Miami International Holdings, which has built and operates regulated markets in traditional finance, has completed an initial public offering while Bullish has become the first digital asset exchange to go public on the New York Stock Exchange.

.@MIAXexchange, the global, fully-electronic exchange group is now NYSE-Listed🏛️

— NYSE 🏛 (@NYSE) August 14, 2025

Congratulations to Thomas Gallagher, and the entire MIAX team on this next chapter! $MIAX pic.twitter.com/Lb7yYQOHQv

Miami International Holdings (MIH) has built and operates regulated financial markets powered by proprietary technology which has been built in-house. The firm priced its initial public offering of 15 million shares on 13 August at $23 each, $2 above the high end of the expected price range. J.P. Morgan, Morgan Stanley and Piper Sandler were lead joint bookrunning managers for the $345m IPO on the NYSE.

The MIAX Exchange trading platform was originally built to meet the high-performance quoting demands of the U.S. options trading industry and the firm argues it is differentiated by its throughput, latency, reliability and wire-order determinism.

Thomas Gallagher, chairman and chief executive officer of MIH, told Markets Media that investors were attracted to the IPO due to the firm’s proprietary technology, which has allowed the group to grow since the pandemic in March 2020.

Gallagher said: “I like to say I built the church for Easter Sunday from day one as we have never had to increase capacity since launch on 7 December 2012. Just like starting a new grocery store, cheap fees, coupons and rebates got people in the door but the tech is keeping them here.”

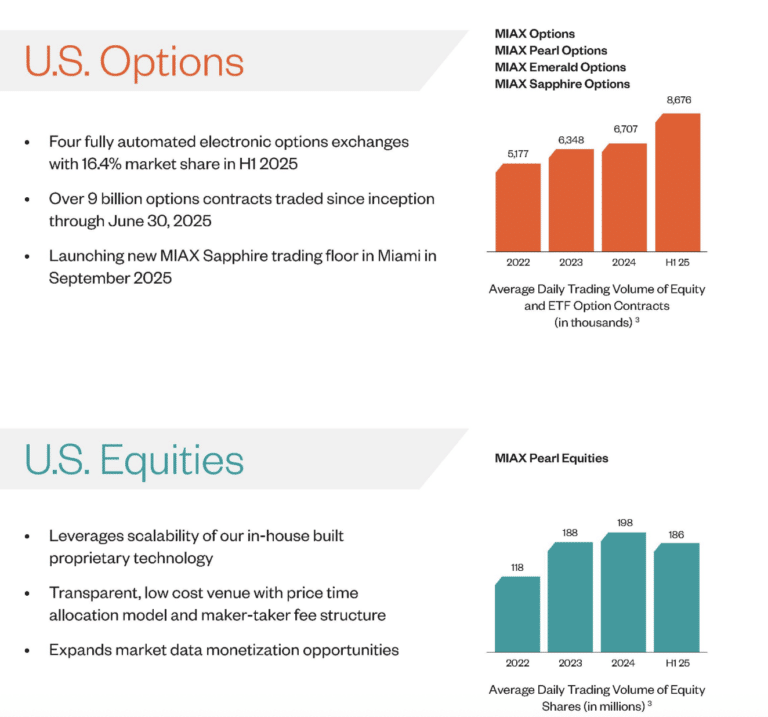

The scalable technology infrastructure allowed MIAX to expand into other asset classes and MIAX Pearl Equities was launched in September 2020. The prospectus said: “MIAX options technology was adapted for the unique functional and performance demands of equities trading, which allows us to provide high performance while taking advantage of the scale associated with a system built for options trading.”

Since launching its first options exchange in 2012, MIAX has grown to be the fourteenth largest global derivatives exchange operator as of 30 June 2025 according to the prospectus. The group operates four fully automated SEC regulated electronic options exchanges in the U.S., each with its own distinct allocation and pricing model.

The fourth electronic U.S. equity options exchange, MIAX Sapphire, was launched in August 2024 and accesses approximately 94% of total multi-listed volume. The remaining 6% is traded on exchange floors and MIAX is due to open a trading floor in Miami, Florida in September this year.

Gallagher said the firm is obtaining final permits from the Miami authorities, but every customer and their equipment is on the new floor, and mock trading sessions have been held.

“We are locked and loaded for September 12, and I’m so excited about it,” said Gallagher. “What started out as a temporary relocation as a result of the pandemic has become a full fledged migration to the south east and I’m proud we’re going to be the first national exchange to open up a trading floor in Miami.”

MIAX said it has traded more than 9.5 billion contracts from inception through 30 June 2025 on its options exchanges. Average daily volume for options increased from one million contracts in 2015 to 6.7 million contracts in 2024, a compound annual growth rate of 23.5%.

Total volume on the options exchanges reached 1.69 billion contracts in 2024, a 6.5% increase from 2023 and a market share of 15.1% according to MIAX. in In the first six months of this year total volume on the options exchanges reached 1.1 billion contracts, 30.5% higher than the same period in 2024 and representing a market share of 16.4%.

Gallagher believes the increase in retail participation and the increase in options volumes are a long-term sustainable trend as the macroeconomic and geopolitical issues that are impacting markets around the world will take time to be resolved.

“The other thing is new products are coming out, and we have an outsized share of those,” he added.

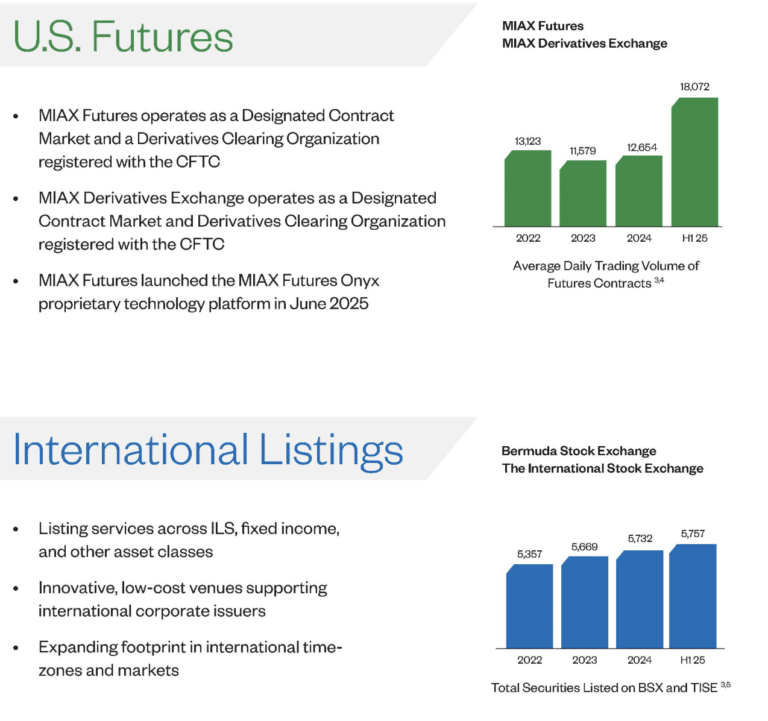

Total volume of futures and options on futures on the MIAX Futures exchange was 2.2 million contracts for the first six months of this year, an increase of 36.6% from the same period in 2024.

The group operates two CFTC regulated futures exchanges and two futures clearing houses in the U.S., with different products and service models.

Hard Red Spring Wheat futures and options on futures contracts are currently listed on MIAX Futures. The firm is developing new products for the exchange including products based on Bloomberg indexes and may enter into additional clearing as a service agreements with other futures markets. New MIAX Futures products will be traded on the MIAX Futures Onyx trading system which was launched on 29 June 2025. The launch marked the migration of MIAX Futures’ Minneapolis Hard Red Spring Wheat (Minneapolis HRSW) Futures trading and completes the post-acquisition modernization of the entire MIAX Futures trading and clearing infrastructure. MIAX Futures was acquired by MIH in 2020 and its flagship contract, Minneapolis HRSW has traded continuously since its inception in 1881.

“We are currently in the process of making significant investments in MIAX Futures, to transform it from an agricultural focused market to a full solution designated contract markets (DCM) and derivatives clearing organization (DCO), both in terms of products and technology,” said the prospectus.

Bloomberg 500 index futures will be traded on the new platform this year, pending filing with the CFTC.

Gallagher said the biggest risk that concerned investors during the IPO roadshow was whether customers would connect to the new MIAX Futures Onyx trading system.

“Every major market participant connected so that I can use those relationships to open up the trading environment to new products and new customers,” he added. “The roadshow started before June 30 so that risk factor has dissipated.”

MIAX said in the prospectus it has a robust pipeline of new products it plans to launch covering different asset classes on its exchanges and may also launch event-based contracts and crypto-related cash settled products, including cash settled futures contracts on bitcoin and ether and options on bitcoin and ether futures contracts on its venues regulated by the CFTC.

“We do not intend to launch any crypto-related products or services in the near future on our national securities exchanges which are regulated by the SEC (MIAX, MIAX Pearl, MIAX Emerald or MIAX Sapphire, other than crypto-related ETFs and options on ETFs that are approved by the SEC),” added the prospectus.

Outside the U.S., the group has expanded through the acquisitions of Bermuda Stock Exchange (BSX) in 2020 and Guernsey-based The International Stock Exchange Group (TISE) in June this year.

The prospectus said the Bermuda regulatory environment provides attractive opportunities for introducing innovative cryptocurrency and digital asset products on BSX.

“The TISE Acquisition provides us with access to the European and UK markets, as well as giving us access to another vertically integrated market ecosystem that can accelerate our growth strategy,” added the prospectus.

Gallgher continued that becoming a public company and having a traded stock benefits long-standing employees and is also a “tremendous” recruiting tool.

“I have not had a problem keeping my employees because we had very little turnover, but it’s certainly something that I think will ensure success going forward,” he added. “It’s another tool in my toolkit to retain and get new hires.”

Listed stock can also be an acquisition currency but after completing five acquisitions in four and a half years, Gallagher believes he has all the pieces needed to leverage the technology stack, the employees and to leverage the relationships with firms like Citadel, Susquehanna and other market participants.

“I don’t see something that I need right and I just want to enjoy my balance sheet for several quarters,” said Gallagher. “I’ve been raising capital for 15 years to get to where we are.”

Bullish

The first digital asset exchange to go public on NYSE 🔔 Congratulations CEO @ThomasFarley and the entire @Bullish team on this epic milestone. $BLSH | @CoinDesk pic.twitter.com/GtefYl5mty

— NYSE 🏛 (@NYSE) August 13, 2025

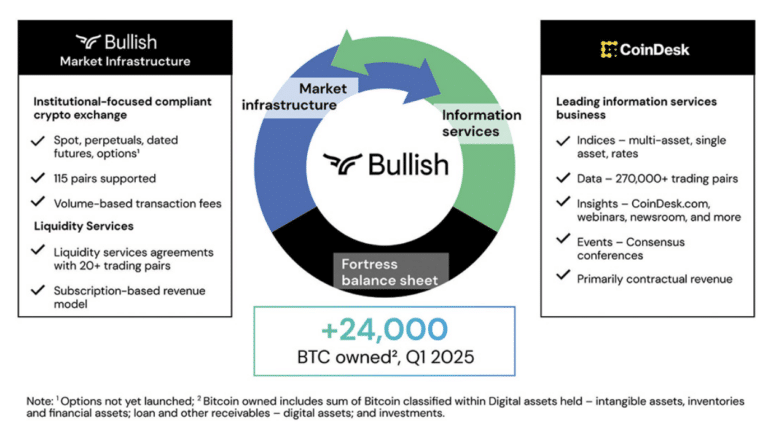

The flotation of Bullish is a return to the NYSE for Tom Farley, chief executive of the institutionally focused digital asset platform that provides market infrastructure and information services. Bullish was founded in 2020 with the aim of building an institutional-grade global exchange enabling optimized execution powered by a customizable, compliance-first infrastructure.

The Bullish Exchange operates a regulated and institutionally focused digital assets spot and derivatives exchange, which it said integrates a high-performance central limit order book matching engine with automated market making to provide deep and predictable liquidity. The exchange supported over 70 pairs for spot trading and offered more than 45 pairs for perpetual futures trading, servicing eligible customers in over 50 jurisdictions as at 31 March 2025.

The prospectus said: “The Bullish Exchange aims to differentiate itself through reliable liquidity, diverse product selection, capital efficiency enabled by our unified and cross-collateralized margin account structure, access to multiple forms of on-platform credit, competitive fee structures, regulated status and robust third-party software integrations.”

Farley was president of the NYSE Group of Intercontinental Exchange between 2014 and 2018. He led all operations for the NYSE and managed a diverse range of equity and equity options exchanges. Prior to the NYSE, Farley was senior vice president of financial markets at ICE, where he oversaw a variety of modernization efforts, strategic acquisitions, and exchange consolidations.

Who says you can’t go home again? See you in the morning. @NYSE @Bullish pic.twitter.com/qg66sK44sg

— Tom Farley (@ThomasFarley) August 13, 2025

In the IPO prospectus Farley described his first lesson in crypto occurring more than ten years ago on a sunny summer day in 2014.

“My neighbor, enthusiastic about joining a new startup working on something called ‘blockchain technology’, sat on my porch and described a vision for programmable finance,:” he said. “Our hours-long conversation was eye-opening, transforming me into a believer that this new technology would drive efficiency and excite major institutional players, transforming traditional finance workflows.”

Farley then invested $10m of NYSE Group’s balance sheet in his neighbor’s new employer in early 2015 – a startup called Coinbase, which is also now a public company. He continued that while he may have misjudged the speed of disintermediation and adoption, he also underestimated the scope.

“There were times over the past several years when our confidence that institutions would come en masse to digital assets was tested, largely driven by regulatory considerations, particularly in the United States,” added Farley. “Today, however, I believe it is clear: institutions have arrived, and more are coming.”

Liquidity services is Bullish’s fastest growing business according to the projects, which offers many issuer/ blockchain arrangements for launching, listing, trading, and marketing stablecoins.

The Bullish Exchange’s total trading volume since launch has exceeded $1.25 trillion as of 31 March 2025 according to the prospectus. The filing said total global spot trading volume market share for bitcoin (BTC/USDx) and ethereum (ETH/USDx) was approximately $284.8bn and $144.5bn respectively in 2024, and represented approximately 35% and 44% share among the peer set of exchanges.

In the information services business, CoinDesk is a benchmark for over $30bn in assets, including the CoinDesk 5 and CoinDesk 20 indices, and provides market data to institutional customers. In October 2024 Bullish acquired CCData, the digital asset data and index provider. The prospectus said: “This strategic acquisition enhances our ability to deliver cutting-edge data solutions and analytics.”

Shares of Bullish began trading on the NYSE on 13 August 2025 at $37 per share after the initial public offering was upsized, and ended the first day at $70. J.P. Morgan and Jefferies were lead book-running managers with Citigroup as joint book-running manager of the $1.1bn IPO.

Bullish’s registration filing for the IPO with the U.S. Securities and Exchange Commission said certain funds and accounts managed by subsidiaries of BlackRock and ARK Investment Management had indicated an interest in purchasing up to $200m of shares in the offering.

Behind the scenes of @Bullish IPO allocation process pic.twitter.com/Ab5Dv2dowQ

— Tom Farley (@ThomasFarley) August 15, 2025

Congrats to @Bullish on their successful market debut.

— Vlad Tenev (@vladtenev) August 14, 2025

Also I want to commend @ThomasFarley on ensuring one of the largest retail IPO allocations ever (20%!)

Glad to see retail investors getting the respect they deserve.

.