Columbia Threadneedle Investments has become the latest U.S asset manager to offer active exchange-traded funds in Europe, after assets in active ETFs reached a record in 2025.

State Street said in a statement on 8 January 2026 that it was the service provider for Columbia Threadneedle Investments’s newly launched QR (Quant Redefined) series of UCITS actively-managed ETFs.

The series builds on Columbia Threadneedle’s US ETF range. The launch in Europe begins with the US and European Equity Active ETFs, with global and emerging markets to follow. Columbia Threadneedle said in a statement that the QR Funds are powered by the scale and efficiency of the asset manager’s proprietary quantitative research and informed by real-time insights from the global fundamental research team of more than 200 analysts. The ETFs are designed to be core active equity allocations in clients’ portfolios.

Michaela Collet Jackson, head of Distribution, EMEA, at Columbia Threadneedle, said in a statement: “This is an important moment for Columbia Threadneedle as we execute our growth strategy. Expanding our Active ETFs offering to Europe is a natural evolution of our global product strategy, leveraging our proven US track record to meet growing client demand for transparent, cost-efficient and truly active solutions.”

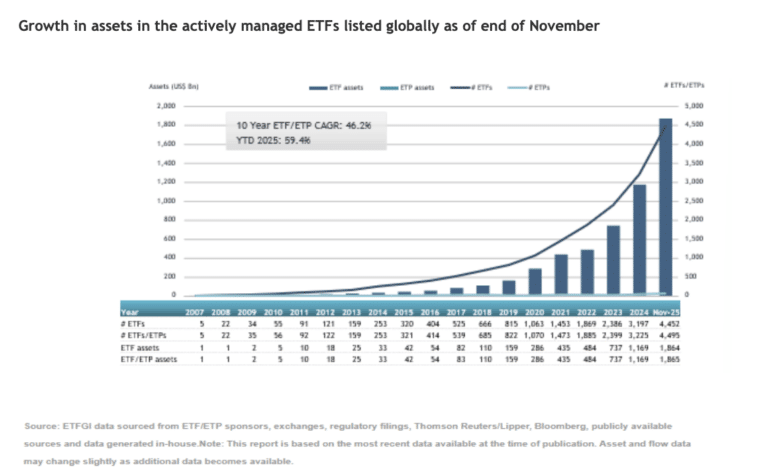

Assets invested in actively managed ETFs listed globally reached a new record of $1.86 trillion at the end of November last year according to ETFGI, an independent research and consultancy firm. Net inflows in the first 11 months of last year were also a record $581.25bn, beating $331.8 bn in 2024 over the same period.

Dimensional was the largest active ETF provider globally with $250.1bn in assets, representing 13.4% market share, according to ETFGI. JP Morgan Asset Management was second with $244.3bn and 13.1%, followed by BlackRock’s iShares with $111.4bn and 6.0%. There three providers account for 32.5% of global active ETF assets, while the remaining 643 providers each hold less than 6% market share.

Michael Mohr, global head of Xtrackers products at DWS, said in an email that the active ETF market will continue to grow. Xtrackers is the ETF franchise of Germany’s DWS Group. Deutsche Bank spun off DWS in 2018. The firm is listed on the Frankfurt Stock Exchange as an independent company, but is still majority-owned by the bank.

“We are seeing a large number of new providers entering the market,” added Mohr. “In addition to traditional ETF providers, these include previously purely active managers, US asset managers, and even completely new companies.”

Professional fund investors and asset managers have been the main users of active ETFs but Mohr expects private clients and independent decision-makers to become increasingly interested in the funds.

However, he also predicted that growth in passive strategies will continue as record inflows of recent years show they have become firmly established among private and institutional investors.

“This trend will continue to grow, particularly in Europe, and I am therefore generally optimistic about the ETF landscape in 2026,” said Mohr. “The ETF landscape is now so diversified that investors have virtually unlimited opportunities to target different market segments and themes.”

He expects to see the highest inflows in major categories such as global equities from developed markets or individual themes.

“On the product side, I expect the differentiation mentioned above to continue, for example through further types of active ETFs or structures that offer attractive opportunities even in volatile market phases,” added Mohr.