The majority of trading volume on OTC Markets Group originated from European cross-traded securities in 2025 and the U.S operator of regulated markets for local and international securities also had “exponential” growth in non-U.S. listings.

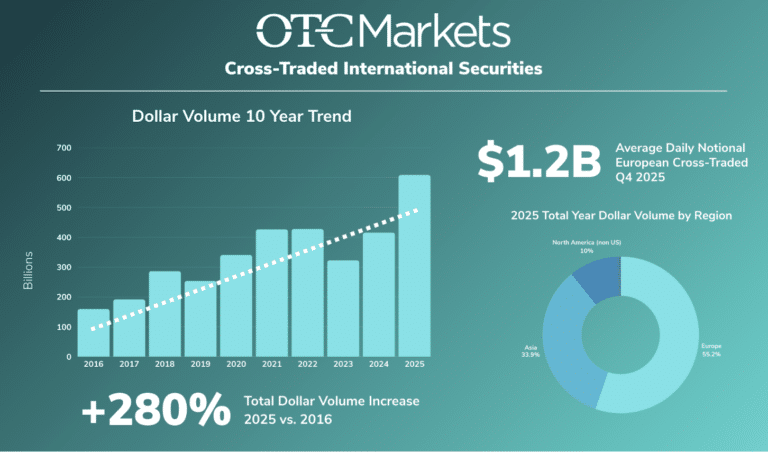

In a blog, OTC Markets Group said overall dollar volume grew 44.5% year-on-year in 2025 and cross-traded international securities grew by 46.7% to reach $609bn.

“In 2025, 55% of the dollar volume originated from European cross-traded securities, and the average daily notional for European cross-traded securities was $1.2bn in Q4 alone,” added the blog.

Jason Paltrowitz, OTC Markets executive vice president of corporate services, told Markets Media that the growth of non-US listings was a highlight during 2025.

“Last year saw the explosion of global brands seeing the value of our market and the economic ecosystem, and wanting to embrace access to U.S. investors and capital in a more efficient way,” he added. “The growth was exponential.”

For example, in July 2025 Singapore Exchange (SGX), the multi-asset venue for equities, fixed income, currency and commodity markets, began trading on the OTCQX Best Market. Companies have to meet high financial standards, follow best practice corporate governance and demonstrate compliance with applicable securities laws.

Daniel Koh, chief financial officer of SGX Group, said in a statement: “As SGX expands its footprint in the U.S., with a rising share of our derivatives products traded during U.S. and European hours, we’ve seen growing interest from U.S.-based investors.

To boost its presence in Asia, the firm is opening an office in Hong Kong, which Paltrowitz said will be a big focus for this year.

From Europe, companies including Aviva, the U.K. insurer, and London Stock Exchange Group chose the OTCQX Market in 2025. New clients included Intesa Sanpaolo, the Italian financial services group and French bank Société Générale.

OTC Markets operates a “List Local. Trade Global” strategy where companies maintain their home listings while enabling U.S. investors to trade through U.S. brokers in U.S. dollars. This provides seamless market access without the complexity or cost of a traditional U.S. exchange listing.

Paltrowitz said: “Some really global brands listed which was big for us, and that trickled down into small and medium-sized enterprise space as well.

Overall, close to 450 non-U.S. companies listed on the OTC Markets Group’s markets, according to Paltrowitz. On 2 January 2026 Tesco, the U.K supermarket chain, qualified to trade on the OTCQX Best Market, after being upgraded from the Pink Limited Market.

“Upgrading to the OTCQX Market is an important step for companies seeking to provide transparent trading for their U.S. investors,” said OTCM. “For companies listed on a qualified international exchange, streamlined market standards enable them to utilize their home market reporting to make their information available in the U.S.”

There have been concerns that it has become too difficult for smaller companies to go public, especially in Europe. Paltrowitz said OTC Markets made “great strides” in building relationships with the largest exchanges across the region in order to address this challenge, which will be a continuing focus.

For example, in July last year OTC Markets joined Deutsche Börse’s Capital Markets Partner network and OTCM wants to replica this with other exchanges.

“Our pitch is that these smaller companies can raise the IPO capital in their home market but we can provide the secondary market liquidity,” he said.

He continued this will help those companies be national champions at home, but also benefit from the U.S. self-directed investor being the biggest pool of capital with appetite to buy into pre-revenue, early-stage growth companies so “everybody wins.”

Overnight trading

Paltrowitz said another highlight was the group’s MOON ATS trading venue, which launched in November 2024 to provide access to National Market System (NMS) securities listed on major exchanges during the overnight session.

He argued that a differentiator for MOON ATS, compared to other venues for overnight trading, is that OTC Markets Group is one of the first ATS operators offering broker-dealer subscribers the ability to trade both over-the-counter (OTC) equity and exchange-listed NMS securities. Eligible NMS securities are available for trading from 8 PM to 4 AM Eastern Time, Sunday to Thursday, giving access to Asian retailer investors during their day time trading hours.

“A lot of our growth is coming out of Asia,” added Paltrowitz. “Asian retail investors can buy global brands using our markets in their daytime and using one currency.”

Previously, Asian investors would have needed to use sterling, euros or Swiss francs to buy stocks in the U.K, the European Union and Switzerland, respectively.

National U.S exchanges have filled for regulatory approval to launch 24×5 trading, but Paltrowitz maintained that Moon has a first mover advantage as an ATS (alternative trading system), and can be more agile.

When the U.S. exchanges get regulatory approval for 24-hour trading, Paltrowitz believes they will be competing for the NMS book of business.

“We will have already grown a book of business and we have the overlay of OTC securities that the others don’t have,” he added.

Tokenization

Nasdaq and NYSE have also applied to trade tokenized securities and Paltrowitz said the firm believes tokenization is the future. However, when he speaks to issuers they are worried about platforms creating unregulated tokens of their stock in various structures, which could harm investors.

“It has to be done in a regulated way, where issuers have a platform to provide disclosure so investors can make informed investment decisions on tokens,” he added.

As OTCM is an inter-dealer quotation system that connects every U.S. market, Paltrowitz said the firm could be uniquely positioned to be the platform to tokenize these securities.

“We see tokenization as an opportunity,” he added. “We are working to make sure that when and if this happens, we have the connectivity and technology to facilitate trading.”