Sasha Mills, executive director of financial market infrastructure at Bank of England, said the UK central bank is well advanced in developing the detailed regulatory framework for stablecoins. A stablecoin is a type of cryptocurrency which aims to maintain a stable value by being pegged to another asset, typically the U.S. dollar.

Mills gave a keynote speech at AFME’s Operations, Post-Trade, Technology & Innovation conference (OPTIC) conference in Amsterdam on 8 October 2025.

Sasha Mills, Executive Director of Financial Market Infrastructure, @bankofengland, opens Day 2 with insights into resilience, supervision and innovation in the FMI sector #OPTIC2025 pic.twitter.com/6z5xt9ZLUa

— AFME (@AFME_EU) October 8, 2025

UK legislation gives the Bank of England powers to regulate systemic stablecoins, which Mills defined as those that may be widely used as money rather than only for non-systemic uses such as supporting crypto trading.

“We are now well advanced in developing the detailed regulatory framework, which will be forward-looking, setting out the standards stablecoins must meet to support responsible and sustainable innovation,” said Mills.

The regulation will reflect international standards and recommendations, such as those from the Committee on Payments and Market Infrastructures and the Financial Stability Board, the GENIUS Act, the first federal framework for stablecoins in the U.S.,the European Union’s MiCA regulation and Singapore’s stablecoin framework. Mills said the Bank will now allow systemic stablecoin issuers to hold a portion of their backing assets in a subset of high-quality liquid assets in central bank deposits.

“This means that we are prepared to provide the accounts and in effect be “the banker” to stablecoin issuers, which can further enhance trust in this new form of money and means stablecoin issuers need not rely on entities (commercial banks) with whom they are seeking to compete,” she added.

Stablecoins could potentially change market structures by weakening the link between money and credit creation, which in the UK is traditionally performed by banks, according to Mills.

“In the future, we could see more market-based finance instead, but this is unlikely to happen immediately,” said Mills. “In the meantime, applying holding limits to stablecoins could allow us to learn more about the potential impact on the cost and availability of credit, and mitigate the risk of a disorderly transition.”

The Bank’s proposals for regulating systemic stablecoins will be set out in a consultation paper later this year.

The Citi Institute said in a report in April this year that 2025 would be “blockchain’s ChatGPT moment” with stablecoins igniting the shift. In another report in September Citi Institute said “transformation is unfolding at remarkable pace.”

Stablecoin issuance volumes have grown $200bn since the start of 2025 to about $280bn, according to the report, and Citi said the passing of the GENIUS Act is a “game changer.”

The report said: “We are revising our stablecoin total issuance forecasts in this report to: $1.9 trillion base case (previously $1.6 trillion) and $4 trillion bull case ($3.7 trillion), due to the strong growth of the market in the past six months and the wide range of project announcements, in the U.S. and internationally.”

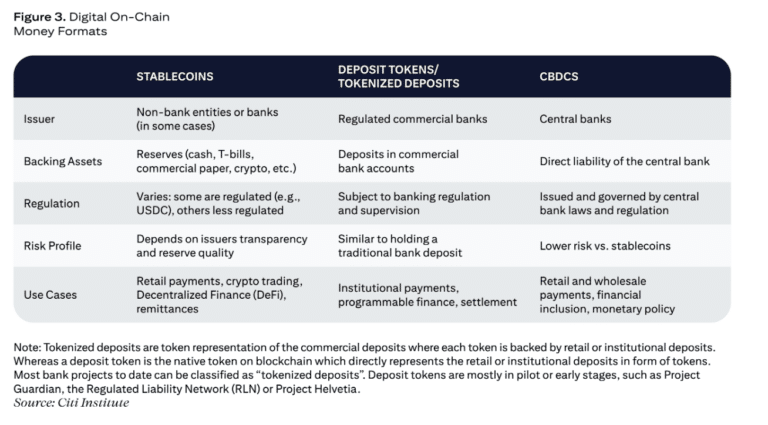

Citi is positive on the growth outlook for stablecoins, but believes they will co-exist with other on-chain money formats, especially bank tokens (tokenized deposits, deposit tokens, and hybrids). The bank predicted that the turnover of bank tokens could exceed stablecoins by 2030, even with a small shift of current traditional rails onchain.

In addition, the bank argued that growth of onchain money, particularly stablecoins, does not signal the end of traditional banking as innovation can often mean integration. For example, some large stablecoin issuers rely on regulated banks to safeguard their reserves, provide FX and cash management services.

Biswarup Chatterjee, global head partnerships & innovation at Citi Services, said in the report: “Stablecoins will only move to mainstream use when they can interoperate seamlessly with existing financial instruments and systems. Otherwise, they risk becoming like loyalty points – valuable in silos but never truly universal.”

Innovation in FMIs

Mills said we are at a “pivotal moment” in the evolution of the financial system due to the entrance of decentralised, disintermediated finance. Blockchains and decentralised ledgers offer the potential to fundamentally restructure the way the financial system operates, enhance transparency, and drive efficiencies in settlement, clearing, custody, and risk management but Mills also highlighted that they bring new risks.

In addition to distributed ledger technologies (DLT), Mills said artificial intelligence, machine learning and data-driven innovations also have the potential to optimise operations and build resilience.

“Not so many years ago DLT and smart contracts were new ideas, now they are coming of age,” she added. “But these ideas are not born in a vacuum. Existing regulations and processes exist.”

She emphasised that innovation in the heart of the financial system and needs robust risk management to ensure systems remain resilient and regulatory outcomes achieved.

In 2021 Bank of England introduced the Omnibus Account to support the settlement of tokenized assets backed in central bank money. In April this year, the UK central bank launched its renewed Real-Time Gross Settlement (RTGS) service, RT2, which aims to allow for the conditional settlement of funds in RTGS against a variety of assets including programmable, DLT-based ledgers. The renewed RTGS service will also offer enhanced functionalities to improve market efficiencies, such as extended settlement hours, according to Mills.

Mills said incumbent FMIs are also embracing innovation, such as the move towards a shorter settlement cycle of T+1, the day after a trade. One benefit is that firms and central counterparties (CCPs) face lower counterparty risks.

“I anticipate this will lead to significant amounts of margin being released by CCPs to members and their clients, perhaps in the order of £1bn according to our estimates – a significant sum which could be used by market participants for other productive purposes, supporting the UK economy,” she added.

The Bank of England is consulting on the regulatory regime for CCPs and will do the same for central securities depositories (CSDs).