Nils Rode, chief investment officer at Schroders Capital, said continuation investments are a strategic priority as the private markets division of UK asset manager Schroders predicted that total investment volumes in the sector will increase fourfold in a decade.

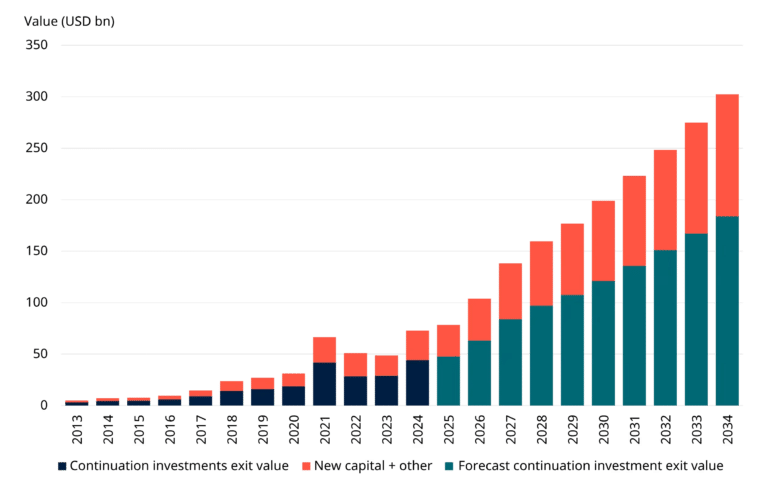

Schroders Capital forecast in a report that total continuation investment volumes will grow from a little more than $70bn in 2024 to more than $300bn by 2034, driven by both buy-side demand and structural supply-side growth drivers.

The report said: “The cyclical tailwind for continuation investments contributed about 17% of the transaction volume in 2024. Overall, the compound annual growth of these deals between 2013 and 2024 stands at 27%.”

Continuation funds allow a private equity firm (GP) to move one or more high-performing companies from an existing fund to a new fund. Rode told Markets Media that investors in the old fund can either cash out or provide additional capital in the continuation fund.

Some investors may be skeptical that non-performing companies are being transferred into continuation funds.

Rode told Markets Media: “We are most interested in continuation investments that otherwise would have been sold to another fund, and where there’s a good reason not to exit too early to a strategic buyer or in a few cases, through an IPO. These are the investments that are kept for the right reason.”

He argued that Schroders Capital’s analysis found that 80% of last year’s continuation fund transaction volumes were “done for the right reason.” For many companies it makes sense to stay private without changing their owner because that is lower risk proposition, according to Rode.

“We have been active in continuation funds and have a dedicated team,” he added. “We believe it will be one of the fastest growing parts in private equity and is very beneficial for investors if the selection is done right in the way.”

Many continuation vehicles are just for one company, so Schroders Capital’s due diligence is similar to a direct co-investment. The asset manager wants to see that most of the strategic plan for the next holding period is similar to what was done successfully in the prior holding period.

“If there are totally new plans that would be a red flag,” he adds. “If they have all these great new ideas, why haven’t they done it already?”

Schroders Capital’s analysis of approximately 2,600 realised buyout deals in the firm’s database found that nearly one third, 31%, of all buyout portfolio companies are potential candidates for continuation investments.

“This reflects the proportion of deals that had a return profile similar to what we see for continuation investments and that generated more than a 2x multiple on invested capital (typical minimum target return for both secondary buyouts and continuation investments),” said the report.

Rode said the most attractive opportunities are in the small and mid-market segments where there is more original dealflow because most of these companies in the first holding period were bought from families or from corporate spin offs, and the asset manager has many private equity relationships in this segment.

“Being connected to these GPs allows us insights into their portfolios and helps us, in some cases, to even initiate continuation investments,” he added.

Increased access

There has been an increase in fund managers offering access to private funds to wealth channels and retail investors. In the U.S President Trump has signed an executive order to democratize access to alternative assets for 401(k) investors in retirement plans.

On 24 October 2025 alternatives manager Apollo said in a statement that it has received regulatory authorization to launch three new evergreen, semi-liquid European Long-Term Investment Funds. The statement said this provides individual investors with greater access to Apollo’s private markets expertise via tailored, evergreen formats and broader distribution channels.

Veronique Fournier, head of EMEA global wealth at Apollo, said in a statement: “With these three new ELTIFs, we continue to bring the best of Apollo’s investing expertise to wealth investors in Europe and around the world, in product formats tailored to their needs.”

Apollo’s Global Wealth business reported $9bn of inflows in the first half of this year, across 18 separate strategies.

Rode said: “Increased access is the big driver of growth for the next 10 to 20 years.”

He argued that continuation investments are particularly interesting for the wealth segment because they are lower risk, have more predictable returns, faster liquidity and lower fees compared to traditional private equity buyouts.

Schroders Capital’s report cited data and analysis from private market provider Preqin which suggested that management fees on continuation vehicles are roughly half of those of traditional buyouts and that carried interest is also typically structured in tiers, meaning the overall fee burden is lower.

“Based on 2024 volumes, the total aggregated investor savings over a four-year hold period compared to traditional buyouts would amount to approximately $3.8bn,” said the report.

Continuation investments have more predictable returns because their return profile has historically been statistically more stable than that of traditional buyouts, according to the report. They also tend to deliver liquidity faster than other buyout investments.

“On average, they have a 1.5-year shorter hold period (less than three years instead of more than four years), which translates to a 25% faster time to liquidity for investors,” added the study.