iShares, BlackRock’s exchange-traded fund franchise, had record in inflows in 2025 as active ETFs are one of the growth areas that is expected to generate $500m in revenue over the next five years.

Martin Small, chief financial officer at BlackRock, said on the fourth quarter results on 15 February 2026 that private markets to insurance, private markets to wealth management, and digital assets are other newer, high-growth markets expected to $500m in revenue in the next five years.

Small said: “iShares led the industry and set a new flows record with $527bn in 2025, representing 12% organic asset and 13% organic base fee growth.”

Net inflows were diversified across core equity and premium categories such as fixed income, active and digital assets.

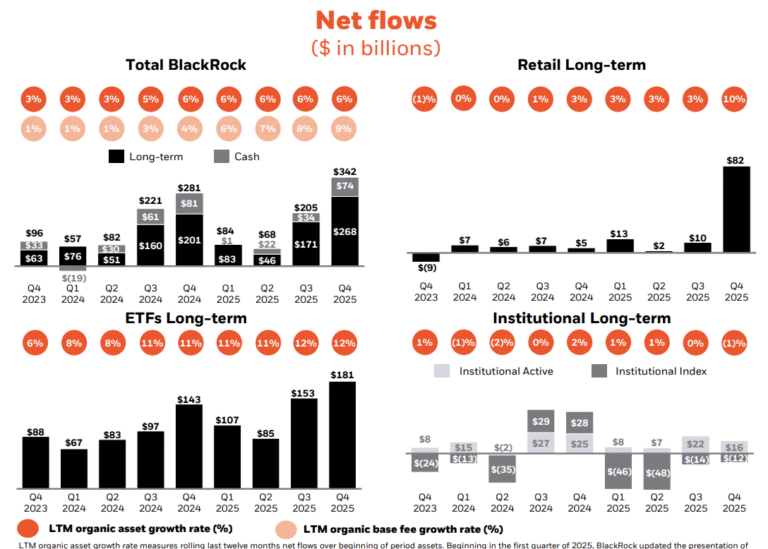

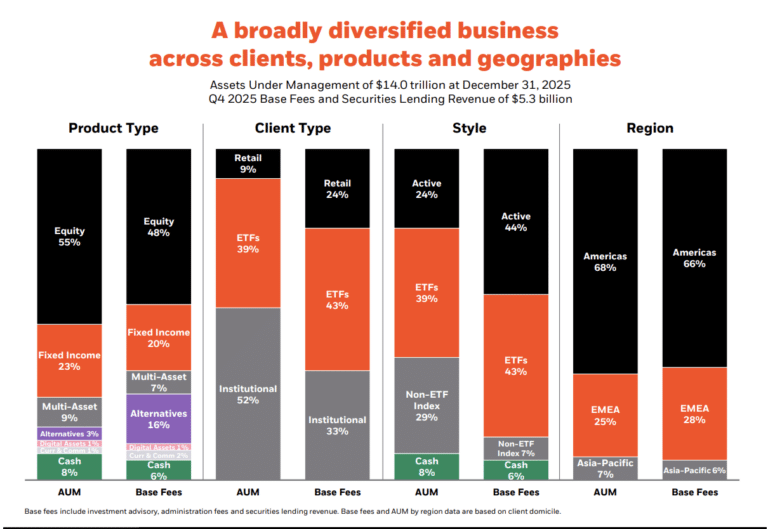

In total, BlackRock ended with $14 trillion in assets under management following record $698bn of full-year net inflows, including $342bn in the fourth quarter. The firm had nearly 150 products across its ETF and mutual fund ranges with over $1bn in flows last year, according to Small.

Laurence Fink, chairman and chief executive, said on the call: “Our foundational businesses like iShares are unlocking new markets like active ETFs and digital assets. iShares continues to be an innovation engine for BlackRock.”

Fink said IShares remains the market leader in ETFs in organic assets, growth, countries served and product lineup. As a result, 2025 was another record year for iShares, with $527bn of net inflows. Total iShares assets increased to $5.5 trillion, and revenues were over $8bn.

iShares’ active ETFs had more than $50bn in net inflows in 2025, nearly tripling their assets from last year, according to Fink. He said iShares’ systematic U.S. equity factor rotation ETF, DYNF, was the highest inflowing active ETF in the industry, with $14bn of net inflows. “It is a flagship of our systematic equity platform,” added Fink.

BlackRock’s systematic equity franchise raised over $50bn in 2025, said Fink, even as the active equity industry had another year of outflows, because the manager has been using data and AI for 20 years.

“We are optimistic that the systematic platform will continue to grow double-digit organic base fees,” he added. “Its position is a bright spot in the active equity industry.”

iShares also grew outside the U.S. In Europe, ETF net inflows of $136bn were approximately 50% higher than in 2024 and Fink said more individuals are coming to the firm through digitally enabled offerings and monthly savings plans.

He added that the trends in India are similar though its joint venture with Jio Financial Services, which operates through a digital-first direct to consumer model. Jio Blackrock raised $2bn upon launch, six times the previous industry record according to Fink, and now manages assets on behalf of nearly 400 institutions and more than one million Indian retail investors.

In addition, Fink said BlackRock is seeing “great” momentum and connectivity with clients in in Asia, Latin America and the Middle East, which is one of its one of its fastest growing regions.

Private markets

Small described BlackRock as entering 2026 with strong momentum and that it will be the first year that the asset manager has fully integrated firm Global Infrastructure Partners (GIP), Preqin and HPS.

In 2024 BlackRock completed the purchase of Global Infrastructure Partners (GIP), as Larry Fink, chairman and chief executive, said infrastructure was a “generational investment opportunity.”

In March last year BlackRock completed its purchase of Preqin, a private markets data provider, to serve clients’ whole portfolios across public and private markets by combining investment, technology, and data solutions in one platform. Preqin’s proprietary data and research tools have been integrated in Aladdin, BlackRock’s common technology platform, and eFront, an end-to-end alternative investment management software and solutions provider.

A few months later BlackRock completed its acquisition of HPS Investment Partners, a private credit manager. Small said credit conditions are generally stable across the main HPS strategies.

“Our scaled private markets platform delivered $40bn of full year net inflows led by private credit and infrastructure,” added Small.

He continued that BlackRock aims to use the data from Preqin to build models for private markets for asset allocations, benchmarking and comparing returns.

“The larger long-term opportunity is leveraging our engines in Aladdin and iShares to build the machine for indexing private markets,” added Small. “We are working on building investable indices that we hope to bring to market here in the next few years.”

Fink described BlackRock as a leader in the emerging trends of providing access to private markets to wealth managers and U.S. retirement plans of 401k plans, and providing private market data. He said the firm’s investments in infrastructure, private credit and wealth underpin its ambitions to raise $400bn in private markets by 2030.

“We have a significant opportunity to deliver better outcomes clients in private market allocations,’ said Fink. “For our shareholders, that shift represents new private markets assets under management and potentially over $1bn in new base fees.”

He gave the example of Blackrock being the largest general account manager for insurers with $700bn in assets with HPS.

In retirement, BlackRock is seeing “important” progress towards a regulatory framework to include private assets and target date funds. The firm expects to launch its first life path target date fund with private markets this year. As retirement plan sponsors look to incorporate private markets, they will need standardized benchmarking and performance data and Fink argued Preqin can be a central provider.

“Guaranteed Income and private markets are not two separate conversations,” said Fink. “BlackRock can bring it all together.”

Financials

Small said BlackRock had one of the strongest years in its history with nearly $700bn in net new assets and 9% organic base fee growth.

The asset manager reported full-year revenue $24bn in 2025, up 19% year-over-year. Full-year operating income of $9.6bn increased of 9.6 18% over the same period and earnings per share set a new record.

The firm is entering this year with a base fee run rate that is approximately 35% higher than base fees in 2024, and approximately 50% higher than 2023 according to Small. BlackRock had 6% or higher organic base fee growth in each quarter of 2025 and ended the year with two consecutive quarters of double-digit organic base fee growth, including 12% in the fourth quarter.

“That growth is broad based across our systematic franchise private markets, ETFs, digital assets, cash and outsourcing,” added Small. “It is across capabilities that we have had for decades and others that we’ve built or acquired in the last two years and that gives us confidence we are on the right track with clients.”

He continued that structural growers such as private markets, systematic models, outsourced chief investment office (OCIO), ETFs and separately managed accounts (SMAs) boosted average fees.

“In these fields, new asset flows in 2025 were six to seven times higher than they were in 2023 and are at a premium to our overall fee rate,” said Small.