J.P. Morgan Asset Management and State Street Investment Management have become the latest traditional financial institutions to launch tokenized funds as institutional adoption is expected to snowball in 2026.

Kelly Mathieson, chief business development officer at blockchain technology provider Digital Asset, said in an email to Markets Media: “As 2025 draws to a close, institutional finance has reached a defining moment in its relationship with blockchain. What was once an experiment outside of general operations has now become a strategic imperative.”

She added that large asset managers, banks and trading firms have enacted real financial activity onchain for its operational efficiency, settlement ability and round-the-clock operations that traditional infrastructure cannot match.

J.P. Morgan Asset Management

On 15 December 2025, J.P. Morgan Asset Management said in a statement that it had launched its first tokenized money market fund. MONY (My OnChain Net Yield Fund) was issued on the public Ethereum blockchain via Kinexys Digital Assets, the firm’s multi-chain asset tokenization platform, to increase the speed and efficiency of transactions and add new capabilities to traditional products.

J.P. Morgan is the largest GSIB (global systemically important bank) to launch a tokenized money market fund on a public blockchain according to the statement.

John Donohue, head of global liquidity at J.P. Morgan Asset Management, said in a statement: “We are excited to be a first mover with the launch of MONY, and we expect other GSIB banks to follow our lead in providing clients with greater optionality in how they invest in money market funds.”

Morgan Money is also the first institutional liquidity trading platform to integrate traditional and onchain assets according to the statement. Qualified investors can access MONY exclusively through the Morgan Money platform, receiving tokens at their blockchain addresses. MONY invests only in traditional U.S. Treasury securities, and repurchase agreements fully collateralized by U.S. Treasury securities.

State Street Investment Management

On 10 December 2025, State Street Investment Management and digital asset firm Galaxy Asset Management, said in a statement that they were launching a tokenized private liquidity fund.

The State Street Galaxy Onchain Liquidity Sweep Fund (SWEEP) will unlock the potential for 24/7 onchain liquidity by using PYUSD stablecoins, issued for PayPal, for subscriptions and redemptions. SWEEP will be powered by Galaxy’s Digital infrastructure which will provide the tokenization and security infrastructure.

Kim Hochfeld, global head of cash and digital assets for State Street Investment Management, said in a statement: “We’re beginning to see what’s possible when TradFi and DeFi sector players unite – and it’s increasingly clear that joint efforts like this stand to have a far-reaching impact on the future of asset management and capital markets.”

The fund is slated to debut on the Solana blockchain in early 2026. Ondo Finance, which designs institutional-grade platforms, assets, and infrastructure to bring financial markets onchain., is anticipated to seed the fund with approximately $200m.

Ian De Bode, president of Ondo Finance, said in a statement: “Tokenization is rapidly becoming the connective tissue between traditional finance and the onchain economy, and SWEEP represents a major leap forward in that evolution.”

Security Token Group said in a newsletter that companies need onchain vehicles that are similar to traditional, liquid options they have offchain for treasury management. SWEEP allows qualified purchasers to trade in and out of the fund at any time using a stablecoin.

“State Street being one of the largest global custodians, Galaxy a leading onchain asset manager, and Paxos’ national bank charter conversion together brings an increased level of legitimacy to this kind of asset which raises the question: Who will be the first non-crypto company to use it and expand their around-the-clock treasury management capabilities?,” added the newsletter.

Mathieson said: “As 2026 sees institutional adoption snowball, onchain systems will continue to be integrated into everyday operations.”

Growth of tokenization

@theRWAguy highlighted on X that three of the largest five asset managers have tokenized funds: BlackRock, Fidelity Investments and State Street Investment Management. He said: “Institutional adoption, regulatory shifts, and new cash rails point to 2026 as the year of acceleration.”

💥 Excited to share my piece for @CoinDesk spotlighting what became the breakout tokenization asset class of 2025: Tokenized Money Market Fund👇

Tokenized MMFs emerged as the clear winner this year:

1️⃣ The market grew more than 110% from $4B at start of the year to $9B YTD

2️⃣…

— theRWAguy (@theRWAguy) December 12, 2025

JPMorgan just launched a $100M tokenized money market fund on Ethereum.

The fund (MONY) is JPMorgan Asset Management’s first fully tokenized cash product, allowing qualified investors to hold tokenized fund shares on-chain, with subscriptions and redemptions via cash or USDC.… pic.twitter.com/RN1sGzAXV1

— Asva Capital (@asvacapital) December 15, 2025

Asva Capital, a digital asset investment & advisory firm, said on X:

“Why this matters

Traditional cash products are moving on-chain, not just pilots.

Investors can subscribe and redeem using cash or USDC while earning daily yield.

Regulatory clarity from the GENIUS Act and Clarity Act is accelerating institutional adoption.

Tokenized money-market funds solve a key problem: idle stablecoins earning zero yield.

This comes as the tokenized RWA market hits ~$38B, with Ethereum hosting the majority of on-chain funds. BlackRock’s BUIDL ($1.8B+ AUM), Amundi, Goldman Sachs, and BNY Mellon are all moving in the same direction.

The signal is clear: Tokenization is becoming core financial infrastructure—not a crypto experiment.”

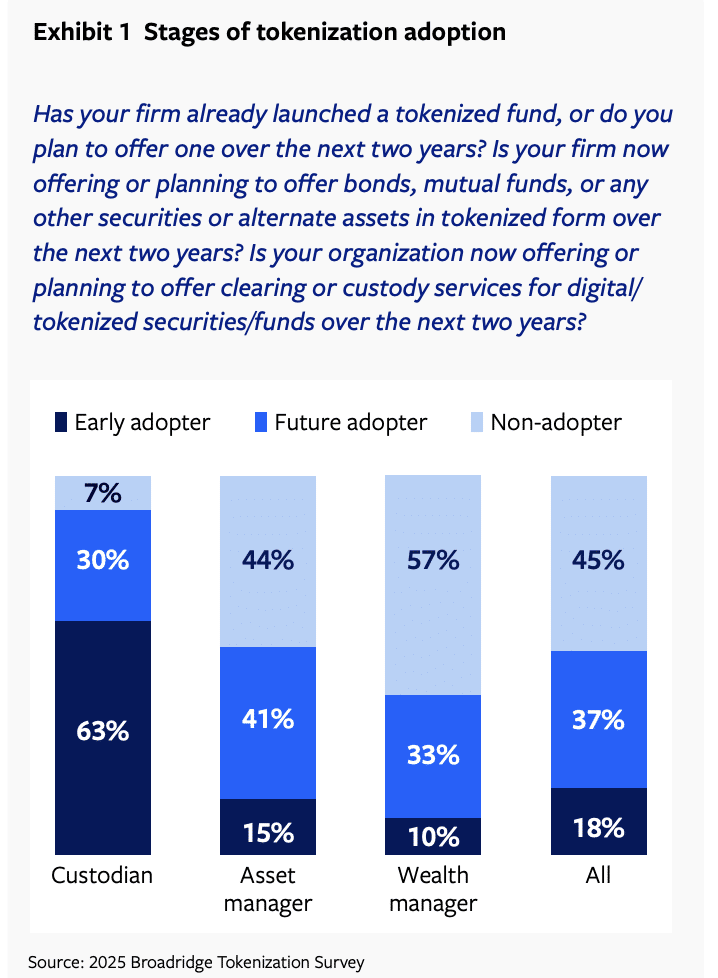

Fintech Broadridge said in a survey in October this year that tokenization is in its early stages. However, financial institutions view tokenization as one of the most significant structural shifts for global capital markets with the potential to change how financial products are structured, distributed and serviced.

“Long-term projections vary, but industry reports indicate that tokenized assets could represent $10 trillion to $16 trillion in value by 2030, with the bulk of growth expected to come from private markets, treasuries, and fund tokenization,” added Broadridge.

Broadridge’s survey found that 15% of asset managers currently offer tokenized funds but 41% plan to introduce them soon. One tenth of wealth managers are actively involved in tokenization but one third, 33%, anticipate entering the tokenized market in the near term.

In addition to tokenized money market funds, Broadrisdge highlighted that Hamilton Lane, Apollo Global Management and KKR have all tokenized private asset funds to increase transparency, automation and democratize access. For example, feeder funds for private equity can be digitized and distributed globally with lower entry points and private credit funds can use smart contracts to streamline coupon payments, NAV (net asset value) calculations, and compliance reporting.