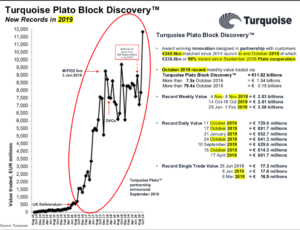

Turquoise Plato has been recognised by regulators in Hong Kong and Dubai as the London Stock Exchange Group’s multilateral trading facility has set records for daily, weekly and monthly value traded.

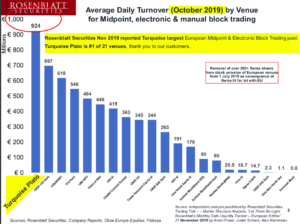

Dr Robert Barnes, global head of primary markets and chief executive of Turquoise at the London Stock Exchange Group, told Markets Media: “Turquoise Plato Block Discovery has had phenomenal growth thanks to the whole community and despite the removal of 200 Swiss symbols from 1 July this year.”

The European Commission had granted temporary equivalence for stock markets to Switzerland in December 2017, which was extended to 30 June 2019. When equivalence ended Swiss shares were removed from trading on European Union venues.

Turquoise Plato Block Discovery continues to go from strength to strength and 2019 has been a record breaking year. It was great to mark it yesterday! https://t.co/eGCPmlhJys

— Plato Partnership (@PlatoMarkets) November 20, 2019

Barnes said: “Turquoise Plato achieved all-time daily, weekly and monthly value traded records in October and we have continued to set a new weekly record in November.”

Plato Partnership is the not-for-profit industry group representing asset managers and broker dealers which aims to improve market structure and achieve better results for end-investors. In 2016 Plato announced the creation of Turquoise Plato which brought together the buy side, sell side and a trading venue for the first time in a formal agreement in order to increase efficiencies and reduce costs in anonymous European equity block trading.

Turquoise rebranded its dark trading venue as Turquoise Plato and the two partners agreed to jointly promote the service and co-develop anonymous European equity block trading services

“Post MiFID II, Turquoise Plato Block Discovery trade averages in blue-chips are usually above €1.2m per trade and we routinely see individual trades of €15m and more,” added Barnes.

The MiFID II regulations went live in the European Union at the start of last year and include thresholds for large-in-scale trading and caps on volumes of trading in dark pools with the aim of shifting volume to lit venues.

Lit auctions

Periodic auctions have grown in volumes since MiFID II went live. They are different from the traditional opening and closing auctions on exchanges as they can last for very short periods of time during the trading day and can be triggered by market participants, rather than the venue. They are considered to be lit trades under MiFID II, as the indicative matched size is published prior to execution.

Barnes said: “Turquoise Plato Lit Auctions now have many examples of unique liquidity, from small trades in AIM stocks to large trades in blue chips. Very large trades are benefitting from lack of signalling and evidenced with execution price being close to the arrival price.”

The European Securities and Markets Authority issued a call for evidence on periodic auctions in November last year as the regulator said there are concerns that frequent batch auctions may be used to circumvent the double volume caps on dark trading.

“Esma issued its opinion on changes required for frequent batch on 4 October and we decided to implement their recommendations straight away in Turquoise Plato Lit Auctions,” added Barnes. “We are confident that quality will remain high and users can continue to use the service without any detriment.”

He continued that the behaviour of market participants has changed as they realise that Turquoise Plato can provide a unique liquidity profile with great fill rates.

“One broker put an order of €100m in Turquoise Plato Block Discovery and at the same time, €50m in Turquoise Plato Lit Auctions,” said Barnes.

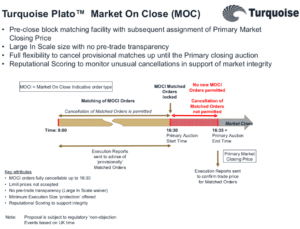

New closing order

Turquoise Plato Market-On-Close and Trade at Last are due to launch next year to allow clients to get the primary closing price, without affecting price formation.

“The closing auction is a beautiful jewel of a liquidity event,” Barnes added. “Clients requested that Turquoise introduce an order type to match the primary closing auction price.”

He continued that Market-On-Close is very simple to implement and avoids further fragmenting the market with a new order book.

“We have been in consultation with the buy-side since September, and based on their feedback, the new order type gives clients the flexibility to pull orders before the close,” said Barnes.

Clients also also have 10 minutes between 4.35 and 4.45 in the UK to access the closing price across Europe.

Looking ahead to next year Barnes said the clear message from clients is that they want more of the same.

“Turquoise Plato has been recognised by regulators in Hong Kong and Dubai so that will raise visibility in other countries,” he added.

The exchange’s visibility has increased in China since the launch of Shanghai-London Stock Connect.

Congratulations, Huatai Securities as 1st issuer to list via Shanghai Segment on London Stock Exchange – investors can now trade Huatai Securities via @LSEplc @tradeturquoise. pic.twitter.com/YI8rucAlO8

— Trade Turquoise (@tradeturquoise) June 25, 2019

Stock Connect allows established Chinese issuers to raise capital in London while UK-listed issuers can access Chinese domestic markets. It is the first fungible cross-listing mechanism enabling international investors to access China A-shares from outside Greater China. Huatai Securities became the first issuer to list global depository receipts on the Shanghai Segment of London Stock Exchange when it raised $1.54bn (€1.37bn).

“Huatai Securities issued GDRs through Shanghai-London Stock Connect in June and and had a fungibility event in October enabling conversion of London GDRs into the same underlying class of China A Shares, which has led to a narrowing of the discount,” added Barnes. “On Shanghai-London Stock Connect, investors can trade exposure to A-shares using mechanisms that are not available in Asia.”