Kinexys by J.P. Morgan, the bank’s blockchain business unit, is developing an application to tokenize global carbon credits at the registry layer as the Northern Trust Carbon Ecosystem has also expanded its capabilities.

In July this year Kinexys by J.P. Morgan said in a statement that it is testing a blockchain application on Kinexys Digital Assets, the firm’s multi-asset tokenization platform, to help tokenize global carbon credits at the registry layer in collaborating with S&P Global Commodity Insights, EcoRegistry and the International Carbon Registry (ICR).

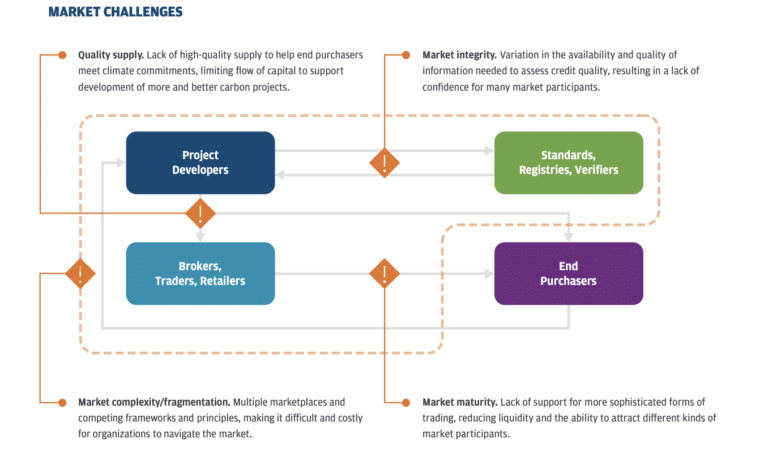

Keerthi Moudgal, head of product at Kinexys Digital Assets, Kinexys by J.P. Morgan, said in an email to Markets Media that the Voluntary Carbon Market (VCM) faces challenges including inefficiencies and a lack of standardization, transparency, as well as market fragmentation.

The voluntary carbon market enables private parties to buy and sell carbon credits representing the avoidance, reduction or removal of greenhouse gases. There are a number of registries, which set requirements for creating and issuing credits, and numerous third parties who verify the projects and the quality of carbon credits.

Moudgal explained that using blockchain technology enables all existing and future registry carbon credits to be tokenized, with each digital token loaded with key metadata including price, status, region, issuance date, and credit type. The same data that is used by existing carbon registries to define and identify carbon credits can be programmed into a tokenized carbon credit.

Jonty Rushforth, head of product & portfolio, energy transition at S&P Global Commodity Insights, said in a statement: “If this collaborative testing progresses as hoped, and eventually includes our Meta Registry, this could extend our environmental registry infrastructure solutions to the financial industry, creating a transformative carbon market expansion.”

If all existing and future tokenized carbon credits are on a single ecosystem based on blockchain infrastructure, market stakeholders can read and action registry data more easily due to improved standardization, transparency and unification according to Moudgal. As a result, tokenized carbon credits can also unlock asset portability, enabling carbon credits to move with greater ease between buyers and sellers, and across market applications, which will lead to more efficient settlement, increased asset utility, and greater liquidity.

“Market connectivity is a core principle for Kinexys Digital Assets (KDA) as we strive to build composable financial ecosystems,” Moudgal added. “We envision market participants, DMRV [digital measurement, reporting, and verification] solutions, and related service providers connecting to the platform, directly integrating services with natively tokenized credits, and independently realizing their own value streams.”

She gave the examples of insurance providers and rating agencies being able to integrate directly with the registry layer, marketplaces listing tokenized credits, or financial institutions structuring new products and offering them across the Kinexys Digital Assets platform.

“Our vision for market-wide connectivity can help to ensure that data is updated in real-time based on ecosystem events,“ she said.

The current phase of the Kinexys Digital Assets carbon credits project aims to establish the tokenization of carbon credits.

In the future a carbon credits trading application may be possible if blockchain payments using some form of digital money could take place on the same ledger as tokenized assets to allow atomic settlement, i.e delivery versus payment only when the specified conditions are met via programmable smart contracts.

Northern Trust Carbon Ecosystem

In September 2024 Northern Trust formally launched the Northern Trust Carbon Ecosystem for end-to-end lifecycle management of digital carbon credits, with the first trades on the digital platform. Private ledger blockchain technology allows buyers to purchase digital carbon credits directly from project developers and retire them against their emissions footprint.

Northern Trust acts on instruction to record, transfer and settle digital carbon credits in its capacity as the designated custodian. The ecosystem is powered by Northern Trust Matrix Zenith, the firm’s digital assets platform.

In January this year Northern Trust said in a statement that it had significantly enhanced the Voluntary Carbon Market through the ability to generate digital voluntary carbon credits in near real-time on The Northern Trust Carbon Ecosystem.

The Northern Trust Carbon Ecosystem was able to receive data and record verified carbon credits in near real-time from participating providers, with the associated data attributes captured and stored on individual credits for accuracy and transparency. The data includes precise measurements of carbon dioxide capture flow rates, power consumed to capture the carbon dioxide and parameters critical for robust verification and traceability such as when and where the carbon was captured.

Justin Chapman, global head of digital assets and financial markets at Northern Trust, said in a statement that despite some automation and digitization being developed in the Voluntary Carbon Market over the last few years, the measurement, reporting and verification of carbon credits has been characterised by inefficient manual processes.

“This additional capability of The Northern Trust Carbon Ecosystem further enhances our ability to support a fully digital lifecycle management solution for voluntary carbon credits,” Chapman added. “The recording of verified carbon credits in near real-time on our platform supports project developers in expediting the commercialisation opportunity of their projects.”

Data collection providers and project developers involved in the project included InceptionX which provides an end-to-end platform for equipment monitoring and carbon measurement; Mangrove Systems, a digital measurement, reporting and verification (dMRV) solution for project developers focused on carbon dioxide removal and carbon storage, and The Carbon Removers, a UK-based project developer which captures, removes and sequesters biogenic carbon.

Sanjay Parekh, chief commercial officer at The Carbon Removers, said in a statement: “Having the capability to capture specific information like the date, location and flow rate for every carbon credit we capture and sequester allows us to ensure that the buyers of our credits can see the full lifecycle of each credit created – providing full transparency and traceability.”

In July this year Northern Trust said in a statement that it is collaborating with Swift to explore how tokenized assets such as carbon credits can be transacted using a commercial bank account in Australia as part of Project Acacia. The research project is led by the Reserve Bank of Australia and the Digital Finance Cooperative Research Centre (DFCRC). The project will simulate a delivery-versus-payment (DvP) settlement between a tokenized, digital carbon credit and fiat currency, using Swift’s infrastructure to coordinate between the asset and payment layers.

Kevin Wong, chief executive APAC at Swift, said in a statement: “By enabling interoperability between existing banking infrastructures and emerging digital ecosystems, we’re helping to lay the groundwork for scalable, secure, and sustainable adoption of tokenized finance across the globe.”

Chapman added that the evolution of tokenized markets hinges on the ability to link emerging asset types with traditional infrastructure. He said: “Through The Northern Trust Carbon Ecosystem and engagement with initiatives like this, we aim to shape the market infrastructure that will underpin sustainable finance and institutional digital asset adoption.”

Northern Trust has also joined Project Ensemble in Hong Kong to test cross-border trading of carbon credits.