Regulators should prioritise simplified reporting for financial crime and transaction reporting, according to market participants.

Edwin Schooling Latter, head of Compliance UK at Japanese bank Mizuho, said financial crime and transaction reporting were his top priorities for regulation that should be simplified. He said: ”The burden of regulatory reporting is really stifling and it is a serious issue for our businesses.”

He spoke at AFME’s European Compliance and Legal Conference in London on 22 September 2025. Before taking on his current position in November last year, Schooling Latter’s previous roles included being director of wholesale markets policy and supervision at the UK Financial Conduct Authority and FCA representative on the ESMA Board of Supervisors until the UK’s departure from the EU.

Fighting financial crime is very important but Schooling Latter said the way that regulation uses the resources in firms is “staggeringly inefficient”. He highlighted the amount of time and money that wholesale firms have to spend in exchanging documents with other regulated institutions or with listed firms and their subsidiaries.

“In transaction reporting, we have collectively created a regime around MiFID, Emir and SFTR of staggering complexity with hundreds of fields,” he added. “An enormous amount of resources are spent in firms chasing minor details of these transaction reports that in many cases, from my previous experience, are not particularly well used by regulators.”

Different reporting requirements have been defined by different rules in the European Union. Adam Farkas, chief executive of AFME, which represents banks in Europe’s financial markets, said at the conference that the industry feels that reporting requirements were created with the legitimate policy and supervisory objectives, but were not coordinated horizontally and therefore, overlapping requirements have emerged.

Simplified reporting frameworks would reduce compliance costs, eliminate duplicative obligations, and improve data quality. It would also make the EU more attractive for investment and strengthen the competitiveness of its capital markets.

“I can see places where we’re spending a lot of time and effort to tick the boxes on a regulation, but I have very little confidence that’s actually achieving any public policy objectives,” added Schooling Latter. “Regulators should feel excited and empowered about this opportunity to trim things back and I think you can establish just as much public value doing that as you can in rolling out rules.”

Tanya Panova, head of the securities markets unit in DG FISMA at the European Commission, agreed that reporting is being duplicated because each act of EU legislation is negotiated separately.

Her unit is responsible for leading the policy development of securities market legislation and implementation in the European Union and she took part in a fireside chat at the conference.

Now on: Fireside chat between Adam Farkas CEO AFME & Tanya Panova @EU_Commission pic.twitter.com/9yOBuItCnB

— AFME (@AFME_EU) September 22, 2025

However, during the MiFID review, market participants asked why additional reporting was needed. ESMA, the EU financial regulator, then launched a call for evidence, which Panova said has received many responses and suggestions.

She continued that, for the first time, EU regulators are carrying out a holistic view of transaction reporting across several pieces of legislation.

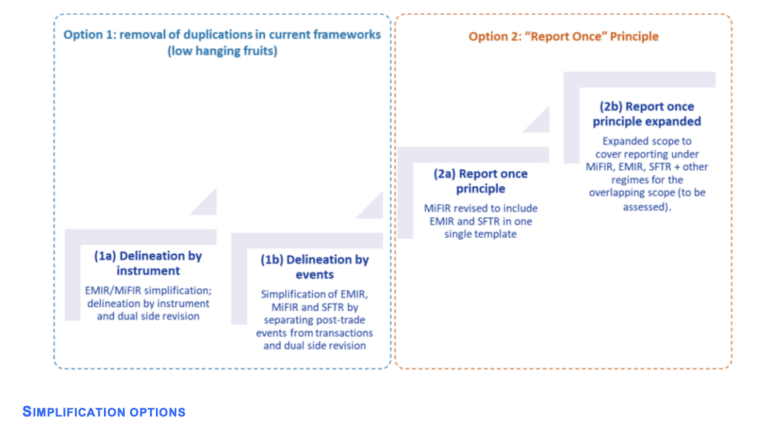

“There are a whole range of solutions starting from something minimal where we make tweaks to remove overlapping reporting,” she added. “Or we go for a ‘big bang’ with one data entry point that would apply across the board?”

However, the big bang approach would require a much more serious rethinking of the way reporting works across different pieces of legislation, and would potentially imply adjustment costs for the industry, so there is a trade off with the larger long-term benefits.

“Now it’s time for ESMA to do its analysis and to advise us, because it’s a technical exercise,” she added.

Response to ESMA

The Managed Funds Association, which represents the global alternative asset management industry, made recommendations to ESMA to simplify the EU’s reporting framework.

Jillien Flores, MFA chief advocacy officer, said in a statement: “Simplified reporting regimes are an important step toward strengthening EU capital markets and advancing the goals of the Savings and Investments Union.”

In its letters to ESMA, MFA recommended that transaction reporting should eliminate dual-sided reporting obligations and adopt a “report once” model; create a centralised EU data hub for transaction reporting; coordinate with international regulators to avoid divergence and improve global alignment and assign reporting obligations to trading venues and clearing houses where possible.

Other trade bodies – ISDA, AFME, FIA and the Global FX Division of the Global Financial Markets Association submitted a joint response to ESMA’s call for evidence on streamlining of transaction reporting.

The associations said in a statement that they supported the elimination of duplicative reporting with a move towards ‘report once’ per transaction, single-sided reporting, a comprehensive review of all the data elements to be submitted to only include data points relevant to a given regime, and the development of unambiguous, machine executable logic to be published alongside the regulatory text.

ESMA said it will produce a final report based on the responses to the call for evidence, which is expected to be published in the first quarter of 2026.