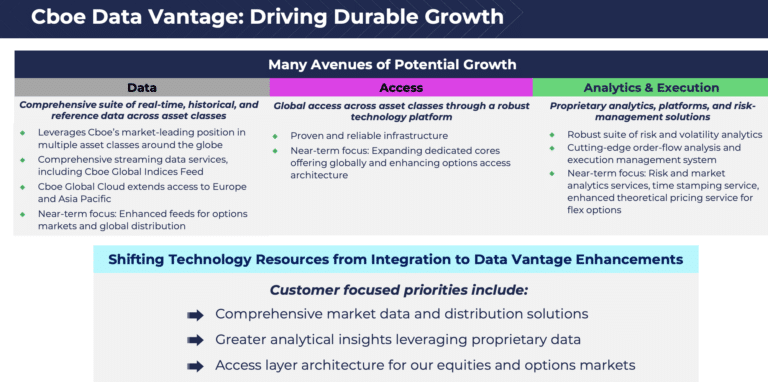

In December last year Cboe Global Markets changed the name of its Data and Access Solutions business to Cboe Data Vantage which it said better represents the breadth of its offerings across data and access, analytics and execution, and indices and better represents its growth potential.

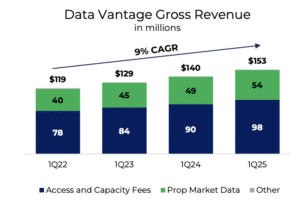

In the first quarter of this year Cboe Data Vantage reported an 8% increase in organic net revenue to $149.4 m.

The group said continued expansion in transaction capabilities drove solid access and capacity fees and a comprehensive suite of data solutions across geographies and asset classes translated to strong revenue results. Organic net revenue growth target for the segment for 2025 is mid to high single digits.

Adam Inzirillo, global head of Cboe Data Vantage, told Markets Media that in the first quarter of this year the majority, 55%, of new data sales and 85% of Cboe Global Cloud sales were outside the U.S. Cboe uses Amazon Web Services (AWS) to power Cboe Global Cloud which provides real-time, cloud-based market data streaming service for market participants globally.

Cboe operates 27 markets across five asset classes in the U.S., Europe and Asia Pacific, which includes equity trading venues in Australia and Japan

Inzirillo said: “We have combined sales and coverage and added staff in Europe, Asia and the US which allows us to get closer to clients.”

For example, in May this year Cboe Data Vantage hired Junichi Nakagawa in Japan and Samuel Zou in Singapore as sales directors in Asia Pacific as investors in the region seek greater exposure to U.S. and European capital markets. This year Cboe also received permission to sell non-crypto related data in China.

“We can access China through approved data vendors and have several clients,” Inzirillo added. “This is a massive opportunity for the data business and we have hired Mandarin speaking staff in Singapore.”

In a blog, Inzirillo highlighted Cboe Data Vantage can provide data from its four U.S. equities exchanges to global market participants, including a range of historical data through Cboe DataShop, including detailed options, equity, and ETF trading data, as well as volume and put/call ratios across its markets. In addition, Cboe Data Vantage can also provide derived data products including proprietary analytics, theoretical pricing, implied volatility metrics, and indices designed to support advanced trading strategies and risk management.

Cboe’s Global Indices Feed was recently made available on Snowflake Marketplace.

“We are simplifying access to our data with more APIs in all the programming languages and making our data available in the Snowflake warehouse,” Inzirillo added. “We will be adding Google and Amazon.”

Access to data is typically the starting point for market participants to begin trading on Cboe. In order to improve execution, Cboe introduced dedicated cores on its US equity exchanges last year, which reduced latency by 60%.

Dedicated cores allows members and sponsored participants to host their specific logical order entry ports on their own CPU core(s), rather than sharing a core(s), which reduces latency, enhances throughput and improves performance. Dedicated cores is an optional service and Cboe will continue to offer shared access, as some customers will always want that service.

Inzirillo said: “Dedicated cores has been launched in the US, Europe and APAC, with positive feedback from clients, and we will be bringing this capability to Canada.”

Cboe Data Vantage also includes the index business. Inzirillo said Cboe is adding automation for validation and testing to scale the index business.

“This adds capabilities in our derivatives business as the indexes are used for more products,” he added.

24×5 equities trading

This year a number of exchanges, including Cboe, have announced plans to offer 24×5 trading for U.S equities, subject to regulatory approval, due to the interest from investors in Asia Pacific to access U.S markets during their daytime hours.

The first phase of 24X National Exchange is also due to launch in September this year. 24X National Exchange said it will be the first national securities exchange approved by the U.S. Securities and Exchange Commission to offer 23-hour weekday trading of U.S. equities.

Extending trading hours from the current 4am ET to 8pm ET on weekdays requires dependable access to markets and accurate data.

Cboe has four U.S equities exchanges and two, EDGX and BZX, already offer early hours trading between 4am ET and 7am ET and the group also supports global trading hours in derivatives for its proprietary products, SPX and VIX, according to Inzirillo.

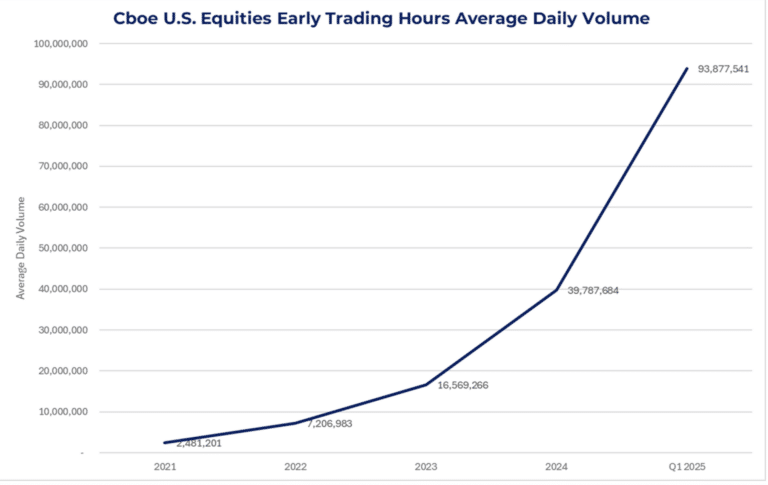

Early trading hours on its U.S. cash equities exchanges is an indicator of the interest in expanded U.S. equities trading access. Average daily volume during early hours trading on Cboe’s U.S. equities exchanges has increased 1,203% from 2022 to the first quarter of 2025 according to a blog.

In the first three months of 2025, average daily volume for early trading hours was 93.9 million, compared to 39.8 million for the whole of 2024.

“The data shows us that this trend is likely to continue and is further evidence of the need for more fulsome access to U.S. equities markets,” said Inzirillo.

Moving to 24/5 trading will require industry-wide collaboration such as deciding on the time for a new day for corporate actions, the SIP and clearing, he added, so the earliest this could happen is in the second half of 2026.

Exchange prices for equities are widely distributed as part of the SIP, a consolidated tape.The SIP is one of the pieces of market infrastructure that need to change to allow 24-hour trading.

In clearing, DTCC, the U.S post-trade infrastructure, has announced that its National Securities Clearing Corporation (NSCC) subsidiary will increase clearing hours to support extended trading with implementation targeted for the second quarter of 2026, subject to regulatory review and approval of any necessary rule changes.