iShares, BlackRock’s exchange-traded fund franchise, is approaching $5 trillion in assets under management after record inflows in the first half of this year.

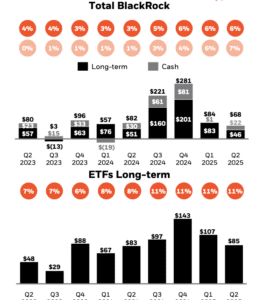

On 17 July 2025 Blackrock reported $152bn of year-to-date total net inflows led by a record first half for iShares ETFs, alongside private markets and cash net inflow in its second quarter results. The second quarter had $68bn of quarterly total net inflows which BlackRock said reflected the impact of a single institutional client’s $52bn lower-fee index partial redemption.

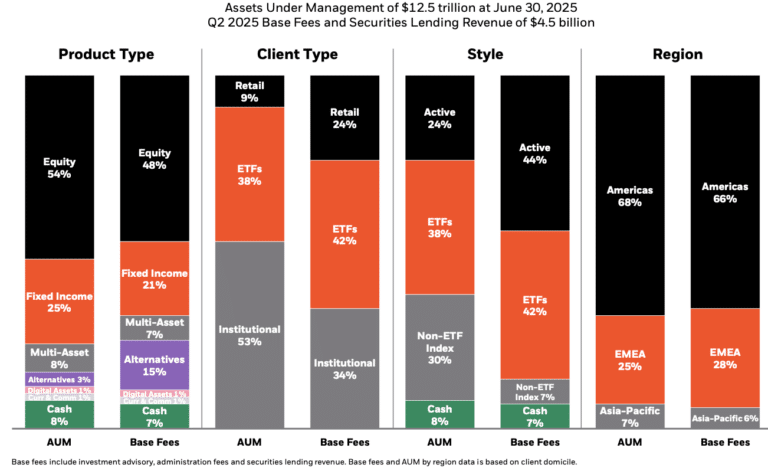

Total assets under management were a record $12.5 trillion as at 30 June 2025, with ETFs reaching $4.75 trillion. Martin Small, chief financial officer said on the results call on 17 July 2025 that ETF net inflows of $85bn were diversified by channel, and over a third of inflows were driven by clients in Europe using local products.

Larry Fink, chairman and chief executive of BlackRock, said on the results call that growth is being powered by both its largest core businesses and newer initiatives.

“In the public markets, our iShares business continues to be a powerful growth engine and a key driver of industry innovation,” added Fink. “Our newest investments and product launches from the last few years are driving outsized growth, contributing to record flows in the first half of 2025 and 12% organic-base fee growth in ETFs this quarter.”

Digital asset products continue to set new records according to Fink, with digital asset ETPs adding $14bn of net flows in the second quarter. BlackRock’s bitcoin ETP, IBIT, had more than $75bn in assets at the end of the second quarter, and crossed over $80bn on 17 July 2025, according to Fink.

“iShares ETPs are bridging the traditional capital markets with fast-growing cryptocurrency markets,” said Fink. “They are also bringing new investors to the iShares brand.”

Fink continued that nearly one third of the investors who first came to Blackrock for IBIT have since purchased other iShares products. Rob Kapito, president of BlackRock, highlighted the diversity of the ETF business on the call as 38 iShares funds had more than $1bn of net inflows in the second quarter, with fixed income leading the way at $44bn.

Kapito said: “We are seeing more and more use cases and ETFs have really caught on in Europe with $29bn of net inflows. We are seeing outsized strength from our highest conviction growth areas like fixed income, active, digital assets and European-listed ETFs.”

Fink continued that iShares has approximately $1 trillion dollars of assets in Europe and about 40% market share. He believes the growth of ETFs in Europe is only just beginning as the region is five to six years behind the U.S in terms of access.

He argued that countries in the region are changing from defined benefit to defined contributions pension schemes, so more financial advisors and digital organizations will adopt ETF-based strategies.

“Many of the categories that are leading our growth barely existed two years ago such as active ETFs, digital assets and our scaled private markets franchise,” said Fink.

Private markets

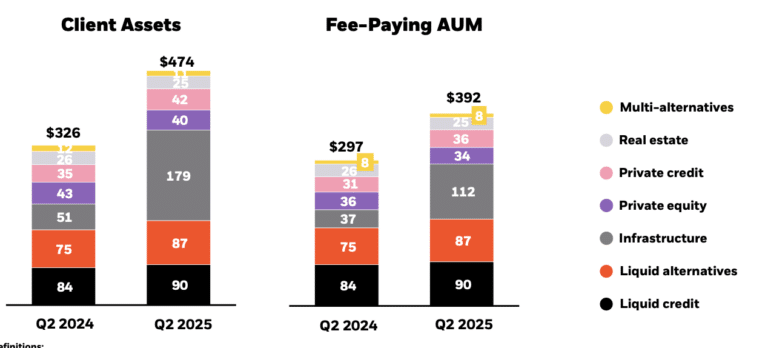

In private markets, BlackRock closed the $12bn acquisition of global credit investment manager HPS Investment Partners on 1 July. This added $165bn of client assets under management and $118bn of fee-paying assets under management.

Fink said: “We are building on our foundational platform to redeploy the whole portfolio by bringing together public and private markets across both asset management and technology.”

Small added that closing the HPS acquisition is a “major milestone” as BlackRock has a target of 30% of group revenue coming from private markets and technology by 2032. He said HPS is expected to add approximately $450m of revenue, including $225m in management fees, in the third quarter of this year.

The fund manager believes private credit is reshaping financial markets and there is an accelerated convergence between public and private markets. As financing activity shifts away from bank lending, BlackRock argues that asset managers are well placed to provide long-dated capital to long-term investors, including insurance companies, pensions, sovereign wealth funds, wealth managers, and individuals saving for retirement.

The HPS deal followed other acquisitions by BlackRock last year to expand in private markets – the purchase of Preqin, an independent provider of private markets data, and Global Infrastructure Partners (GIP), an independent infrastructure manager.

As a result of the HPS acquisition, BlackRock is creating Private Financing Solutions (PFS), which will combine the firms’ private credit, GP and LP solutions, and private and liquid collateralized loan obligation (CLO) businesses in one platform. The combined PFS team will be led by Scott Kapnick, chairman of PFS executive office and chief executive officer of HPS, Scot French, founding partner and co-President of HPS, and Michael Patterson, governing partner at HPS.

In July this year, BlackRock said in a statement that it has agreed to acquire ElmTree Funds, which will also be integrated into Private Financing Solutions once the transaction closes. ElmTree is a net-lease real estate investment firm with $7.3bn in total assets under management as of 31 March 2025, with a focus on single tenant, build-to-suit real estate assets. Small said the deal is due to close in the third quarter of this year subject to regulatory approvals and customary closing conditions.

Kapnick said in a statement about the ElmTree deal: “Structural shifts in the real estate sector are creating new opportunities for private capital. The combination of a premier triple-net investor with our leading private financing solutions platform will position us to capture these opportunities for our clients.”

At the end of June BlackRock surpassed the fundraising target for GIP’s fifth flagship fund by raising $25.2bn, which it said was the largest-ever client capital raise in a private infrastructure fund. Fink argued this was a validation of how clients are embracing the logic of the acquisition.

For example, BlackRock manages more than $700bn in assets for insurance companies, which provides opportunities for private market investments.

“Many would expect a change in ownership to dampen fundraising,” said Fink. “In our case, it ultimately ended up driving an even higher fundraising ability.”

Small reaffirmed BlackRock’s target of raising $400bn in private market funds between 2025 and 2030. In addition, Fink said there has been strong early demand from both GPs and LPs for Preqin data as they are looking to better analyze and benchmark their private market allocations.

“It through better analytics, standardized benchmarks and more widely available performance data that we can close the information gap and enable even more future growth in private markets investing,” said Fink.

Retirement

Half of BlackRock’s assets under management are related to retirement, so if pensions are able to invest in private markets that would accelerate the growth opportunities, including the need for analytics and data.

In June this year, BlackRock was selected to provide a custom glidepath that strategically allocates across public and private markets for Great Gray Trust Company’s first target date retirement solution featuring private equity and private credit exposures. Great Gray provides trustee and administrative services to collective investment trusts and managed over $210bn as of 31 March 2025.

Rob Barnett, chief executive of Great Gray Trust Company, said in a statement: “For too long, access to private markets has been limited to institutions, leaving many retirement savers behind as capital markets have evolved. By strategically allocating across public and private markets, BlackRock’s glidepath, systems and people are helping modernize the traditional target date solution.”

BlackRock said it is already seeing demand for exposure to private assets in DC plans. In a recent survey, 21% of retirement plan advisors said they plan to include private market investments in the defined contribution plans that they manage.

In a research paper, BlackRock outlined that adding purpose-built private market solutions into a target date solution can add 50 basis points in portfolio returns annually over the lifecycle of a target date solution. This can translate into approximately 15% more money for a retiree if private markets exposures are compounded over 40 years. As a result, BlackRock believes the portfolio of the future will comprise 50% public equities, 30% public fixed income, and 20% private markets.

Small said BlackRock is the top defined contribution investment firm and a top five private markets manager following its recent acquisitions, so the building blocks are in place to add private investments to retirement plans. However, some litigation reform or advice reform is needed, especially in the U.S.

“We are really encouraged by the recent dialogue with policymakers on these topics and some of the activity by trade associations that has been helpful,” added Small. “There’s still significant work to do, but we feel positive momentum is certainly building.”

Financials

Second quarter revenue of $5.4bn was a 13% year-over-year increase. The fund manager said this reflects the positive impact of markets, organic base fee growth and fees related to the GIP transaction, as well as higher technology services and subscription revenue, partially offset by lower performance fees.

Fink said: “Our expanding client relationships are resonating in higher, more diversified organic base fee growth. We generated 6% organic base fee growth for the second quarter and the first half of 2025, and 7% over the last twelve months.”

Fink added that the firm is attracting a new and increasingly global generation of investors through its digital assets offerings and it recently raised over $2bn by launching funds in India through its joint venture, Jio BlackRock, to more than 67,000 customers.

BlackRock manages $4.5 trillion for clients outside the U.S. according to Fink. He continued that many of the largest growth opportunities are outside the U.S, including in India and the Middle East.

“We are not just looking at acquisitions, as the opportunity to grow organically as capital markets grow worldwide is something that we are very excited about over the next five year,s” said Fink. “India is just the beginning.”

Another growth area is the cash business, which has been the first entry point for many clients who have gone on to build large mandates with BlackRock, according to Fink. BlackRock manages $1 trillion in cash which Fink described as “remarkable” considering that BlackRock is not a direct retail business or a bank.

“We see a great untapped opportunity for cash and liquidity where people want to use the technologies of digital assets to access traditional instruments like treasuries,” Fink added.

BlackRock’s tokenized money market fund now has $3bn in assets, said Fink, and the firm also manages more than $50bn for Circle, the stablecoin issuer which recently went public.

“Tokenization of assets is going to be the future,” said Fink. “The dialogue we are having with central banks and how they are looking to now use their own digital currency, or using stablecoins to digitize their currency, is surprising but we believe this is just the beginning. We will be playing a significant role as stablecoins are developed in each and every country.”