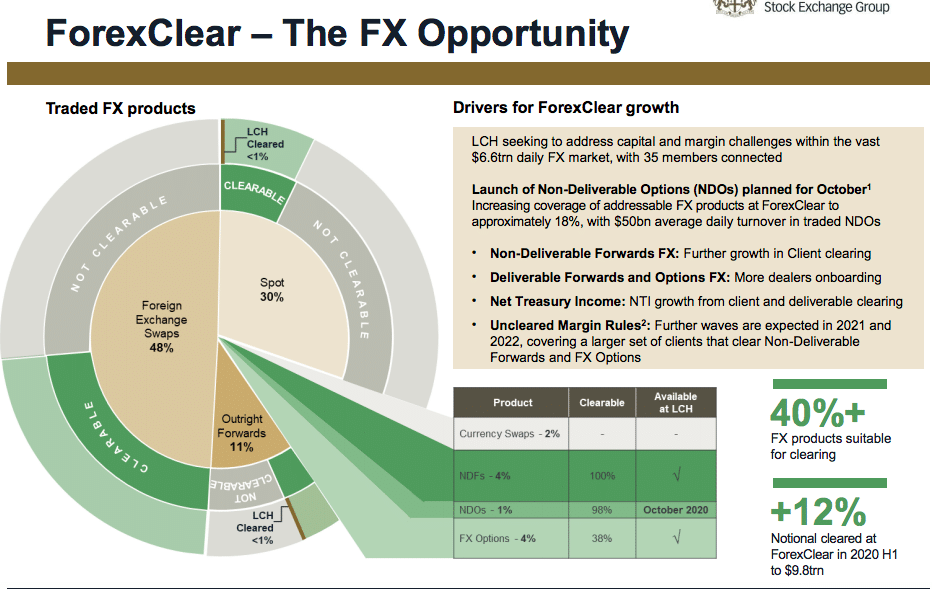

ForexClear, part of London Stock Exchange Group’s LCH, is launching the clearing of non-deliverable options in October, and will then cover nearly all the foreign exchange market that is available for clearing.

Non-deliverable forwards are used to hedge or speculate against currencies where exchange controls make it difficult for overseas investors to make a physical cash settlement, for example, the Chinese renminbi.

Paddy Boyle, global head of ForexClear, LCH, told Market Media: “Non-deliverable options complete the set for us. We will cover more than 95% of the FX market that is available to clear.”

The clearinghouse will then focus on adding new currencies to its existing products and users over the next few quarters. ForexClear already provides client and dealer-to-dealer clearing services for non-deliverable forwards as well as dealer-to-dealer clearing services for deliverable FX options, spot and forwards

Goldman Sachs

Last month Goldman Sachs began offering its clients access to LCH’s FX derivatives clearing service.

.@GoldmanSachs is now live offering client clearing at @LCH_Clearing ForexClear. Find out more about our service: https://t.co/aAT9aD42oB pic.twitter.com/tF7PviNVIP

— LCH (@LCH_Clearing) August 20, 2020

“This significantly broadens the range of firms through which clients are able to access FX clearing at LCH,” added Boyle.

Alicia Crighton, head of prime services clearing at Goldman Sachs, said in a statement that providing LCH as a clearing service helps the bank’s clients manage counterparty risk, while achieving operational efficiencies across a broad range of FX products.

Boyle said ForexClear is in active dialogue with other banks whose clients also see the benefit of clearing products on one platform, which brings netting benefits and reduces margin payments.

“It is significantly cheaper for clients to clear more products in one place,” he added. “We see continued growth on all fronts and the scope of the uncleared margin regulations will increase in September next year.”

Clearing has been boosted since the final phase of the initial margin rules came into force in September last year requiring all financial counterparties to post collateral for initial margin against over-the-counter derivatives contracts that are not cleared.

In addition, the need to post collateral for variation margin for uncleared derivatives also came into force after a six-month grace period given by regulators to allow the necessary contracts to be put in place across the industry.

As the requirement to post collateral has increased the cost of capital of uncleared derivatives, there has been a shift of certain foreign exchange products to clearing, especially NDFs.

Results

In the first half of this year notional cleared at ForexClear increased by 12%.

London Stock Exchange Group reported in its interim results for the six months ended 30 June 2020 that it had record activity in clearing FX, credit default swaps and cash equities.

As a result post-trade revenue rose 9% from the first half of last year to £372m.