloan described the European ETF industry as being at a “pivotal moment. She said ETF assets in the region have more than doubled in the last five years to over $2 trillion and the $5bn revenue pool has been growing at 9% each year.

“What’s really interesting is how Europe’s growth is tracking the US,” she added. “Europe is at an inflection point and if it continues to track the US path, hockey stick growth lies ahead.”

BlackRock believes assets in European ETFs are poised to double to $4 trillion. On 14 February this year assets in the European arm of iShares, BlackRock’s ETF franchise, crossed $1 trillion and the firm expects theses assets to hit over $1.6 trillion by 2030.

“The velocity of growth has been remarkable,” said Sloan. “It took 20 years to gather the first $500bn and only four years to gather the second $500bn.”

Growth in fixed income ETFs

Bloom described the fixed income ETF market as almost 10 years behind the equity ETF market, but said the growth curves for both asset classes look almost identical.

“We expect fixed income ETFs to achieve the level of success that we’ve seen with equities as they are growing at exactly the required rate,” he added.

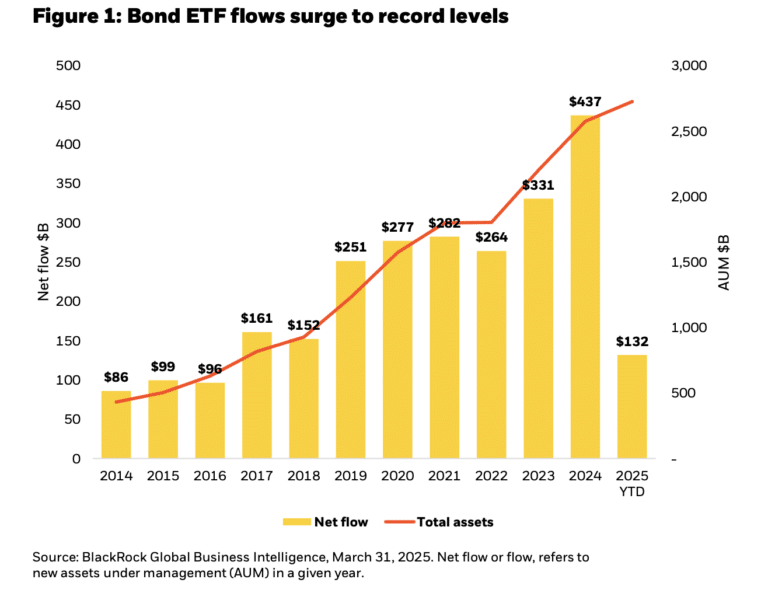

He agreed with BlackRock’s prediction that fixed income ETF assets could reach $6 trillion by 2030, if not sooner. Stephen Cohen, chief product officer at BlackRock, said at the asset manager’s investor day that fixed income ETFs had 20% organic growth last year, which was the fastest of any asset class or any investment vehicle.

Fixed income assets reached $2.6 trillion in assets in 2024 and BlackRock said a record 420 bond ETFs were launched, enabling investors to tailor their fixed income investments in new ways according to a BlackRock report. In addition, more than 75 bond ETFs were launched in the first quarter of this year, which sets the pace for another record year of new ETF issuance.

Through March this year, global bond ETF flows reached $131.6bn, which is 2.5 times larger than the average first quarter inflows over the last decade according to the report.

“Yet fixed income ETFs still represent just 2% of the underlying $140 trillion global bond market,” Cohen said. “That’s the opportunity ahead of us.”

In contrast, equity ETFs represent 10% of the underlying market. Cohen continued that one of the biggest drivers towards the $6 trillion target will be a shift from the $119 trillion held in individual bonds into ETFs.

He added: “Fixed income ETFs have gone from a product that we had to defend from skeptics over and over again, to having proven their worth over and over again with clients through multiple periods of market volatility.”

In early April this year the U.S. Government announced across the board tariffs which triggered increased market volatility. BlackRock said in a report that total fixed income ETF trading in the U.S. reached a record $98.9bn on 7 April 2025, which was 3.4 times higher than the year-to-date average of $29bn.

Daniel Veiner, co-head of global trading at BlackRock, said in a report: “During recent market volatility, bond ETFs played a crucial role in maintaining the functionality of fixed income markets, as evidenced by record trading volumes. Portfolio managers, bond traders and risk managers can no longer ignore bond ETFs – they are a critical part of the fixed income ecosystem.”

BlackRock said innovation within bond ETFs has enabled investors to access more parts of the market such as difficult-to-access AAA-rated CLOs, constructing a bond ladder or generating excess income through options.

“Looking ahead, we anticipate continued innovation in public markets with more granular index products, outcome-oriented products and actively managed products,” added BlackRock. “Additionally, new frontiers are emerging, such as ETF access or replication strategies for private markets.”

Active ETFs

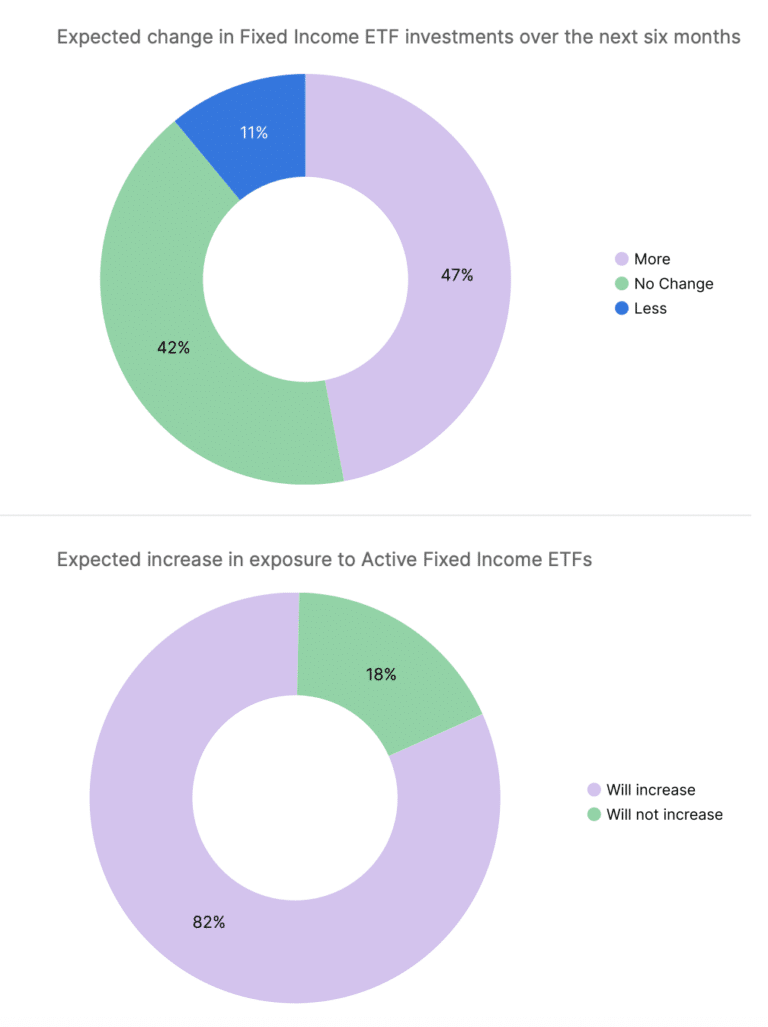

In two years active bond ETF assets have more than doubled to over $420bn globally, according to BlackRock.

One of the most notable shifts in 2024 was the rise of active bond ETFs according to Trackinsight’s sixth annual global ETF survey. The report said that for the first time, active strategies represented the majority of new bond ETF launches globally, with 269 active launches against 250 passive as investors seek flexibility, credit selection and better duration targeting.

Travis Spence, global head of ETFs at J.P. Morgan Asset Management, predicted in the Trackinsight report that flows into active fixed income ETFs will exceed $200bn as investor demand grows for flexible, yield-driven bond exposure.

Bloom highlighted that parts of the fixed income market are very niche, less liquid, or have a lack of homogeneity, so active management becomes important. In contrast, more liquid or more transparent parts of the fixed income market can easily be exploited by an intelligent passive strategy.

“Some fixed income issuances have idiosyncratic features and an active manager can do fundamental research and pull apart the deal documents,“ he added. “We believe there are inefficiencies in certain parts of the fixed income market that active managers are well positioned to exploit.”

Cohen said: “We believe that bond ETFs will continue to expand the investable universe across index, active, public, and private markets, with adoption accelerating even further.”

ETF expansion

Cohen highlighted that ETFs are 6% of global capital markets. He said: “We are at our tipping point, and we believe the industry will nearly double from $15 trillion to $27 trillion in the next five years.”

For example, indexing is still in its early phase and penetration remains low in regions like Europe and asset classes like fixed income, according to Cohen.

“We are continually rethinking indexes as markets change,” said Cohen. “If you go back to 2000 the entire US stock market was worth $15 trillion and today, the top seven companies are worth around that much.”

In addition, ETFs have moved beyond indexing to incorporate active ETFs, digital assets and even private markets.

Bloom said the “jury is still out” on whether private equity or private credit belongs in an ETF as the underlying assets can be illiquid. However, he also argued that Invesco has issued a senior loan ETF, BKLN, which could be described as the “original private credit ETF” and trades with a fairly high correlation to some private credit benchmarks. There is a line of credit attached to the fund so that if there is a large outfloe triggered by selling in a single day the fund is always open for redeeming shareholders, although the line of credit has never needed to be used.

“We will launch an ETF with other types of private vehicles when we feel the liquidity mechanisms are there to give the investor a smooth, solid experience,” Bloom added.