In 2012 Deutsche Börse and Commerzbank entered a strategic partnership with 360X to develop a trading venue for digital assets. Fast forward four years, and 360X in collaboration with DekaBank, the securities services provider of the German Savings Banks Finance Group, and Union Investment, the German asset manager, completed the first secondary market trade of Siemens’ digital bond on a regulated venue.

In August this year 360X said in a statement that it had completed a secondary market transaction of Siemens’ one-year €300m digital bond, which was issued in 2024. The primary securities transaction was settled via the private permissioned blockchain of SWIAT, the German blockchain infrastructure provider, and the Trigger Solution provided by the Bundesbank, the German central bank. The Siemens bond was settled for the first time in a fully automated manner, within minutes and in central bank money.

Peter Rathgeb, group treasury at Siemens, said in a statement: “The inaugural secondary market trading of our tokenized bond is a key achievement for digital bonds. Enabling trading significantly enhances the appeal of our digital bond to investors, who now benefit from greater liquidity and flexibility in their portfolios.”

The multi-million euro trade was the first secondary transaction on a regulated trading venue of this landmark digital security, according to 360X, and bridges the gap between innovative DLT-based instruments and the operational requirements of institutional investors. 360X is overseen by German regulators, BaFin and Deutsche Bundesbank.

Michael Spitz, co-chief executive of 360X, told Markets Media that from the start of the company, it was clear that it had to be “rock-solid” from a regulatory and security perspective. His co-chief executive, Carlo Kölzer and his team founded 360T, the electronic foreign exchange trading platform, in Frankfurt in 2000.

“We’ve spent our first two and a half years establishing 360X as a security firm under German law,” Spitz added. “With great guidance from Deutsche Börse and Commerzbank, we built our technology with a clear goal and to meet the real-world requirements of our clients.”

360X runs three three separate fully regulated markets – the 360X MTF (multilateral trading facility) for transparent, order-driven trading; the specialized 360X DLT-MTF for native digital assets under the EU DLT Pilot Regime; and the 360X OTC desk for bilateral transactions which was used for the Siemens trade. Spitz said 360X is the first, and only, firm to receive the DLT MTF license.

“By also holding a traditional MTF license and supporting FIX protocols, we’ve built a platform that bridges the old with the new,” Spitz added.

The market is fragmented with traditional firms siloed from crypto-native ones, and vice versa, and Spitz explained that 360X wanted to solve this issue by catering to both types for clients as the firm believes the “future is hybrid.” Therefore, 360X provides trading for both digital securities and multiple asset classes in traditional finance – from equities to rates, credit, money market and private market.

“We’re not just supporting a new world, we provide the bridge to it,” said Spitz.

He said the firm is actively partnering with issuers and banks to help them get ahead of the curve.

Michael Spitz, 360X

“The transition to digital isn’t a single event—it’s a gradual process that’s already underway,” said Spitz. “We all need to prepare for a future where digital natives are the new standard.”

He argued that institutions that don’t invest in wallet connectivity for digital assets are missing the next wave of opportunity.

“This isn’t just about technology; it’s about being part of the conversation,” Spitz added. “Just as those who ignored digital photography were left behind, firms that aren’t on this journey won’t be able to shape the future of their industry.”

Settlement as a differentiator

Spitz claimed that 360X’s core differentiator is its agnostic approach to settlement, which ensures that clients have the flexibility to operate in any environment. The venue supports multiple types of settlement from traditional central securities depositories (CSDs), to bank-led mechanisms to emerging systems under the EU DLT Pilot Regime and a range of bespoke solutions like HSBC’s Orion, the bank’s digital assets platform.

He described 360X’s vision as “simple” – that clients should be able to buy a security and choose how to settle it either through a traditional custodian or a crypto wallet via the same ISIN, or security identifier. Eventually, these securities should be freely exchangeable between the two.

“We provide the bridge for firms without a crypto wallet and for those without a traditional custody account,” Spitz said. “We believe in hybrid capital markets.”

Users can buy and sell on 360X and the venue handles the complexity behind the scenes. For on-chain settlement, 360X uses an oracle to broadcast the trade confirmation across approximately 14 different blockchain networks, which Spitz said ensures seamless integration and a single source of truth for all transactions. An oracle is a third-party service that provides external, real-world data to smart contracts on a blockchain. 360X made a deliberate decision not to commit to a single blockchain and be chain-agnostic.

“Limiting ourselves to one would be like building an exchange that trades only Apple stock – it just wouldn’t work,” added Spitz. “We’re building for a future where choice and interoperability are standard.”

Clients of Deutsche Börse Group’s member section can connect to 360X with just a click of a button. Spitz said: “It was a real eye-opener for us – and them – just how much friction this removes.”

Global DLT bond issuance

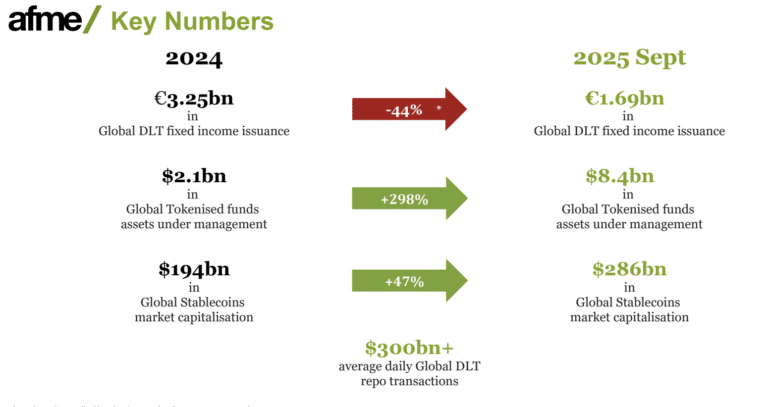

A total of €1.69bn in DLT-based fixed income instruments have been issued globally as of September 2025, according to a report from The Association for Financial Markets in Europe (AFME).

When annualised, this represents a 44% decrease compared to the 2024 full year issuance, which AFME said was primarily attributed to the conclusion of the ECB DLT trials in November last year.

Issuers based in Europe and Asia have led the market so far this year, originating €838m and €854m respectively. AFME said that in terms of issuance platforms, HSBC Orion and SIX Digital Exchange (SDX) held the largest market shares in 2025 year-to-date.

AFME continued that DLT bonds are predominantly held as buy-and- hold investments due to limited interoperability between DLT infrastructures, which has led to fragmented and illiquid secondary markets. Price discovery in the DLT bond market also remains constrained due to low trading volumes and observable pricing data is primarily available for instruments that are listed on traditional exchanges.

Despite these limitations, available data indicates that DLT bond yields generally align with those of comparable conventional instruments, according to AFME. In addition, instances of yield divergence have gradually narrowed over recent years.

James Kemp, managing director of technology and operations at AFME, said in a statement: “The rapid growth of DLT adoption in capital markets over the past six months — particularly driven by US dollar stablecoins and US Treasury funds —highlights the urgent need for Europe to be ambitious in developing DLT-based markets, including through policies and regulations that support scalable adoption.”