Yasmine Coupal, partner at Goldman Sachs, expects a “wave of exchange consolidation” in digital assets as players look to scale and diversify their businesses.

Coupal, a partner in the bank’s technology, media, and telecom group in investment banking, leads coverage of digital asset companies for Goldman Sachs. She discussed the digital asset ecosystem with Mathew McDermott, global head of digital assets at Goldman Sachs, in a briefing for the bank. She said digital asset M&A volumes soared to $15.8bn last year, compared to $1bn in 2019, and there has been $6.4bn of M&A volumes in the sector in the year-to-date.

“This uptick reflects the continued institutionalization of digital assets in global capital markets, the convergence of traditional finance (TradFi) and crypto, and rising demand for access from investors,” she added. “As valuations pulled back in recent years, we’ve seen increased focus on credentialed firms with strong compliance programs, robust KYC/AML practices, and sustainable business models.”

Industry leaders are taking a “buy, not build” approach, according to Coupal. She highlighted the examples of Coinbase, the US-listed crypto exchange acquiring crypto options platform, Deribit; and retail broker Robinhood buying crypto exchange Bitstamp.

McDermott said that in the last 12 to 18 months, many institutional investors have begun actively formulating strategies and building out dedicated teams for digital assets.

“It’s certainly an exciting time, and the market activity has undoubtedly picked up—but we feel there’s still such a long way to go,” he added.

Tokenization

For McDermott, the most exciting development is the ability of blockchain technology to transform the financial system into an increasingly digital-first, 24/7 market. He argued that tokenizing real-world assets and putting them on-chain increases transparency, reduces intermediaries, and eliminates complex, onerous legal and settlement processes.

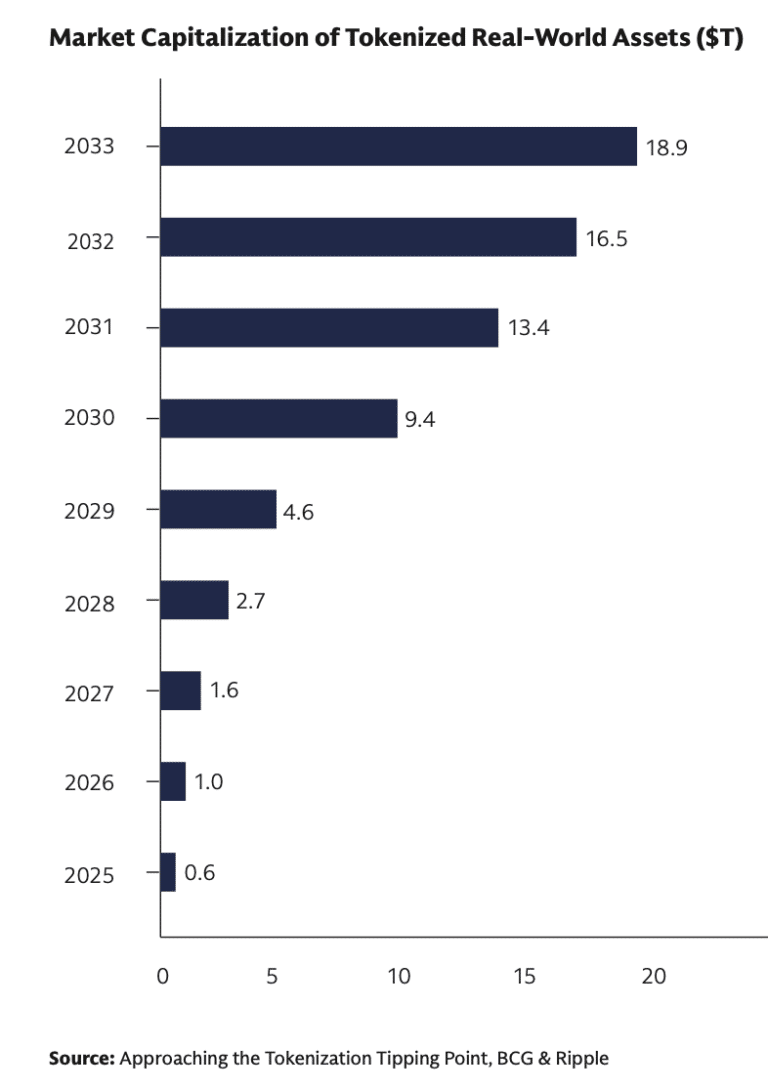

Total assets under management of tokenized real-world assets could reach $600bn by 2030, with 10% of global GDP potentially tokenized and stored on the blockchain by 2027 according to a report from crypto exchange OKX and Blockworks Research. More than two-thirds of financial services respondents in the report said they are developing capabilities to support the issuance and servicing of tokenized assets.

Morgan Krupetsky, senior director of business development at Ava Labs, said in the report that “tokenization will do for assets what ETFs did for mutual funds.” Compared to ETFs, digital tokens trade 365 days a year, 24 hours a day, are programmable using smart contracts for automatic rules-based rebalancing, which lowers cost for investors.

The report said senior professionals at Franklin Templeton, Elwood Asset Management, and Visa all believe that tokenization will impact treasuries, bonds, equities, commodities, real estate, and credit, and that these products will benefit from increased liquidity, accessibility, transparency, and composability.

Smart contracts can be used to program assets on-chain which increases capital efficiency. McDermott argued that the ability to seamlessly move collateral with precision is “one of the most significant opportunities.”

“At Goldman Sachs, our in-house-developed blockchain-based platform, GS DAP®, has been at the forefront of this shift toward creating financial marketplaces on-chain, and we were excited to announce our ambition to spin out the platform into a fully mutualized, distributed technology solution for the digital financial markets,” McDermott added.

OKX and Blockworks said that as regulatory clarity improves, more volume will be driven by institutional investors.

“In the coming decades, crypto banking services will be fully integrated into traditional banking systems,” said the report. “Many major banks could offer comprehensive digital asset services ranging from crypto-enabled debit, credit, and financing, to a diverse array of more sophisticated products.”

Stablecoins

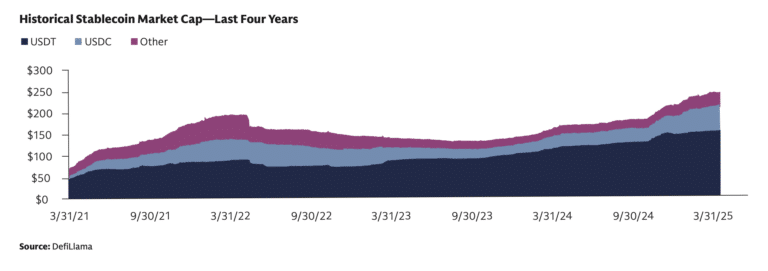

McDermott said stablecoins have become one of the fastest growing segments in digital assets, enabling innovations like programmable payments and supporting continuous financial market activity.

“As financial markets become increasingly global and operate around the clock, stablecoins are emerging as a vital cog in 24/7 markets for collateral and broader cross-border payment use,” he added.

OKX and Blockworks said TradFi players could offer self-managed wallets and regulated stablecoins, such as JP Morgan’s JPM Coin for instant payments. The report added that in financial services, blockchain is leading the shift toward asset tokenization, proof of reserves, and 24/7 trading.

“The tokenization of real-world assets is unlocking liquidity, while stablecoins are revolutionizing global payments,” said the report. “As more traditional financial institutions adopt blockchain technology, we are witnessing the early days of a more transparent, efficient, and decentralized financial world.”