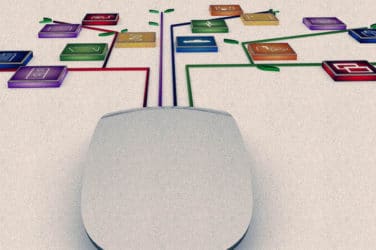

Global Debt Registry, a leading provider of distributed ledger technology for the digital structured credit ecosystem, announced today the company now has over one million registered assets across its distributed ledger platform, including consumer, small business and student loans.

Leading digital lenders continue to increase the number of assets recorded on the platform, and the company is building out its infrastructure to support continued growth. The company is moving the head office to a larger location at 300 Park Avenue to accommodate additional staff hires.

Global Debt Registry is working to develop new products and features across the company to create new market efficiencies. GDR’s current product director Patrick Dietz has been promoted to Head of Product Strategy to lead these efforts. These new products will complement ePledge, the firm’s independent, systemic management tool for collateral pledge risk. ePledge serves as the foundational asset record on the GDR distributed ledger platform to ensure a single, immutable, accurate pledge position across industry participants to reduce errors and operational risk. Christine Stern has been hired to manage and develop GDR’s ePledge product offering as adoption in the market accelerates. Stern has expertise in delivering innovative new products dealing with loan-level data in her previous positions at Orchard Platform and Caliber Home Loans.

“We increasingly see the market validating our approach for improving efficiency via digital structured credit. A phased approach to the digitization of these assets is enabling participation and benefits across the credit ecosystem,” said Charlie Moore, CEO of Global Debt Registry. “We look forward to our digital ledger platform and related tools playing an important role in bringing efficiencies across the market through digital structured credit as it becomes the industry system of record.”

Global Debt Registry launched its platform based on the IBM Blockchain in 2018 and has seen rapid growth in the asset-backed securities (ABS) market from major banks and loan providers as more organizations test, connect and register their assets. The company will be meeting with clients and partners the Structured Finance Industry Group conference in Las Vegas, which will be held from February 24 to 27. Moore will be answering questions at the Blockchain Roundtable at 3:55 p.m. on February 26 onsite.

The GDR website has also moved to gdr.co, a simpler, more convenient domain name for clients.