David Martin, the new chief executive of the derivatives business at AsiaNext, the institutional digital asset exchange based in Singapore, said capital efficiency will “win the game” in crypto.

AsiaNext said in a statement in August this year that it had appointed Martin. He previously worked at digital asset prime broker FalconX, co-founded Blockforce Capital, a crypto hedge fund, and helped launch BLCN, the first blockchain ETF. Earlier in his career, Martin developed quantitative strategies in macro markets and founded a risk analytics platform for hedge funds.

Martin told Markets Media in an email that he has been in crypto for a decade and feels that the next stage of the industry is about the collision of traditional finance (TradFi) and crypto.

“Capital efficiency will win the game, and AsiaNext has a unique opportunity to bridge traditional assets into the crypto ecosystem,” he added.

Japan’s SBI Digital Asset Holdings and SIX Group, the financial market infrastructure based in Switzerland, formed a joint-venture in 2021 to launch AsiaNext due to the growing institutional appetite for trading digital assets and the lack regulated and secure venues to meet this demand, In September 2023, the Monetary Authority of Singapore officially licensed AsiaNext as a recognised market operator. AsiaNext is an institution-only digital asset exchange for spot, tokenized securities and derivatives.

Martin said: “Add in the backing from SIX and SBI, regulatory clarity, not to mention the infrastructure already in place, it was a chance to step into a platform that’s ready to scale.”

He argued that the market does not need more exchanges, but needs platforms that allow “your dollar to go farther.” Capital efficiency is about bridging traditional assets held at prime brokers into crypto markets, according to Martin. Although tokenization of real- world assets is progressing, Martin said real growth lies in bridging existing TradFi assets effectively.

“That unlocks liquidity and helps the market evolve faster than waiting for tokenization to scale,’” said Martin.

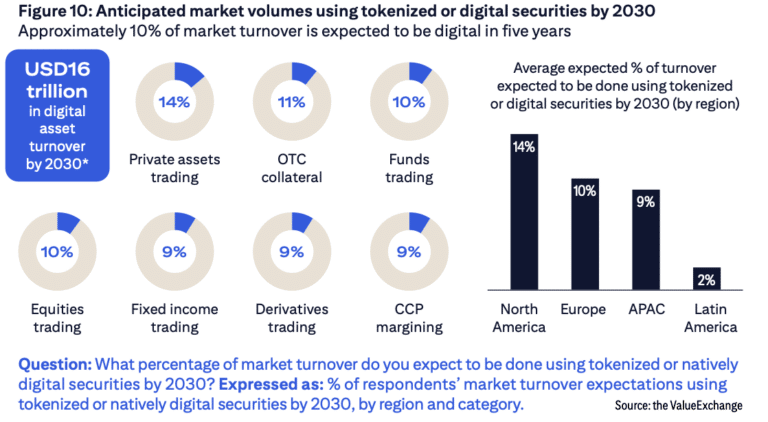

Liquidity and post-trade cost efficiencies are the drivers of institutional investments into distributed ledger technology (DLT) according to Citi’s latest Securities Services Evolution white paper.

“More than half of the survey’s respondents are clearer than ever that the ability of DLT to increase the velocity of securities around the world’s capital markets can have major impacts on their funding costs, financial resource requirements and operating costs before 2028,” said the paper.

Growth strategy

At FalconX, Martin helped launch credit, structuring, and derivatives, and the firm became the first CFTC-approved crypto swaps dealer and ran sales and coverage. He believes that bringing this experience to AsiaNext will allow him to shape products and strategies informed by what truly aligns with market needs.

“FalconX gave me creative freedom, taught me to adapt in fast-changing markets, and gave me a deep understanding of the client relationships and the infrastructure required,” he said.

Martin said the growth strategy rests on three pillars. The first is about providing institutions with a differentiated platform rather than just another exchange and then leveraging regulatory clarity as a competitive advantage. “Lastly but perhaps most importantly, it’s about unlocking capital efficiency,” he added.

The increase in crypto treasury firms will lead to more demand for derivatives because as more firms hold bitcoin and other crypto assets as reserves, there is a growing need to hedge positions or capture arbitrage opportunities. In addition, long-term holders can also use derivatives to harvest volatility yield.

Over the past few years, listed derivative volumes have grown from around $20bn a day in 2019 to nearly $1 trillion, according to Martin. “Institutions trade derivatives, and more TradFi in crypto should continue to grow the space exponentially,” he said.

The passing of the GENIUS Act which provides a federal framework stablecoins in the U.S. will also indirectly boost the derivatives business. Martin said the legislation gives a rubber stamp to stablecoins like USDC, making them a globally recognized asset that trades 24/7.

“That allows hedge funds and other institutions to use stablecoins for hedging or trading outside traditional market hours,” said Martin. “It creates opportunities for positioning, yield generation, and broader participation in crypto derivatives that weren’t possible before.”

AsiaNext’s derivatives business will be able to scale responsibly and sustainably thanks to its strong backing, licenses under tier-one regulatory regimes, and a nimble product offering across securities and crypto, according to Martin. He believes that AsiaNext is “uniquely positioned” through trust, regulatory clearance, and capital efficiency.

“With the backing of SBI and SIX, regulatory licenses, and the ability to operate across both crypto and securities markets, we offer a platform that is credible, compliant, and efficient,” said Martin. “Institutions want the right kind of regulation, not less regulation, and that’s what sets us apart.”