The Bank of England said post‐trade processes that support fixed income, currency and commodities markets are complex, costly and inefficient and has launched a one-year task force to encourage market reform.

The UK central bank said in a report, The Future of Post-Trade: Findings from the Post-Trade Technology Market Practitioner Panel, that financial firms have traditionally invested in front office technology, such as electronic trading. However, many post-trade activities still rely on a patchwork of manual or outdated technological processes.

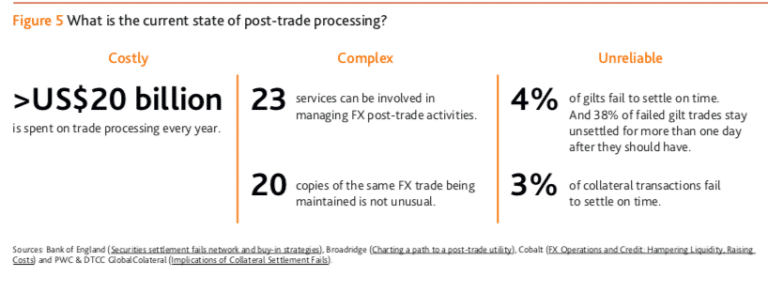

As a result the industry spends billions of dollars on inefficient post-trade processing.

Mark Carney, former governor of the Bank of England, last year set a priority of using new technologies to improve the resilience of the overall system. As a result the bank set up the Post-Trade Technology Market Practitioner Panel which met throughout last year.

Andrew Hauser, executive director for markets at the Bank of England and chair of the panel, said in the report that inefficient post-trade processes raise the cost of financial services.

“It holds back innovation — because post-trade services provide the bedrock and data on which ‘front end’ services are built,” he added. “Aged, slow or incompatible systems can pose real risks to operational resilience: an issue of great importance to firms and regulators, as we have been so vividly reminded in recent months.”

Data standards

The panel said two important contributors to post-trade inefficiency are varying standards in the quality and accuracy of data; and different approaches to processes across firms.

Improving the standard, accuracy, and timely exchange of non-economic trade data could reduce errors.

In addition, multiple copies of the same trade data are maintained across firms, and automated interfaces for data exchange are underdeveloped.

“The panel also identified a need for data to be exchanged earlier in the trade life cycle in order to reduce downstream challenges around reconciliation and exception management,” said the report. “Finally, the panel identified a small number of cases where new standards would be beneficial.”

ICYMI: we’ve published a report about post-trade in Fixed Income, Currency and Commodity (FICC) markets. The report includes our plans for further work aimed at catalysing reform in post-trade https://t.co/m4kEa39DvE

— Bank of England Press Office (@BoE_PressOffice) June 2, 2020

Uncleared margins

One area highlighted was the panel was uncleared margin and collateral related processes.

“Non-standard processes hold back automated processing — leading to operational risks and to disputes, which are often dealt with via protracted bilateral communications (often over email),” said the report.

The panel noted that market-led initiatives have helped to standardise the calculation of initial margin and streamline dispute resolution processes for uncleared products, but gaps still remain.

“These range from the ISDA SIMM to LCH SwapAgent to solutions provided by AcadiaSoft, Cloud Margin, triCalculate and the Margin Trust Utility,” said the study.

Post-Trade Task Force.

The bank is setting up a task force which will aim to make progress on the panel’s recommendations; review ongoing initiatives in post-trade and feed into a Bank of England consultation on transforming regulatory data collection from the UK financial sector.

The report said: “The Bank of England recognises it has a unique position as an independent and trusted third party and can play an important role in convening market participants to catalyse market-led reform.”

The Bank of England and Financial Conduct Authority will therefore be observers on the task force.

Covid-19

Hauser said in the report that the Covid-19 pandemic has underlined the importance of technology in ensuring the continued functioning of markets during times of crisis.

“Technology has helped keep markets open and has enabled market participants, including the Bank of England, to adapt to an unprecedented change in the operating environment,” he said.

Andrew Hauser looks back at the key moments that shaped financial markets during the first six weeks of the Covid-19 crisis. Andrew shares his perspectives on what drove markets, what we have learnt and our response. https://t.co/LDk289h6Kc pic.twitter.com/5BeOo2dTZs

— Bank of England (@bankofengland) June 4, 2020

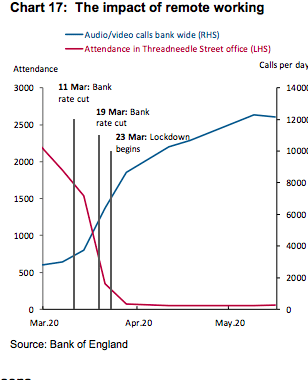

He continued in a speech today, hosted by Bloomberg, that the Bank moved all market operations to full split-site working in the first week of March to reduce the risk of Covid-19 transmission.

When there was a sharp rise in asset price volatility, increased margin calls forced funds to unwind some of their basis trades, selling US treasuries to generate cash.

“As time went on, their speed and size – running to hundreds of billions of dollars – began to overwhelm dealers’ intermediation capacity, which was itself shrinking as the result of rising volatility and the operational challenges of remote working,” he added. “What was unique about this process, and potentially disastrous for the financial system, was that even the highest quality government assets were not good enough.”

On 9 March when oil prices fell by 30% and equity prices by 8% the Bank of England received an email from the Federal Reserve asking if the five dollar swap line central banks could speak the following morning. The standing swap lines were out in place after the financial crisis in 2008 to allow a group of central banks – The Bank of England, Bank of Japan, ECB, Swiss National Bank and Bank of Canada – to lend dollars to their local banks with dollars secured from the Federal Reserve to short-circuit any market dysfunction.

He said: “The expanded swap lines have since been used heavily, with the stock of dollar borrowing approaching $½ trillion – by far the highest usage since the global financial crisis. But all of the major onshore and offshore dollar rates are now back within tight ranges of one another.”

Hauser also highlighted that the Bank had to deal with dysfunction in the gilt market, sterling money markets, the need to keep funds flowing to UK companies and to finance the Government’s increased spending.

“But, more extraordinary still, virtually all of it has been done remotely – hundreds of billions of pounds worth of operations delivered from peoples’ bedrooms, attics and kitchens, whilst isolated on their own, or caring for children and other relatives,” he added.

“Just as our operations have had to adjust, at speed, so too has the way we interact with one other,” said Hauser. “Face-to-face meetings – the lifeblood of central banking, sadly – have been seamlessly replaced with audio and video calls. Indeed, over 12,000 of them every day.”