GFO-X, the first UK regulated and centrally cleared trading venue for digital asset derivatives, launched in May this year and sees huge opportunity to grow the institutional use of crypto futures and options.

The venue was purpose-built for institutions with a high-speed matching engine designed for low-latency execution and high-frequency trading. GFO-X opened for trading bitcoin index futures and options on 9 May 2025.

Arnab Sen, chief executive of GFO-X, told Markets Media: “The launch has gone really extremely well and we have very strong partners on board from day one.”

The first trade executed on GFO-X was between Virtu Financial and IMC.

GFO-X is also the UK’s first regulated and centrally cleared digital asset derivative trading venue to provide streaming prices, according to Sen. As users consume more of this data he expects activity to naturally pick up.

The venue will widen its products selectively, according to Sen. He said: “Our aim is to become the leader in digital assets for institutions and as the digitisation of assets changes finance.”

Sen added there is a “massive opportunity” as options are 65% of derivatives volumes in traditional finance, but less than 5% in crypto. There is also huge demand as bitcoin is building up on corporate balance sheets, which needs hedging, while banks want to provide structured products.

Central clearing

Central clearing is provided by LCH DigitalAssetClear, part of the London Stock Exchange Group’s clearing arm, to ensure secure margining, collateral management and default protections. ABN Amro Clearing, Nomura and Standard Chartered were the first clearing members.

Barry Polak, lead product commerce at ABN Amro Clearing, said in a statement:“By leveraging LCH DigitalAssetClear’s clearing services, we enhance transaction security and minimise counterparty risk, offering our clients unparalleled confidence in trading bitcoin futures and options.”

Sen highlighted the lack of intermediate credit providers in digital assets. As a result, GFO-X has partnered with the largest clearinghouse in the world, which has set up a segregated digital assets business.

“We are unlocking the next level of digital assets with our model, which meets the needs of real institutions,” said Sen. “We are in the right place at the right time and with the right partners.”

Marcus Robinson, head of CDSClear and head of DigitalAssetClear at LCH, told Markets Media there is a degree of nervousness from institutions around crypto-native infrastructure and custody, and the lack of a regulatory framework. He argued that enabling clearing and trading through regulated infrastructure gives confidence, and will encourage greater institutional adoption.

“LCH is tried and tested, with a very strong risk framework that is seen as the gold standard amongst many regulators and customers,” said Robinson. “If the market has confidence in the infrastructure reducing and mitigating risks, that fosters greater market adoption and grows overall liquidity.”

LCH DigitalAssetClear has been created as a separate, segregated clearing service from the other asset classes cleared at LCH. The business has its own waterfall, default fund, technology infrastructure and default management process, so there is no contagion according to Robinson. He said this was an intentional decision based upon feedback from existing members.

“The crypto market can change very quickly so we’ve got to be agile and adaptable,” he added. “A segregated service means there’s less likely to be constraints related to correlation risks with other asset classes.”

Although crypto underlies the contracts being cleared at LCH DigitalAssetClear, Robinson said the business is not recreating the wheel from a derivatives infrastructure perspective.

“The pipes and risk model are the same as for any other product that LCH clears,” he said. “It’s all about familiarity for the users.”

LCH DigitalAssetClear is clearing cash-settled contracts in US dollars for GFO-X without having to touch the underlying bitcoin. The clearer would need a stronger regulatory framework around the physical and over-the-counter markets to be able to give confidence to institutional customers to access these spaces.

“Being able to accept stablecoins, or other forms of digital money, seems to be the general direction of travel,” added Robinson. “If we do bring decentralised finance (DeFi) and traditional finance together, we need to be careful that we’re not creating too much fragmentation or breaking the netting that persists today, so a little bit of market evolution needs to happen.”

The focus for the business is getting clearing members on board, building liquidity, and then really understanding the growth potential for digital asset clearing, which Robinson said includes new products, service enhancements and timezone coverage. He explained that the key to building liquidity and momentum is through raising awareness with crypto-native firms about central clearing and traditional institutions about the crypto world.

In a year LCH DigitalAssetClear would like to have an increased share and liquidity in options and futures.

“The bitcoin derivatives market is very much based on futures and we are trying to create a liquid options market,” added Robinson. “We would also like to have a developed roadmap but that will also depend on regulation and the development of stablecoins, tokenization and collateralization.”

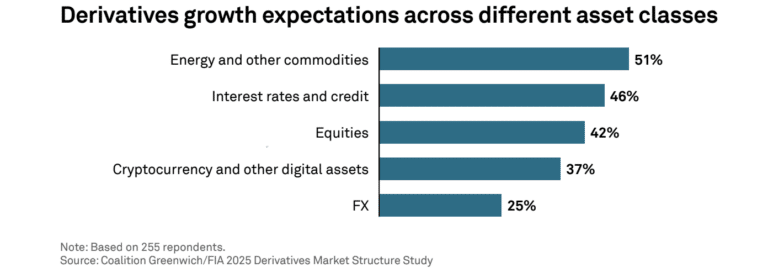

Crypto assets represent a new opportunity for the derivatives industry according to a report from consultancy Crisil Coalition Greenwich. The report said: “A notable 65% of the crypto buy side now trade some type of crypto derivatives, including futures, options and perpetual futures, indicating a growing appetite for more complex risk-taking, hedging and investment strategies.”

Connectivity

In June technology platform Trading Technologies said in a statement it had provided connectivity for its clients to access GFO-X.

Alun Green, EVP managing director, futures & options for TT, said in a statement that the firm wanted to support demand for centrally cleared cryptocurrency trading.

“With the relaxation of the U.S. regulatory market, there is increased global interest among our institutional clients for access to digital assets,” added Green.

TT said it handled more than 2.8 billion derivatives transactions in 2024 Clients trading on GFO-X will be able to use execution algorithms, charting and analytics, and APIs.

Sen said the connectivity enhances GFO-X’s ability to offer deep liquidity and seamless access to the digital asset derivatives market within a familiar institutional framework.