Doug Petno, co-chief executive of the commercial & investment bank at JP Morgan, expects markets and investment banking revenues to increase in this quarter.

Petno spoke to analyst Jason Goldberg at the Barclays Global Financial Services Conference on 9 September 2025 in New York. The commercial & investment bank business includes global markets, payments and security services, and was nearly half, 43%, of group revenues and 46% of net income in the first half of this year, according to Goldberg. The division generated $19.5bn in revenues just in the second quarter and does business with more than 90% of the Fortune 500 in over 60 countries.

Goldberg said: “That would be the fifth largest bank in the United States if that was a standalone company, and would be bigger than both Goldman Sachs and Morgan Stanley’s entire operation.”

Petno argued this gives the bank a “tremendous” lens on the wholesale market and economy and clients are trying to see through the fog of geopolitical, market, trade, legislative and regulatory uncertainty. He highlighted that it was positive that most of the bank’s clients are either innovating, navigating, evolving or adapting to the volatility created by uncertainty around global trade and some of the fog is lifting.

As a result clients are thinking about accelerating capital investment and Petno said that is manifesting itself in the bank’s credit performance and credit costs, and market activities across capital markets and M&A.

“Our markets team is doing extremely well,” added Petno. “They are on track to have a terrific year and the momentum from the first half of this year is extended into the third quarter.”

The bank is seeing broad-based strength across equities and fixed income, commodities and currencies. In addition, the initial public offering market, which Pento described as “completely on its back” in 2022, has come back and JP Morgan has a lot of primary issuance in its pipeline. He expects equity capital markets to continue to be robust, and said the technicals in debt capital markets are “really strong” as spreads are historically tight, so clients are taking advantage of open credit markets.

There are a few weeks left in the third quarter and Pento estimated that markets revenue will increase in the high-teens percentage rate. Goldberg said: “That would put 2025 at a record level for markets revenues.”

M&A

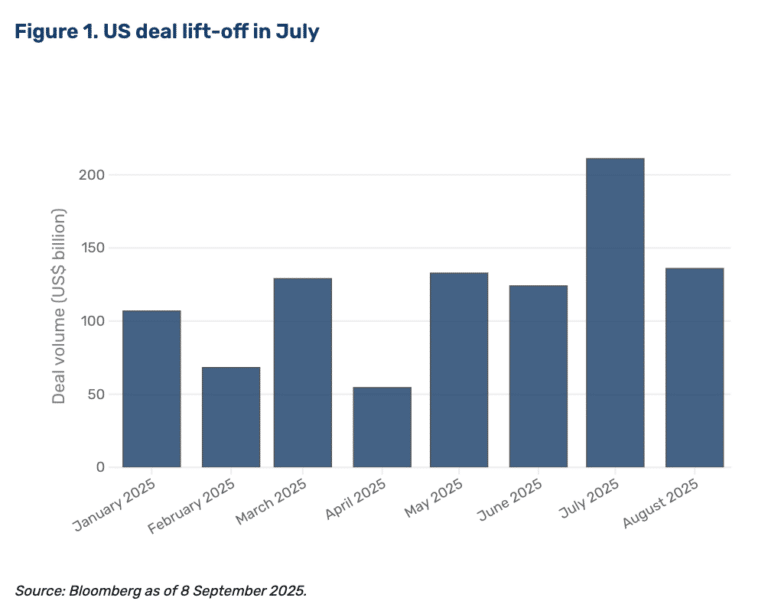

Investment banking is having a “pretty good” year with one of the busiest summers, including the busiest August in a long time, according to Pento. Based on the bank’s pipeline, he expects investment banking revenues for the third quarter to rise by a low double-digit percentage.

“Anything can happen but we feel there’s a lot of animal spirits at the moment,” said Pento. “Big M&A is back as there is a strategic imperative to be global, big, diversified and integrate operations. There is also a sense that you have a finite window to complete large M&A before the regulatory sentiment may shift back.”

Nick Wilcox, managing director, discretionary equities at hedge fund Man Group, said in a blog that there are finally tangible signs that the long overdue acceleration in M&A is finally underway.

“Global M&A has hit over $2 trillion year-to-date, an increase of more than 30% from last year,” he added. “July alone delivered North America’s strongest month since September 2021, and the third-strongest July on record.”

Wilson said that while industrials and technology led the initial charge, dealmaking is now spread across most industries and geographies. In addition, a higher percentage of deals are attracting competing bids, fewer deals are facing shareholder opposition and antitrust risk is lower under the current U.S. administration.

He expects deal momentum to continue absent major macroeconomic disruptions as companies have built up cash reserves and strategic rationales during the quiet years and private equity firms are sitting on record levels of dry powder.

“Crucially, the regulatory and political backdrop has shifted in favour of dealmaking,” said Wilson. “The M&A machine appears to finally be hitting its stride.”

Private credit

Pento described private credit as a “tremendous market” that has grown dramatically in the last several years to a multi-trillion dollar market, which is over half of commercial and industrial lending. However, he warned that banks that have grown loans at over 20% for an extended period of time tend not to do well.

“There will certainly be winners and losers in this asset class over time,” Pento added.

He argued that JP Morgan is not so worried about the outstanding players in private credit as many are clients of the bank. However, secondary and tertiary players have not been through a hard recession so may suffer idc there are two or three quarters with a tough economic climate.

Jim Zelter, president of Apollo Global Management, a provider of alternative assets and retirement solutions, also spoke at the Barclays Global Financial Services Conference on 9 September 2025 in New York. Zelter agreed that not all alternatives managers will be successful.

In order to compete, Zelter said firms need broad distribution, to be able to price products, low operating costs, a highly rated counterparty balance sheet and “massive” origination.

“There are lots of folks who have entered the marketplace who think they will be able to sustain a mid-teens return on equity, and we scratch our heads a little bit,” adde Zelter. “The success of a few of us means there are a lot of imitators, but that does not mean they are going to have success over time.”

He continued that he does not want to say there is an arms race, but people see the benefits of scale players, which is why Apollos is “very confident” on delivering its five year plan. Zester said: “We have a lot of momentum behind our back.”

Zelter also agreed with Pento on the macroeconomic environment and as a result, he said M&A is having its second best year on record.

“If someone landed from Mars today, and notwithstanding all the headlines, said let’s take a look at the macro economy, you have got a major capex cycle,” added Zelter. “Personal and corporate balance sheets are in pretty good shape.”

Zelter said that since he arrived at Apollo 20 years ago, private credit has become a permanent allocation in portfolios.

“We just see more defined contribution plans, global wealth plans, wanting to diversify their exposure,” he said.

He gave the example that Apollo has been working with State Street Investment Management to expand investor access to private market opportunities. In February this year the two firms launched SPDR® SSGA Apollo IG Public & Private Credit ETF (PRIV), the first ETF to offer exposure to both private and public exposures in one fund.

On 10 September State Street Investment Management said in a statement it had launched the State Street Short Duration IG Public & Private Credit ETF (PRSD). The fund is an actively managed short-term core bond solution, primarily allocating to investment grade debt securities through public and private credit instruments, seeking to maximize risk-adjusted returns alongside current income for investors.

Anna Paglia, chief business officer of State Street Investment Management, said in a statement that private credit is one of the fastest-growing segments of the market but has historically been an underutilized allocation in portfolios.

“That changed earlier this year when we launched PRIV – a core bond fund offering exposure to a combination of investment-grade public and private credit ETF,” she added. “Now, PRSD builds on the launch of PRIV and continues the convergence of public and private markets by expanding our lineup to include a short-term bond strategy that can be used to pursue potential excess returns while managing duration risks.”

Apollo believes that the traditional 60/40 portfolio allocation of 60% equities and 40% fixed income will change to include alternatives. Zelter added: “We are going to have a bigger seat at the table.”

In fixed income, Zalter said investors have allocated to a narrow definition of private credit – direct lending to non-investment grade sponsors. However, Apollo sees the the largest area of institutional as well as insurance company activity into private credit as the whole asset-based finance business due to corporates’ capex needs and the changes in how banks are using their balance sheets.

“In terms of scale of market opportunity, I suspect that the direct lending marketplace will be surpassed three or four times over by the end of this decade by private credit in the asset-based world,” added Zelter.

Apollo has estimated that the private credit universe is a $40 trillion opportunity with the investment grade segment becoming “massive” multiples of the non-investment grade side of the business. In addition, most scaled origination has occurred in the non-investment grade segment but over the next decade investment grade industries, such as AI and data centres, who have massive capex needs.

For example, Apollo said in a statement on 8 September 2025 that it had agreed to commit €3.2bn of equity to a newly established joint venture with RWE, Germany’s largest power producer and a global leader in renewable power generation.

Jamshid Ehsani, partner at Apollo, said in a statement: “This partnership reflects Apollo’s commitment to strong, lasting partnerships across both the private and public sectors. Looking ahead, we expect to further accelerate our investment activity in Europe, with a particular focus on Germany, France, Italy and the UK.”