Mark Birkhead, firmwide chief data officer of JPMorganChase, said the bank is focused on a multi-year effort to pull humans out of the cycle for fixing data. Birkhead spoke to Kevin Buehler, a senior partner in the New York office of consultancy McKinsey.

In 2024 the bank set up a firmwide chief data and analytics office so that all its data initiatives were under one umbrella, led by Teresa Heitsenrether, chief data and analytics officer. She reports to chairman and chief executive, Jamie Dimon, and is part of the operating committee. Birkhead’s role as chief data officer is to oversee the team that sets the central data strategy for the firm in partnership with the business.

Birkhead explained that the bank operates in almost 100 countries and across its consumer businesses, investment banking, asset and wealth management and payments. As a result, more than an exabyte of data moves across the firm in any day in many forms , including structured and unstructured data, voice and video files. An exabyte of data is so large that it has been estimated that all the words ever spoken or written by humans in every language since the beginning of mankind would fit on five exabytes.

“Our data strategy centers on how we can best deliver all types of data assets and curate them in a way that is discoverable, highly accurate, and highly governed and controlled,” added Birkhead. “That last part is really critical for us as a bank because our customers count on us to keep their information private.”

The group has built many data governance systems to ensure data risks are managed to respect privacy and is now investing in bringing them together into a central platform.

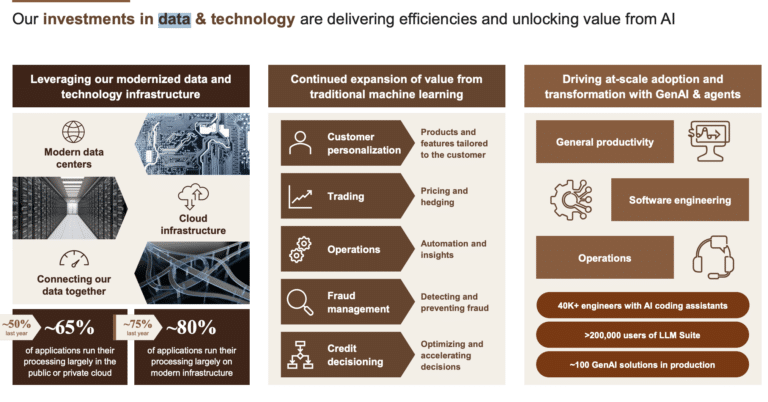

A critical focus is modernizing the group’s data so that it can be published in a way that is consistent and understandable by large language models (LLMs) used in artificial intelligence and generative AI models.

“We are focused on pulling humans out of the cycle when it comes to fixing data, and that is going to be a multi-year effort,” said Birkhead.

JPMorgan Chase has created an LLM Suite, which provides employees with access to LLM models. There are currently 200,000 users on LLM Suite, according to Birkhead. He continued that the bank is “particularly excited” about AI agents systems with more reasoning capabilities.

“Being able to put data and AI together is going to be really meaningful and impactful, not only for our company, but also for our customers and clients,” said Birkhead.

Another focus is launching more data products and ensuring they are interchangeable, interoperable, and reusable. The final focus is ensuring that data is available in milliseconds.

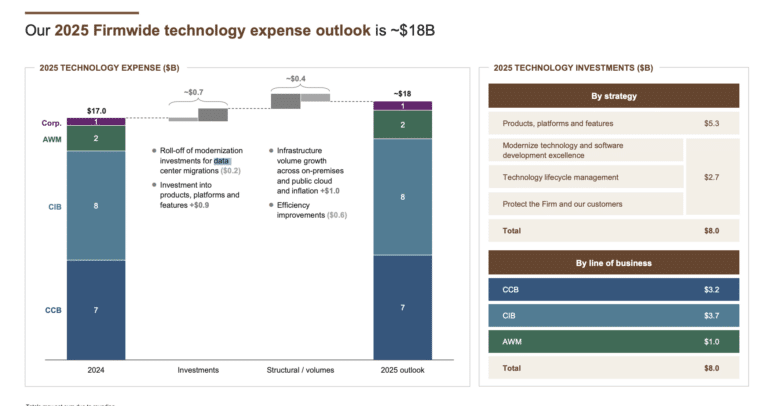

Jeremy Barnum, chief financial officer at JPMorganChase, said at the group’s investor day on 19 May 2025 that total technology spend this year will be approximately $18bn, up about $1bn from 2024.

Barnum said the firm is continuing to make progress on moving to the cloud and modern infrastructure with about 65% of applications now running a large part of their workloads on the public or private cloud, up from 50% last year. If applications that run largely on virtual servers are included, that number increases to 80%.

In addition, the firm has almost completed the application migrations for its largest legacy data centers and is in the process of dismantling the physical infrastructure in those sites.

“This progress in our modernization efforts continues to deliver significant engineering efficiencies, which we see through ongoing improvement in our speed and agility metrics, but we can’t afford to fall behind,” added Barnum. “Competition is fierce and innovation in AI and the cloud is making it easier for everyone to deliver features faster, and we know it’s critical for us to do the same.”

He highlighted that the firm is particularly excited about the accelerated adoption of AI coding assistance by software engineers. Barnum said: “It’s amazing stuff and we have high hopes for the efficiency gains we might get.”

The firm was an early mover in AI, according to Barnum, and has been investing in for over a decade, initially focusing on risk management, particularly in areas like fraud detection. More recently, the firm has significantly expanded its use of AI and is increasingly focused on driving operational efficiencies.

“While we’ve made substantial progress over the last decade, we are still in the early stages of our AI journey,” Barnum added.

At the investor day Mary Callahan Erdoes, chief executive of asset & wealth management at JPMorganChase, also discussed how technology has helped her business cope with the ”volume explosion” since April.

The business averaged about 14 million trades a day, which doubled to 28 million trades in April, which included three of the four highest trading days the business has ever had.

“We trade roughly $260bn every day across asset and wealth management,” said Erdoes. “In April that went up to $500bn a day with no stress on the system.”

Artificial intelligence is being used to reimagine workflows, and change the loading capacities for thousands of staff. For example, portfolio managers use AI to digest millions of call reports, regulatory filings, the movement of stocks, including those that are not in their universe.

“It’s taking things that take days and weeks and turning them into seconds, which is super powerful,” she added.

Doug Petno, co-chief executive of commercial & investment bank (CIB), said at the investor day that CIB has over 175 AI use cases in production. Troy Rohrbaugh, co-chief executive of commercial & investment bank, added at the investor day that the business faces a challenging environment with potential downward pressures on the investment banking wallet, acute competition, and the increasing war for talent.

“We will continue to expand our client franchise through our targeted growth initiatives,” Rohrbaugh said. “For example, we are using our data to better target 60,000 middle market prospects to become their primary bank.”