High-frequency trading has become something of a litmus test for market participants, as one’s stance can be the sole factor in rendering judgment, superseding other, and possibly, more relevant evidence.

The reality is that HFT is neither black nor while, and many of the opinions that have been expressed on it are tinged with bias.

“Much of the narrative on high-frequency trading stems from a lack of understanding of what the group really does,” Christian Zarcu, CEO of TradeDynamiX, a provider of analytics for equities, options and FX, told Markets Media. “People have a tendency to wrap high-frequency trading into one group, which is not a good idea in my opinion. There are definitely some folks out there who try to take advantage, but for the most part I think the high-frequency community is trying to provide a service.”

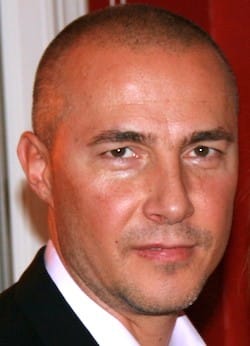

Cristian Zarcu, TradeDynamiX

This is not to say that vigilance isn’t required from the market and regulators. “We’re seeing changes in high-frequency strategies, which is not necessarily unexpected because they don’t last very long,” said Zarcu. “The questionable behavior has slowed down with all the noise in the market related to high-frequency trading since Flash Boys. There is definitely a bit of reticence on their part to do all the things they used to do prior to the book.”

In her June 5 speech, SEC chair Mary Jo White said: “The SEC should not roll back the technology clock or prohibit algorithmic trading, but we are assessing the extent to which specific elements of the computer-driven trading environment may be working against investors rather than for them.”

“I think she’s taking a pretty tough stance compared to previous people at the SEC, but we’ll see what they actually end up doing,” said Zarcu. “Folks are already overwhelmed by the amount of regulation that’s come their way, and now there’s this. Most large banks are somewhat under-invested when it comes to technology for compliance, and they are a little overwhelmed. So until they hear from the SEC that they really need to move on this, they’re reticent to put any resources there.”

In her speech, which focused on equity market structure, White included several proposals for HFT alone: an anti-disruptive trading rule; a rule to clarify the status of unregistered active proprietary traders; a rule eliminating an exception from Finra membership requirements for dealers that trade in off-exchange venues; enhanced regulatory oversight of trading algorithms; minimizing consolidated data latency; time stamps in the consolidated data feeds for trade orders and executions; and disclosures by exchanges on how they are using data feeds.

“Clients are trying to get prepared for what regulators might pass, so we’re seeing a lot of interest in people understanding behaviors in the marketplace related specifically to high frequency trading, including patterns they engage in and potentially questionable behavior,” Zarcu said. “I would love to see the industry do something about it themselves. I’d love to see Finra come out with some requirements on surveillance, but I’m not sure that that’s going to happen.”

Feature image via Rawpixel/Dollar Photo Stock