Adena Friedman, chair and chief executive of Nasdaq, said the increasing institutional interest in digital assets is leading to opportunities across its whole franchise including trading, technology, surveillance and the index business.

In the third quarter, Nasdaq filed with the U.S. Securities and Exchange Commission for approval to use its existing trading infrastructure for equities and exchange-traded funds in both traditional and tokenized form.

Friedman said on the third quarter results call on 21 October 2025 that the firm’s proposal is for the underlying security itself to be tokenized, preserving investors’ rights and benefits of share ownership. She explained that an investor will be able to flag on an order-by-order basis if they want shares they are buying to be settled in a tokenized form into a digital wallet. The flag would then flow through Nasdaq’s systems into post-trade.

“We are working collaboratively with the DTCC to understand exactly how they would have two different settlement paths,” she said.

DTCC, the U.S central post-trade infrastructure, is looking to launch on a number of different blockchains, according Friedman. The digital wallet would be available to investors through their brokerage firm or investment manager to give them access to the securities in a way that might be more fungible in their overall investment portfolio, which may include other digital assets.

“We are tokenizing the underlying equity, not a derivative of the equity,” said Friedman. “We are not changing the overall settlement cycles as we walk into this.”

She highlighted that the benefits of tokenization include increasing the mobility of collateral, eventually reducing the settlement cycle and creating capital efficiencies if there is a more seamless global payment infrastructure.

Friedman continued that Nasdaq has been involved with the digital assets ecosystem for many years as a technology provider, and that business continues to grow.

“We definitely see our fintech solutions being highly relevant as the digital asset ecosystem expands and institutional interest in digital assets becomes more mainstream,” she added. “We’re very excited about what we do in terms of supporting markets around the world with trading and surveillance technology.”

Nasdaq has developed trade surveillance technology that is specific to crypto assets, and is working with the digital asset ecosystem on collateral management capabilities through its Calypso platform. A proof of concept was completed earlier this year with some digital asset players to help show that Nasdaq can use blockchain technology to manage collateral.

“We’re doing a lot to support infrastructure solutions as we think about the institutional adoption of digital assets,” she added.

In addition, Nasdaq has investable index products for crypto assets and also lists crypto index ETFs.

Friedman said: “We see ourselves as having a broad-based opportunity across our entire franchise. As a market operator, we’re encouraged by the fact that the SEC and CFTC are cooperating to think about the regulatory landscape for crypto markets.”

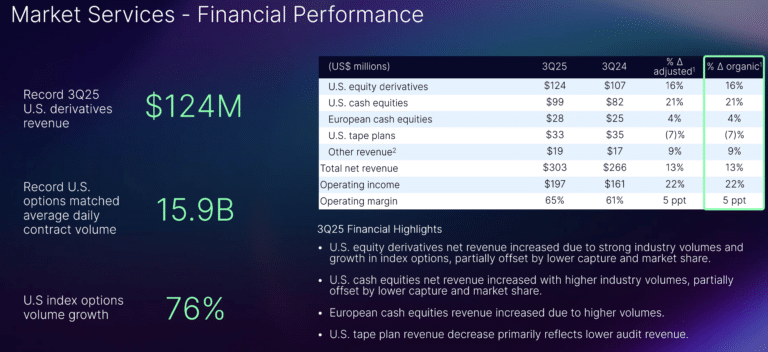

Market Services

Friedman said Market Services continues to deliver double-digit organic net revenue growth from elevated volumes in U.S. options and U.S. equities, as well as “excellent” growth in index options trading.

Market Services reported record revenues of $303m in the third quarter, boosted by record U.S. derivatives volumes. The industry had six of the 10 highest options volume days in history in the third quarter, with a subsequent record established in October. Index option volumes also hit record levels in the third quarter.

Friedman said U.S. cash equities had an “excellent” performance including Nasdaq’s Closing Cross setting a new daily notional value record in September.

“U.S. equities industry volumes remained robust during the summer months and have persisted into the fall,” she added. “Nasdaq-listed securities currently represent 53% of total industry volume, up from 49% a year ago.”

Operating companies raised $6bn in IPO proceeds in the third quarter, with over $14bn raised in the year to date.

“In the public markets, we see meaningful momentum, particularly among companies with strong fundamentals and compelling growth stories,” added Friedman.

She continued that from a macroeconomic perspective, global uncertainty is impacting certain sectors, resulting in some delays in IPOs. However, Friedman argued that this dynamic is balanced by several trends giving investors more confidence to invest in new issuances, including an expectation of lower cost of capital, the resilience of the U.S. economy and the deregulatory agenda in Washington

“Our IPO pipeline is robust, and we continue to expect a meaningful pickup and IPO activity in the quarters ahead,” said Friedman. “While we are experiencing some short-term delays from the government shutdown, a strengthening foundation is in place and the market is showing signs of durable re-engagement.”

Friedman added that she is pleased that the SEC recently approved the ability to file IPO documentation with mandatory arbitration, and is encouraged by the administration’s interest in reducing the frequency of SEC mandated disclosures.

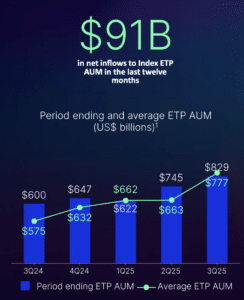

Index business

Index revenue of $206m in the third quarter increased 13% over the same period last year. The index business has had $91bn of net inflows over the trailing twelve months and $17bn in the third quarter.

Index exchange-traded product (ETP) assets under management reached a record $829bn at the end of the third quarter. Average ETP assets under management over the third quarter was also an all-time high of $777bn. Nasdaq launched 30 new Index products in the third quarter, including 18 international products and 13 in the institutional insurance annuity space.

Friedman said: “We also continue to deliver on our three growth pillars of product innovation, international expansion and institutional adoption.”

In the data business, Nasdaq is focusing efforts on enhancing investments capabilities and expanding its role across the broader investment management workload.

In September this year, Nasdaq Ventures invested in Juniper Square, which provides fund operations to more than 2,000 private markets GPs. Nasdaq and Juniper Square said in a statement they will establish a partnership which will explore ways to advance the development of integrated data and liquidity solutions for private fund managers.

“We’re expanding the scale and reach of our unique data assets to meet the evolving needs of our clients and to enhance the value that we bring to asset owners and asset managers, including in a private market space,” Friedman added.

AI

Friedman said Nasdaq continues to see durable demand for technology that supports the modernization of the financial system, and the firm is increasingly supporting clients with AI-enabled solutions.

She argued that Nasdaq is deepening its competitive position by providing value to clients through a combination of sophisticated solutions, highly differentiated proprietary data and the powerful network effects of its platforms.

Nasdaq Verafin, the anti-financial crime platform, launched its first digital worker earlier this month, the digital sanctions analyst, to address the resource-intensive pain points in daily compliance workflows. In the third quarter Goldman Sachs signed as a new Nasdaq Verifin client.

The business also announced a strategic partnership with BioCatch, integrating the behavioral and device intelligence alerts into its workflow. In August this year, the Commodity Futures Trading Commission said in a statement that it would be deploying Nasdaq’s suite of surveillance technology.

Caroline Pham, acting chairman of the CFTC, said: “Nasdaq Market Surveillance will, for the first time, provide the CFTC with automated alerts and cross-market analytics that will benefit each of the CFTC’s operating divisions and better protect our markets from fraud, manipulation and abuse.”

Financials

Sarah Youngwood, chief financial officer of Nasdaq, said on the call: “Nasdaq delivered an excellent third quarter performance with revenue growth across all three divisions driving robust earnings growth and generating more than $2bn in operating cash flow over the previous four quarters.”

Third quarter net revenue was $1.3bn, an increase of 11% over the same period in 2024.

Friedman said: “I’m pleased with Nasdaq’s excellent overall financial performance. Solutions quarterly revenues were over $1bn for the first time in our history, a milestone truly reflective of our transformation to a leading technology platform.”

Solutions revenue was $1.3bn in the third quarter. Annualized recurring revenue reached $3bn in a quarter for the first time, increasing 9% over the same period last year

Friedman added that Nasdaq remains on track to surpass $100m in run rate revenue from cross sells by the end of 2027.