SIX is integrating its separate clearing houses in Switzerland and Spain to create a single multi-asset clearer that will allow the group to compete for higher margin business.

In December 2025 the Swiss exchange group operator said in a statement that it was going to integrate SIX x-clear in Switzerland and BME Clearing in Spain. SIX acquired Spanish stock exchange operator, Bolsas y Mercados Españole, in 2020 for €2.8bn.

The new clearing house, SIX Clearing, will be headquartered in Madrid with presences in Zurich and Oslo. The combined CCP will bring together SIX x-clear’s interoperable pan-European cash equity model, which covers 28 venues and 18 European markets, with BME Clearing’s multi-asset capabilities.

Laura Bayley, head clearing services at SIX, told Markets Media: “Cash equities is a low-margin business, but the new clearer will allow us to enter the higher margin derivatives business.”

Last year SIX also integrated the clearing business of Baymarkets, following the acquisition of the Oslo-based firm in November. Baymarkets’ clearing platform supports both exchange-traded and OTC markets. SIX said Baymarkets’ platform offers a scalable and proven clearing system with a robust risk model for multiple currencies and asset classes.

Bayley argued that as a result SIX can bring significant efficiency to the market, which will result in lower fees for clients.

SIX x-clear and BME Clearing currently collaborate but maintain separate legal entities and systems. The aim is to form one legal entity by the end of 2026, according to Bayley, with the new clearing house launching in the first quarter of 2017. This will give the group a six-month buffer before the European Union, UK and Switzerland are due to move to a shorter settlement cycle of T+1, the day after a trade, in October 2027.

Bayley said: “The technical lift will be as small as possible for clients. A big target for 2026 will be helping clients to get ready.”

BME Clearing’s existing European license will give the new clearer access to European Central Bank euro liquidity, T2 and T2S, the EU settlement infrastructure, and other EU relevant regulated markets and trading venues.

Rafael Moral Santiago, head securities services, SIX, said in a statement: “With the EU license, we are in a position to become the leading provider of integrated and digital post-trade solutions for the European market and compete internationally with a unique value proposition.”

European post-trade fragmentation

SIX said it will continue to champion and promote the adoption of interoperability across Europe to enhance efficiency in European financial markets. Fragmented European capital markets infrastructure impedes capital formation, reduces liquidity, escalates costs and lowers efficiency according to a report from the Citi Institute.

The study, Reimagining European Capital Markets: From Fragmentation to Harmonization, said capital market fragmentation in Europe has contributed to a capital formation gap with the U.S .

Between 2020 and 2025, the value of IPOs in EU was 0.6% as a percentage of GDP compared with 2.1% for the U.S., according to the report. The proportion of European IPOs listing in the U.S. has tripled since 2015 to 22% of all IPOs by European companies by value.

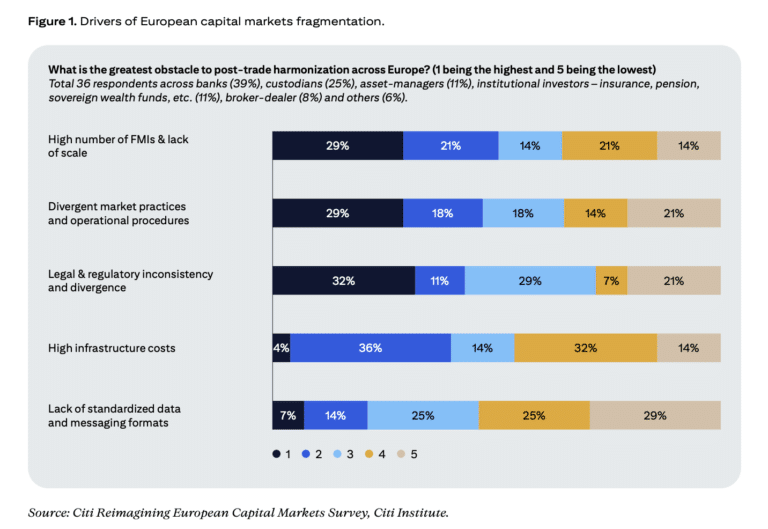

Half of respondents in Citi Institute’s survey cited the high number of financial market infrastructures (FMIs) in Europe as a key factor driving capital markets fragmentation. The European post-trade landscape consists of 29 distinct markets (EU, the UK and Switzerland), with 36 central securities depositories (CSDs) and 13 central counterparties (CCPs). Half of respondents to Citi Institute’s believe Europe has too many FMIs and there is a lack of scale.

“The existing FMIs (CSDs and CCPs) frequently operate in the interest of their shareholders, rather than primarily serving the end investor,” added the report. “The focus could switch to greater integration and harmonization between a reduced number of CSDs and clearing houses to potentially enhance choice, price efficiency and increase competitiveness.”