CME Group said its new central limit order book (CLOB) for U.S. Treasury trading in Chicago has traded over $1bn of notional traded across all seven tenors since launching on 6 October 2025.

BrokerTec’s platform for benchmark cash U.S. Treasuries and U.S. and EU repo transactions set a single-day average daily notional volume record of $1.05 trillion across its dealer-to-dealer CLOB, dealer-to-client request-for-quote and streaming platforms in the first quarter of this year, according to CME.

The derivatives group reported in its third quarter results on 22 October 2025 that firms including Citigroup, J.P. Morgan and Morgan Stanley, were on board for CME’s launch of BrokerTec Chicago, and more than 25 firms have joined the new book including banks, proprietary firms and brokers.

In Chicago, clients can trade all seven of BrokerTec’s on-the-run benchmark U.S. Treasuries with quotes for the full curve for more than 90% of the trading day. Mike Dennis, global head of fixed income at CME, said on the call that this is the first time in the group’s history that its cash fixed income markets are side by side with its core futures and options markets.

Dennis added: “Two thirds of volume done has been at price points not available in the New York CLOB, which gives clients choice depending on their trading strategy and market conditions.”

Terry Duffy, chairman and chief executive of CME Group, said on the call: “Going forward, innovation will continue to be a key driver of our performance and our ability to serve clients in an increasingly complex and volatile global market.”

Duffy continued that CME remains focused on delivering efficiencies, new products and expanded access for market users, including its new partnership with prediction market FanDuel, 24/7 trading in its cryptocurrency futures and options and the extension of its cross-margin agreement with DTCC to enable increased margin savings to end users.

FanDuel partnership

In August this year CME announced a partnership with FanDuel to launch new products and expand access to financial markets for millions of customers of the U.S. online gaming company.

CME said: “Building upon our sixth consecutive quarter of double-digit year-on-year retail client acquisition growth, up 22% in the third quarter of 2025, we are partnering with FanDuel to develop an innovative event contracts offering.”

The companies will develop new fully funded, event-based contracts with defined risk which are expected to launch this year, and they will operate a non-clearing futures commission merchant (FCM). Customers will be able to express their views multiple times a day on a wide range of markets with simple “yes” or “no” positions for as little as $1.

The products will include benchmarks such as the S&P 500 and Nasdaq-100, prices of oil and gas, gold, cryptocurrencies, and key economic indicators such as GDP and CPI, with further details of additional offerings to be determined in the coming months, according to CME.

Duffy described CME’s retail strategy as vast, global and continuing. The partnership with FanDuel is about distribution and getting CME’s products in front of the retail community. All retail customers, whether or not they use FanDuel, will be able to trade the contracts, which are also open to all FCMs that want to provide access.

“The announcement with FanDuel is very important for CME,” he said. “We are looking at 13 million potential accounts that will have access to CMEs products, but more importantly, have access to having a view on CME.”

He compared the partnership with FanDuel to CME launching a bitcoin contract in 2017, which was met with scepticism.

“The credibility of our institution, which we protect mightily, is very important to the institutional participant who wants to also participate with retail in some of these newer asset classes,” Duffy added.

Duffy believes CME can work with, and partner, some of the new retail entrants, whether in prediction markets, gaming, or Robinhood and other retail brokers that are opening futures accounts.

He stressed CME would not be interested in events contacts which can be easily manipulated, as they would not meet the requirements of the Commodity Exchange Act. Duffy also emphasised that CME has no objection to listing sports events contracts, but only when they have been approved by the federal government.

Tim McCourt, global head of equities, FX and alternative products at CME, said on the call that the group has operational and technological scale for the new contracts.

“In our existing option complex, we have options in every asset class on every day of the week and the ability to meet customer demand for where they want to trade these events,” added McCourt. “We are well established in intra-day events.”

24/7 trading

CME has applied to the Commodity Futures Trading Commission to make crypto futures and options available to trade 24 hours a day, seven days a week, in early 2026. If approved, the contracts will trade continuously on CME’s technology platform Globex with at least a two-hour weekly maintenance period over the weekend.

Suzanne Sprague, chief operating officer and global head of clearing at CME, said on the call that the firm has partnered with Google on a tokenization initiative.

“We are progressing with our initial phase with Google of tokenizing cash through the end of this year and enabling that to go live in 2026,” she added.

Sunil Cutinho, chief information officer at CME Group, highlighted on the call that CME was the first exchange to operate for 23 hours every day of the week.

“We are just adding additional sessions over the weekend,” he added. “We are well positioned to do so, especially because of our investment in our Google transformation.”

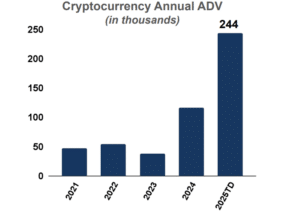

In the third quarter of this year, CME had record crypto average daily volume of 340,000 contracts, or $14.1bn notional, up over 225% relative to a year ago. Duffy said this growth was aided by the early success of Solana and XRP futures, which were launched this year. Options on these futures launched on 12 October 2025.

CME said: “The third quarter of 2025 marked a period of significant expansion and increased institutional involvement in the crypto market, solidifying its standing as a key asset class.”

Institutional demand was shown by a record number of 1,014 large open interest holders (LOIH) during the week of 16 September 2025.

Expanding cross-margining

CME has filed with the CFTC to expand its existing cross-margining agreement with DTCC, the U.S post-trade infrastructure.

The proposed enhancement will enable end user clients with positions at CME and the Government Securities Division of DTCC’s Fixed Income Clearing Corporation (FICC) to benefit from capital efficiencies when trading U.S. Treasury securities and CME’s interest rate futures that have offsetting risk exposures.

Volumes

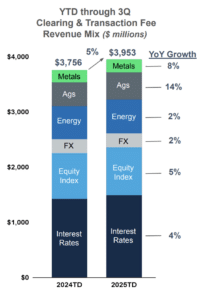

CME Group reported revenue of $1.5bn for the third quarter of this year, and operating income of $973m.

Duffy said the group achieved its second-highest average daily volume for the third quarter, as well as adjusted net income and adjusted earnings per share which were on par with last year’s “exceptionally strong” third quarter performance. Average daily volume in the third quarter of 25.3 million contracts was down 10% from a year ago.

At the end of September, open interest was 126 million contracts, up 6% from the end of the third quarter last year. Duffy said this was the highest open interest at the end of September in the last five years, and has continued to grow in October.

Duffy said: “FX Spot+, which was launched earlier this year and provides the benefits of futures capital efficiencies to spot market participants, set new volume records in every month in the third quarter.”

Non-U.S. average daily volume of 7.4 million contracts was the sixth highest on record for CME. The group said there was growth in metals, energy and agricultural products across Asia Pacific and growth in Latin America.

After the third quarter, CME announced the opening of a Dubai office which it said was fueled by “surging” institutional and retail participation in financial markets in the region and demand for broader trading access in the Middle East. CME’s third quarter average daily volume out in the United Arab Emirates rose 9% year-on-year.

Lynne Fitzpatrick, president and chief financial officer of CME, said on the call: “Market data reached a record level delivering over 200m in quarterly revenue for the first time, up 14% to $203m.”