Cboe’s second quarter results call on 1 August was the first for Craig Donohue, the new chief executive who replaced Fredric Tomczyk in May. Donohue said that since taking on the role he has been impressed by the power of Cboe’s suite of cash, data and derivatives products, its global presence and market leading technology.

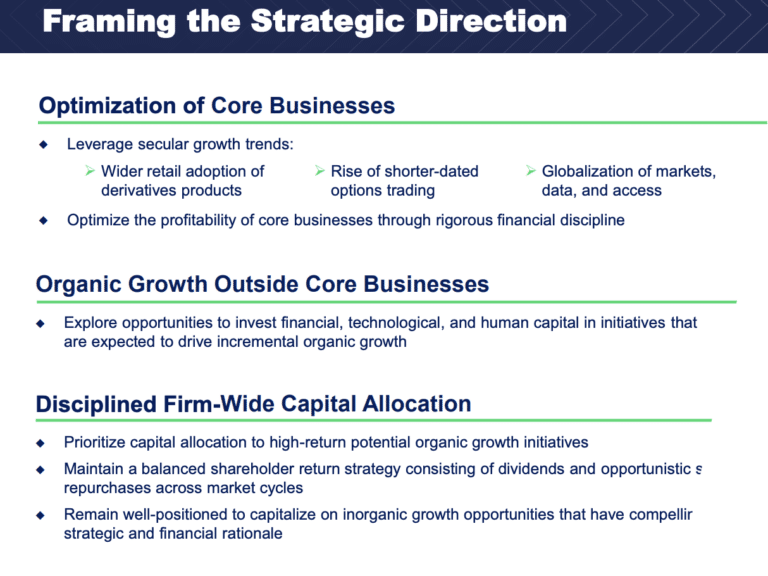

“At the same time, with the continued guidance and support of our board, we are an organization that remains committed to improving, adapting and positioning ourselves to deliver more value to shareholders over time,” he added. “This not only means exploring organic and inorganic investment opportunities around key capabilities, but optimizing the growth and profitability in our core businesses.”

Donohue successfully completed more than $20bn in mergers and acquisitions when he led CME Group, and so was expected to consider both organic and inorganic growth strategies. He said the management team will be working on M&A over time and any deal would have to be compelling from both a strategic and financial rationale perspective.

“There’s nothing that we need to do right now,” Donohue added. “We are committed to bringing a rigorous financial discipline to how we allocate capital, both dollars and people across the firm.”

He highlighted Cboe’s decision to close its Japanese equities business as representative of that thought process. Cboe had announced in July this year that it will close its Japan equities business on August 29, subject to consultation with regulators, including the Cboe Japan proprietary trading system and CBOE BIDS Japan business.

“This decision reflects our philosophy of directing resources to the highest potential return activities across our organization,” said Donohue. “We will redeploy time, energy and investment dollars to supporting Japanese customers through our derivatives and market data capabilities.”

Donohue continued that Cboe sees great demand from Japanese market participants for access to international markets; for US and European market data and Cboe’s global derivative products. Therefore, CBOE will maintain a presence in Japan focused on sales and client engagement.

Jill Griebenow, chief financial officer, said on the call that Cboe expects to record an estimated pre-tax charge of $5m in the third quarter of 2025 for the closure of the Japanese equities business.

Options

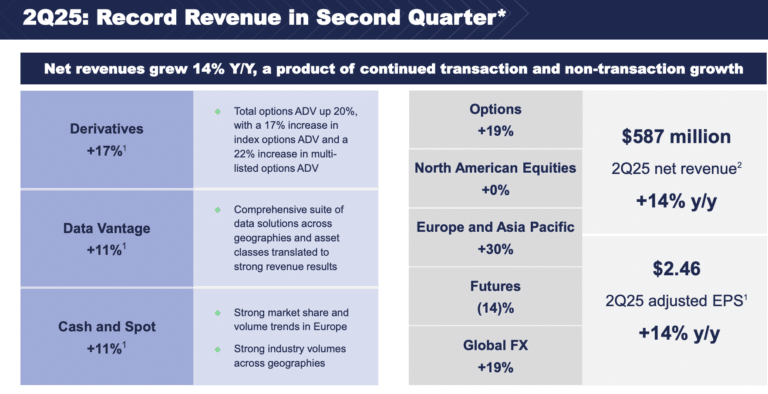

Cboe reported record net revenue for the second quarter of this year of $587.3m, up 14% from a year ago. Donohue said strong double-digit net revenue growth across derivatives, Data Vantage and cash and spot markets drove “outstanding” results.

Derivatives delivered a record quarter as revenue grew 17% year-on-year, driven by robust volumes across the options business.

Donohue highlighted that as volatility surged in April, Cboe’s S&P 500 Index (SPX) options set a single-day record of 6 million contracts on 4 April. He said much of the increase in volume in April came from institutional investors using index options to hedge, particularly using longer-dated options, which had the biggest increase relative to other tenors.

In contrast to institutional activity, retail traders pulled back in April as volatility spiked, and the volume share of short-dated zero days to expiry (0DTE) options declined in April.

“Retail typically re-engages once volatility moderates, which is what we observed in May and June,” added Donohue. “SPX zero days to expiry volumes rebounded to new highs, ending June with a new record monthly average daily volume of 2.2 million contracts.”

In the second quarter, zero days to expiry options made up a record 57% of Cboe’ overall SPX options volume.

“Looking ahead, we remain positive about the growth potential of options as an asset class and our proprietary index options franchise,” added Donohue. “Continued uncertainty regarding monetary and trade policy is expected to support the continued use of options to dynamically manage risk structural factors such as increasing retail participation and international expansion should provide further tailwinds.”

Cathy Clay, head of global derivatives at Cboe, said on the call that the firm will continue to partner with more retail brokers , particularly in Asia Pacific where there is “incredible” demand for Cboe’s products and data.

“We really think this is early innings for the 0DTE complex,” she added. “SPX options have set three daily records this year, two in April and one on July 31, so we think the secular tailwinds for this space are strong.”

Data Vantage

Data Vantage produced 11% year-on-year net revenue growth in the second quarter.

“We are looking to accelerate that growth with new hires to lead our market data sales as well as our analytics and indices businesses in the Asia Pacific region,” added Donohue.

In addition to strengthening sales capabilities, Cboe is using new technologies and developing new products to enhance the data and access offerings, such as accelerating the migration of derivatives data to the cloud and actively exploring new global access points.

Donohue said the interconnectedness and importance of the Data Vantage business should not be understated.

“Each enhancement to our market access layer, subscription based data, sales and even real -ime values from the index business provide an ecosystem benefit to Cboe in the form of better customer engagement and improved activity levels for our trading businesses.”

Total net revenue for Cboe grew 13% from the first six months of 2024. Griebenow said that following the first half performance, the group has increased 2025 organic total net revenue growth target to high single digits, from mid to high single digits and reaffirmed Cboe Data Vantage organic net revenue growth target of mid to high single digits.

Clay said the firm believes that Data Vantage is well positioned for sustained, long-term growth.

“We are really leaning into our new distribution channels like Cboe Global Cloud, where 85% of our sales are from international clients,” she added. “We’re leaning into strengthening our sales execution, making sure that the derivatives team and the data management team across the globe are really working hand in hand, because we know that the data sales often are a leading indicator of the derivatives volumes that we might enjoy.”

Clay was given extra responsibility to provide oversight of the Cboe Data Vantage business under the new management structure. Chris Isaacson, chief operating office was also given the added responsibility of the oversight of cash equities, global FX and clearing.

The expanded roles are due to Dave Howson, global president, stepping down from the role effective 1 August 2025. Howson will be returning home to the UK after spending three years in Chicago.